Elon Musk’s SpaceX Moves $94M in Bitcoin Amid IPO Plans: Sell-Off or Custody Shuffle?

Highlights

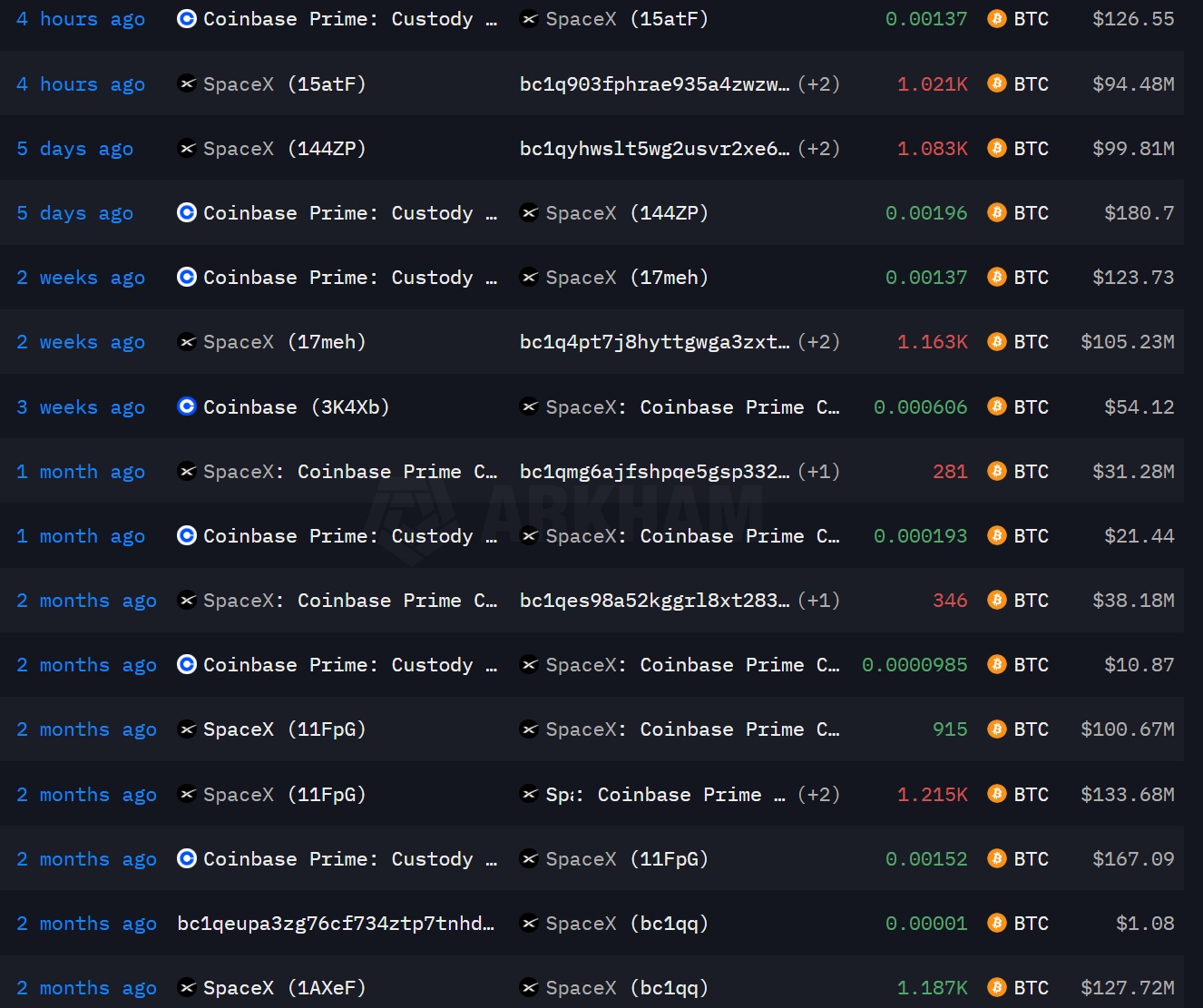

- SpaceX moved 1,021 BTC worth about $94.48M, likely tied to Coinbase Prime.

- The wallet pattern continues, with holdings still near $368.8M in BTC.

- IPO expectations build, with $30B+ target and $1T+ valuation bets on Polymarket.

SpaceX shifted a fresh batch of Bitcoin this month, moving 1,021 BTC valued at about $94.48 million. The transfer flagged by Lookonchain and described as likely linked to Coinbase Prime. The move adds to a recent sequence of large transactions tied to wallets tracked as SpaceX-related.

SpaceX Bitcoin Transfers Follow a Repeat Pattern

In an X post, Lookonchain cited a similar move on Dec. 5, when more than 1,000 BTC was sent to a brand-new address with no prior activity. After the latest transfer, the company’s known Bitcoin stash still stands at about $368.8 million, according to Lookonchain. The platform also pointed to another major shift on Nov. 26.

That transfer was for 1,163 BTC and divided among two new wallets. 399 BTC was sent to one address and 764 BTC went to the other. Prior to those transfers, the huge Bitcoin transfer spotted by the platform was on Oct. 29 when 281 BTC exited a monitored wallet.

SpaceX did not provide a reason for the transfers. Lookonchain characterized the recent movement as probably related to Coinbase Prime, a product for institutional trading and custody. No public statement was made about the transaction.

Musk Reflects on DOGE Role as IPO Plans Surface

The Bitcoin activity comes as Elon Musk spoke about his time leading the Department of Government Efficiency, known as DOGE. In a podcast interview with Katie Miller, Musk said the effort stopped some wasteful spending. He also said the initiative brought heavy backlash, both political and personal.

Musk said he would not return to DOGE. He said he wished he had spent that time focusing on Tesla and SpaceX instead. He also claimed Tesla faced vandalism and protests during the effort.

Bloomberg reported SpaceX is pursuing a record-breaking initial public offering. The report said the company hopes to raise more than $30 billion. It added the listing could come as soon as mid-to-late 2026.

The report added SpaceX is targeting a valuation of around $1.5 trillion. The recent insider share sales have already priced the company above $800 billion. It added that if SpaceX sells even 5% of its equity, the IPO would surpass all previous listings in size.

Polymarket has shown active trading tied to SpaceX’s potential IPO value. The market showed a 67% probability that the company’s market cap could exceed $1 trillion. Prediction market odds reflect trader positioning, not a company forecast.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs