Dogecoin Whales Accumulate Over 120M DOGE As Price Eyes Rally To $4.5

Highlights

- Crypto analyst Ali Martinez revealed that Dogecoin whales have bought over 120 million DOGE this past week.

- This came as crypto analyst Ali Martinez predicted that the meme coin could reach $4.5

- Crypto analyst Kevin Capital stated that the Dogecoin price needs to continue the last line of bull market support at $0.13.

Crypto analyst Ali Martinez recently revealed that Dogecoin whales have accumulated a significant amount of DOGE this past week. This presents a bullish outlook for the meme coin’s price, which is currently eyeing a rally to $4.5.

Dogecoin Whales Accumulate As Price Eyes Rally To $4.5

In an X post, Martinez revealed that Dogecoin whales have bought over 120 million DOGE this past week, as they continue to actively accumulate despite the market downtrend. This provides a bullish outlook for the meme coin, which is currently eyeing a rally to $4.5.

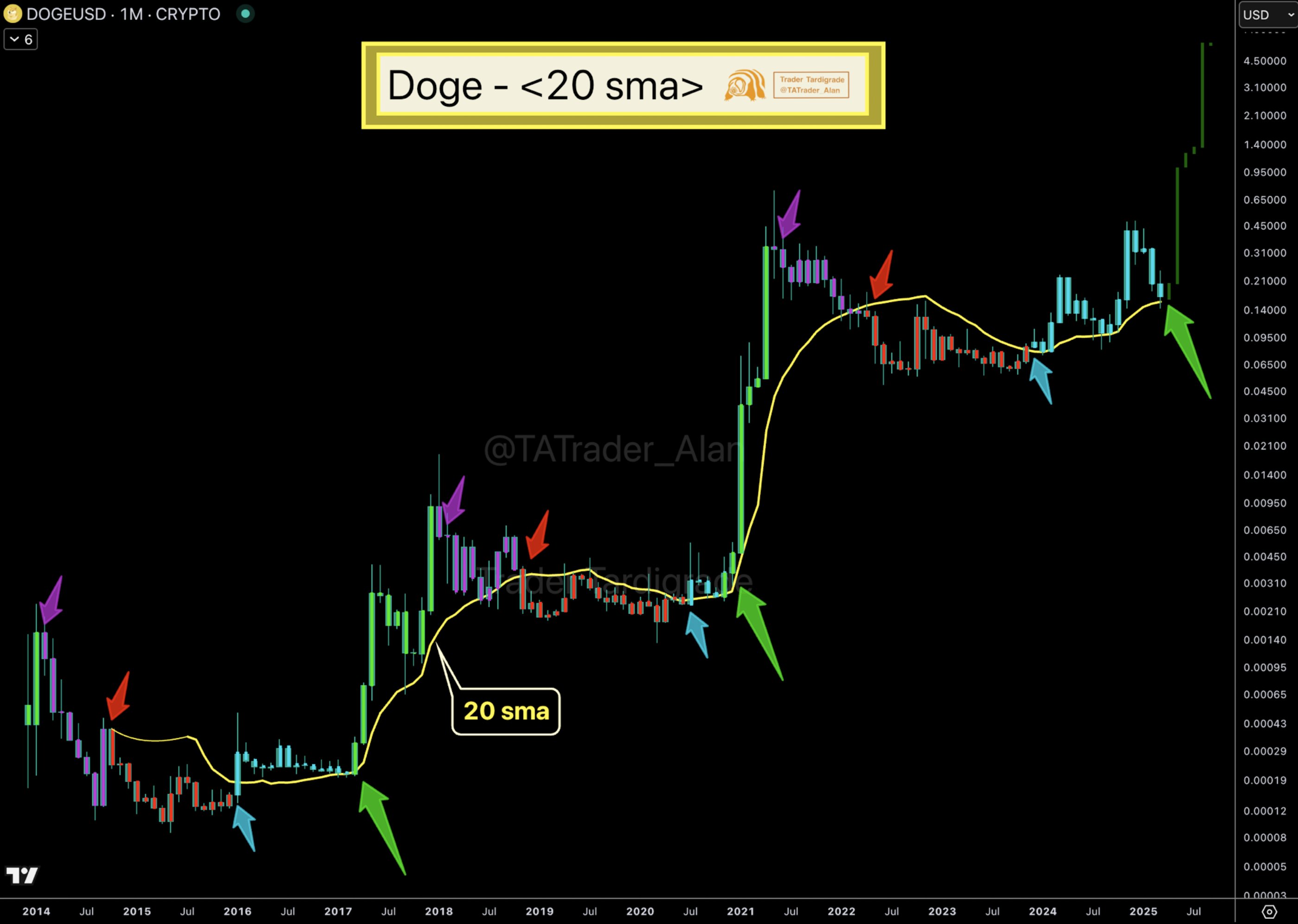

In an X post, crypto analyst Trader Tardigrade noted that DOGE’s 20 Simple Moving Average (SMA) highlights various phases in DOGE’s history. His accompanying chart showed that the top meme coin is just about to enter its parabolic phase in this bull run and could rally to as high as $4.5 when that happens.

Crypto analyst Crypto Elites also asserted that a Dogecoin price rally to $5 is coming soon. These price predictions indicate that the foremost meme coin could still surpass its current all-time high (ATH) of $0.73.

Crypto analyst DOGECAPITAL recently provided an ultra-bullish outlook for Dogecoin, predicting that the meme coin could rally to as high as $80. The analyst alluded to historical trends as to why DOGE could reach such an ambitious price target.

DOGE Needs To Continue To Hold The Line

In an X post, crypto analyst Kevin Capital noted that Dogecoin, on the weekly candle, received a weekly demand candle last week at the ‘last line of bull market support.’ He remarked that it is crucial that DOGE holds this level at $0.139 while it resets higher time frame indicators like the 3-day MACD, weekly Stochastic RSI, and 2-week Stochastic RSI, which are getting very close to being fully reset.

Kevin opined that this price level continues to be a spot where the risk-reward ratio on DOGE is “absolutely phenomenal,” considering that if the meme coin loses that level on weekly closes, market participants could easily cut their trades and losses. He added that the upside potential outweighs the downside risk by miles.

From a holder perspective, the analyst remarked that market participants simply have to hold this $0.139 level while these higher frame indicators reset and prepare for the next big move. Kevin stated that the 1-week Stochastic RSI has fully reset, the 3-day MACD is getting closer to fully resetting, and the 2-week Stochastic RSI is also close to a full reset.

The analyst indicated that the Dogecoin price boasts a bullish outlook as long as the Bitcoin price holds these levels and does not drop below $70,000.

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible