ETH Price Shoots 6.5% As Ethereum Address Activity Surpasses Bitcoin’s For the First Time

After moving sideways and staying under pressure for the last week, the Ethereum (ETH) price has shown a strong recovery starting this week. At press time, the ETH price has surged 6.5% and moved past $2100 as of writing this story.

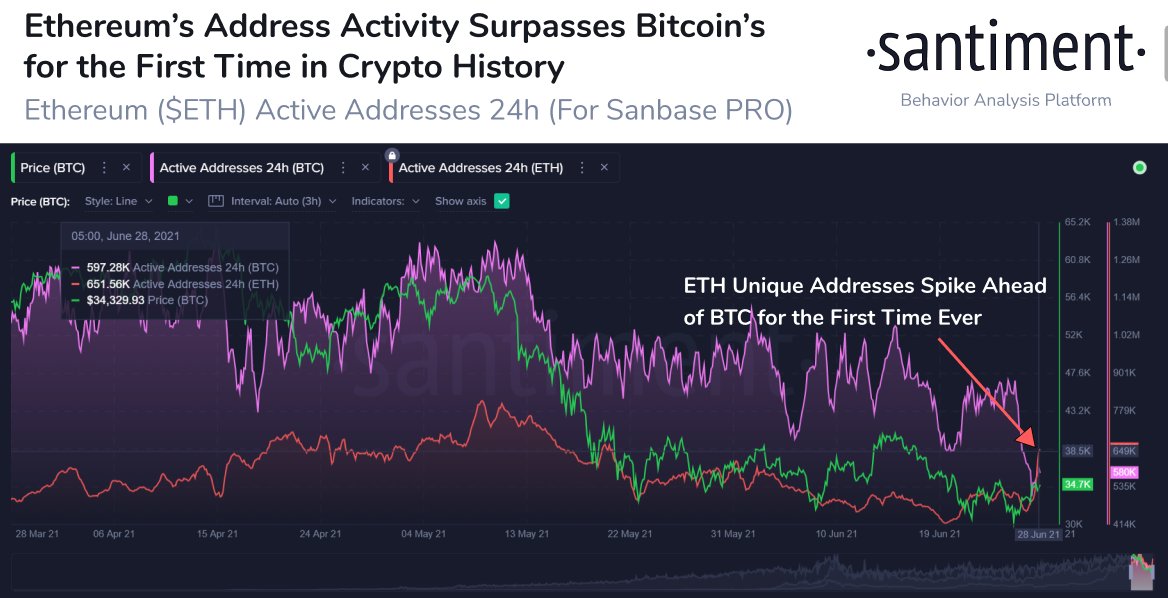

Some of the on-chain indicators as pointed out by CoinGape were already hinting at this price recovery. However, another major reason is that the world’s second-largest cryptocurrency has hit another milestone. For the first time in history, the address activity on the Ethereum blockchain network has surpassed that of Bitcoin’s.

This comes amid the constantly declining address activity of the Bitcoin blockchain, whereas that on the Ethereum network sees an uptick, as reported by Santiment.

Ethereum London Hard Fork Approaches Closer

Last week on June 24, the much-awaited London hard for was launched on the Ropsten Testnet as developers are looking ahead to the mainnet launch in July next month.

The hard form will bring the EIP-1559 modification which changes the calculation mechanism for the Ethereum transaction fee. Besides changing the fee structure, the EIP-1559 aims to implement the mechanism to burn the “base fee” which will make the Ethereum economy deflationary over time. So far on the Ethereum Ropsten testnet, over 88K ETH coins have been burnt worth around $177 million.

Almost 90k ETH burned on ropsten testnet already. pic.twitter.com/wDlX7vswup

— Documenting Ethereum 🦇🔊 (@DocumentEther) June 28, 2021

As per blockchain firm ConsenSys, the EIP 1559 implementation will reduce the annual supply with a rate of -1.4%. In its recent blog post, ConsenSys notes:

“As a side effect of a more predictable base fee, EIP-1559 may lead to some reduction in gas prices if we assume that fee predictability means users will overpay for gas less frequently.”

The retail and institutional demand for Ethereum in recent times has shot up. Host of CNBC’s Mad Money show Jim Cramer said that he’s bullish on Ethereum going ahead as a lot of money is flowing into it.

"Bullish. Have to be. There's too much money coming in," says @JimCramer. "I went back into #ethereum because #bitcoin held $30K. I like ethereum because people actually use it much more to be able to buy things." pic.twitter.com/IIAeUL4BNL

— Squawk Box (@SquawkCNBC) June 28, 2021

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs