Equilibrium Partners with Chainlink on Price Oracles

Equilibrium is excited to announce its partnership with Chainlink. This collaboration will enable price feeds. These will first be live on Polkadot for Equilibrium’s stablecoins, followed by its lending and synthetic assets. To understand these interrelations, you can read about Equilibrium’s Token Economy.

Chainlink is a decentralized oracle network that enables smart contracts to securely access off-chain data feeds, web APIs, and traditional bank payments. It is regularly identified as a leader among blockchain technologies by top independent research companies like Gartner. Chainlink provides secure and reliable oracles to blue chip enterprises (Google, Oracle, Docusign, SWIFT) and leading smart contract development teams.

“We look forward to providing Equilibrium with a robust set of price oracles that provide real-time valuations on assets used within its DeFi platform,” said Daniel Kochis, Head of Chainlink Business Development. “Chainlink’s high quality data and decentralized oracle infrastructure ensures that all price feeds are highly accurate, available, and resistant to manipulation, empowering users with trustless interactions with Equilibrium’s DeFi protocols.”

Let’s take a closer look at Equilibrium’s products to see how they work with price feeds and oracles.

Stablecoins

The point of stablecoins is to reduce the volatility inherent in the prices of digital assets. They are decentralized and yet resilient against market fluctuations, which is augmented by Equilibrium’s unique risk management system and programmatic interest rate. Stablecoin oracles feed price data on their exchange rate to the USD to smart contracts continually in near real time. Without oracles, external data feeds have no access to blockchains. Regular current price feeds are essential to ensure robust pegging and exchange pair fluctuations. Using Equilibrium, users will be able to generate decentralized stablecoin in the blockchain of their choice by supplying collateral in any other blockchain of their choice.

Borrowing/ Lending

Equilibrium enables non-custodial, multi-asset, cross-chain lending. Users can use multi-asset collateral baskets to borrow both stablecoins and major crypto assets on Equilibrium. Chainlink will allow Equilibrium to access price feeds on the value of diversified crypto-assets continually to do mark-to-market of the loan portfolio in the system.

Equilibrium’s price discovery system, which will be also facilitated by Chainlink’s price feeds, ensures a crucial part of overall system stability. As borrowers take out loans and prices fluctuate, the system could become more risky: interest rate pricing adjusts to drive the entire system to the predefined liquidity target set by system governance.

Synthetic assets

Synthetic assets are a mix of assets that have the same value as another asset. Based on price feeds, users will be able to generate synthetic assets of their choice and trade them decentrally on Equilibrium’s substrate.

Clients will be able to count their synthetic assets as another user’s liability, thus introducing a fractional reserve feature which allows us to expand and lever the supply of these assets. This is similar to fractional reserve banking practiced by the worldwide banking system. Synthetic assets may be exchanged easily without an on-chain order book and matching engine. This basically constitutes a swap of one kind of asset or liability for another.

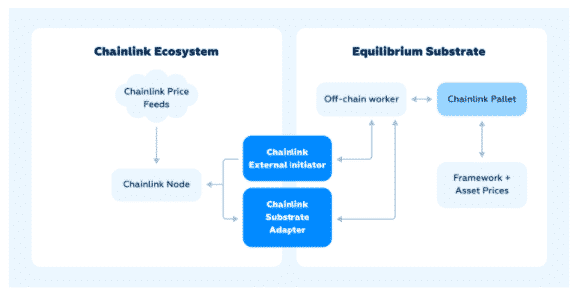

How Integration between Equilibrium and Chainlink works

Thanks to Chainlink’s module which allows integration with other projects built on the Polkadot Substrate, integrating its oracles is easy. Equilibrium will use Chainlink’s oracle pallet inside its own substrate. There will be a whitelist of nodes/ validators which feed prices from Chainlink’s trusted sources.

Later, when parachains appear on Polkadot, Equilibrium will integrate with the Chainlink parachain using cross-chain messaging by establishing message channels between two chains.

Equilibrium’s CEO Alex Melikhov believes that, “With its oracle solution, Chainlink is spearheading the security and privacy of decentralized data feeds, and playing a key role in facilitating our vision of multi-asset, non-custodial liquidity.”

About Equilibrium

Equilibrium is the first decentralized cross-chain money market that combines pooled lending with synthetic asset generation and trading. Equilibrium is set to open up the vast potential of the DeFi market and become its #1 app by offering exceptional services to the users of major crypto assets that were previously isolated. Visit: equilibrium.io

About Chainlink

Chainlink is the most widely used and secure way to power universal smart contracts. With Chainlink, developers can connect any blockchain with high-quality data sources from other blockchains as well as real-world data. Managed by a global, decentralized community of hundreds of thousands of people, Chainlink is introducing a fairer model for contracts. Its network currently secures billions of dollars in value for smart contracts across the decentralized finance (DeFi), insurance and gaming ecosystems, among others.

Chainlink is trusted by hundreds of organizations to deliver definitive truth via secure, reliable data feeds. To learn more, visit chain.link.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs