ETH Price Tanks Over 3%, 143,000 Ethereum Options to Expire Today

The Ethereum bounce on Thursday, August 31, failed to hold the momentum as the ETH price came crashing down under $1,650 amid strong selling pressure. ETH is trading 3.21% down in the last 24 hours amid a broader sell-off in the crypto market.

Around 143,000 Ethereum (ETH) options are set to expire. The Put Call Ratio stands at 0.85, indicating a balance between bets on price decrease and increase. The “max pain” level, where the most options are likely to expire worthless, is $1,700. The combined value of these options, known as the notional value, is $230 million.

It’s relatively uncommon for both BTC and ETH to drop just before expiration, causing the delivery price to move away from the max pain point. This scenario could be triggered by a delay in ETF approvals, leading short-term bullish gaming funds to exit.

During this week’s ETH options expiration, a significant portion centered around the $1,500 to $1,600 range, shows data from Greeks.live. While the volume of ETH put options this week wasn’t extensive, many buyers held their positions until the end. The market experienced limited volatility this week, and the Implied Volatility (IV) level continued to decrease. Based on recent market trends, it’s probable that there will be continued sideways movement in the short term.

Ethereum Price Support Zones

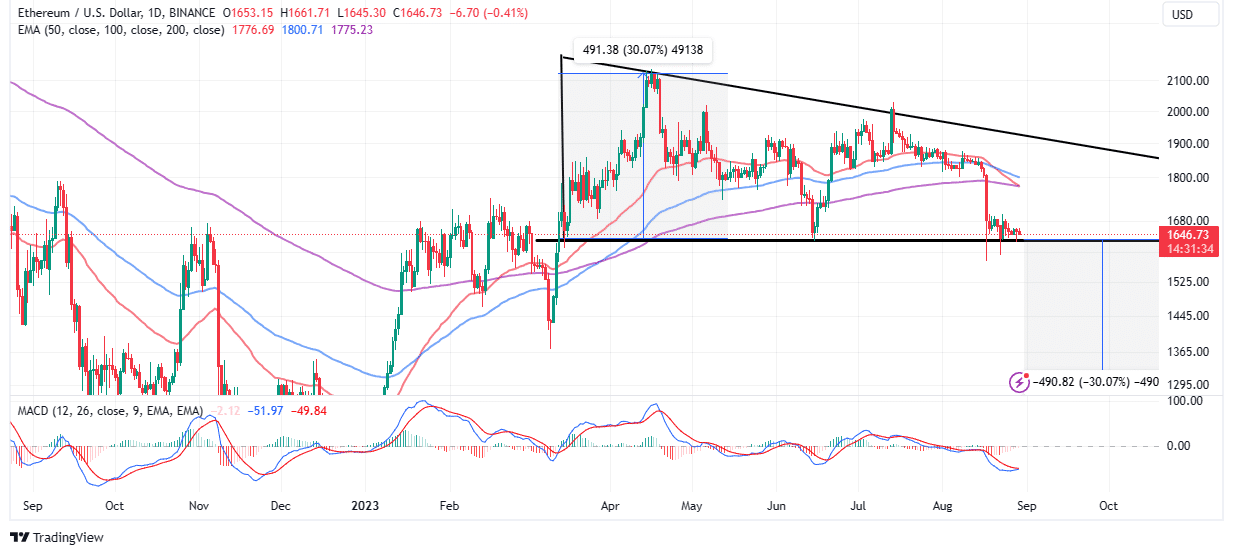

Over the past weeks, the ETH price has been seeing selling pressure and is floating around $1,650 levels. After the failed recovery attempt above $1,700, the immediate support for Ethereum is $1,630.

As reported by CoinGape, looking at the daily chart from a technical perspective, there’s a concerning scenario unfolding for ETH price. There’s a possibility of a significant 30% drop below the breakout point situated between $1,630 and $1,140.

The presence of a descending triangle pattern on the daily chart adds to the potential challenges Ethereum’s recovery might face. This pattern could increase the risk of the downtrend extending to the $1,140 level before the price of ETH finds alignment with the anticipated uptrend during the bull market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs