ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

Highlights

- Ethereum faces renewed downside pressure as institutional investors continue large-scale sell-offs.

- Trend Research deposited another major batch of ETH into Binance, signaling continued liquidation.

- The sell-off follows a failed $2 billion leveraged long position backed by ETH collateral on Aave.

ETH price could face deeper losses as institutions keep selling off their tokens. Crypto firm Trend Research has deposited another tranche of Ethereum into Binance, seeking to sell off tokens.

Tresearch Trend Research Empties Portfolio as ETH Price Dips

According to data from Lookonchain, the crypto company deposited 1.8 billion tokens into Binance and continued the trend of its previous selling. This comes at a time when the Ethereum price continues to drop in value across the larger crypto market crash.

Trend Research had been building a long bet that is worth $2 billion during the last few months, done by taking out stablecoins from Aave, collateralized according to reports by Ethereum. The team was betting on the ETH price’s long-term potential and expected a quick rebound from the October drop below $4,000.

However, the projection did not play out as expected. It only got worse this month as the coin began falling quickly amid the crash of Bitcoin to the $60,000 mark. Ethereum fell to its lowest since April 2025. This led the firm to sell off over 300,000 ETH.

At the same time, Jack Yi, Trend Research founder, referred to the sale as one meant to reduce risk, with the firm currently sitting on $747 million in losses.

“We’re just making some adjustments to control risk, with no change in our expectations for the future mega bull market.” he said. “But I believe the long-term trend in the crypto circle remains unchanged, this is now the absolute best time to buy spot assets, calculated based on investment returns over the next three years.”

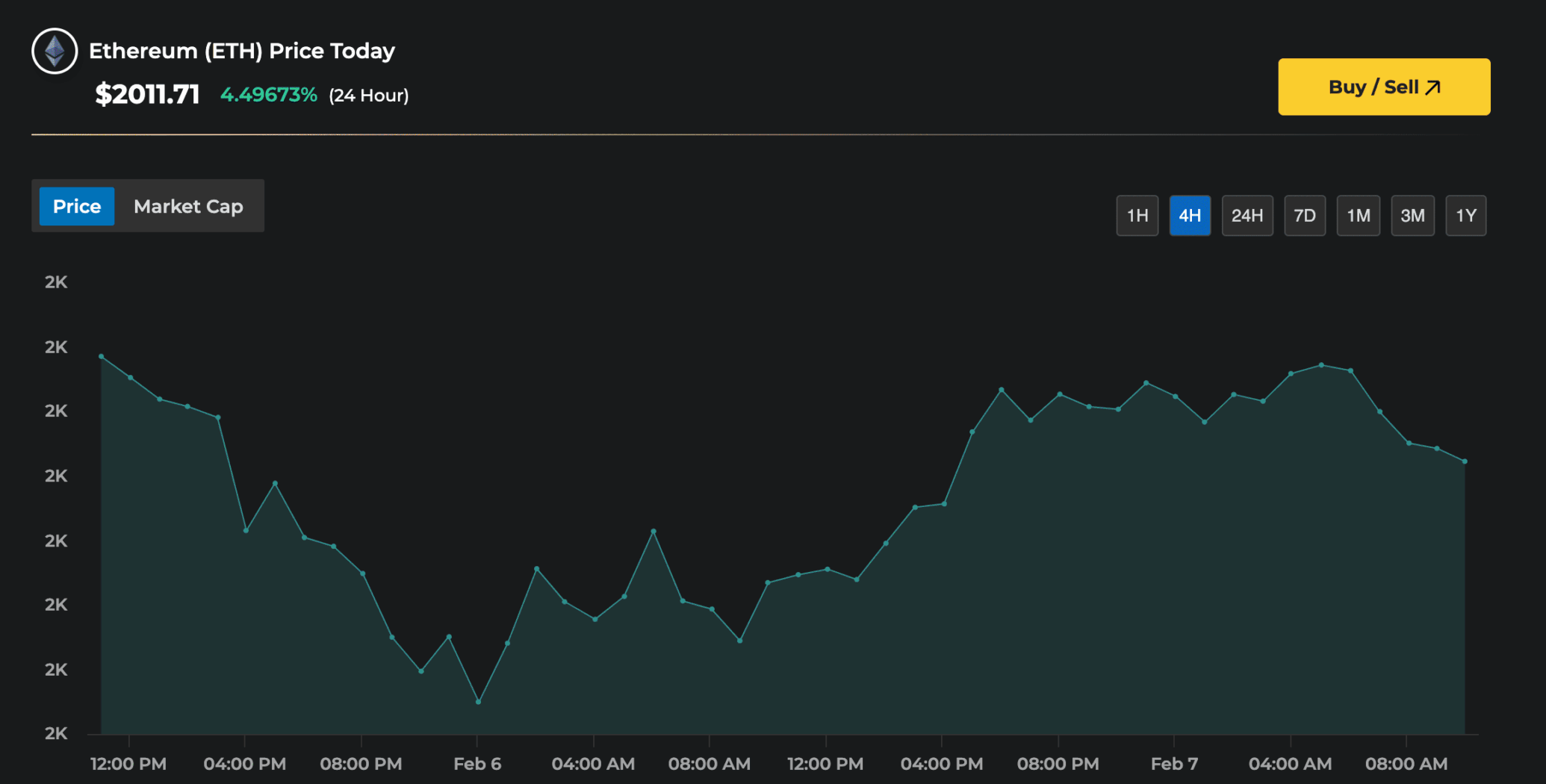

As of press time, the ETH price is up by 4% as Bitcoin recovers close to the $70,000 mark.

Ethereum Selling Pressure Grows Amid Crypto Crash

Another top crypto holder, Garrett Jin, had also been dumping his portfolio. It was reported by Lookonchain that both entities have been using the same Binance deposit address in offloading tokens, creating speculation of internal links.

Two big #Ethereum bulls with huge losses — Garrett Jin(#BitcoinOG1011short) and Trend Research — used the same Binance deposit address.https://t.co/XNqkvCrpV2https://t.co/BHYHYrHzca pic.twitter.com/yCjISkVZqZ

— Lookonchain (@lookonchain) February 7, 2026

“7 Siblings” are also very close to their liquidation value at the ETH price. The firm currently holds nearly 287,000 ETH, with liquidation levels at $1,029. Also, as reported by CoinGape, Vitalik Buterin has been selling off his tokens. Over the last week, Buterin sold 2,900 ETH, valued at $6.6M. He sold them an average price of $2,228.

Also, Ethereum’s largest treasury holder, BitMine, is sitting on billions of losses. However, Tom Lee has maintained that his firm would continue buying up tokens regardless of the unrealized losses.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs