ETH Treasury: Trend Research Uses USDT Loans to Expand Holdings to $1.8B, Eyes 2026 Bull Run

Highlights

- Trend Reasearch now holds 601,074 ETH, valued at approximately $1.83 billion.

- They have relied heavily on leverage, borrowing around $958M in USDT from Aave to fund ETH purchases.

- Founder Jack Yi said the fund is positioning for a structurally bullish 2026.

A Hong Kong-based investment firm called Trend Research has lately been seen as one of the most aggressive investors in the Ethereum token. The firm has managed to build an ETH treasury of close to $1.8 billion while preparing for a potential bull run in 2026.

Trend Expands ETH Treasury Through Leverage

The firm has been adding to its ETH holdings even as it recognizes the likelihood of a sharp market correction in early 2026. According to Lookonchain, it has amassed a total of 601,074 ETH. At present, this total has a value of approximately $1.83 billion.

Trend Research(@Trend_Research_) keeps borrowing $USDT to buy $ETH.

Trend Research currently holds 601,074 $ETH($1.83B) and has borrowed a total of $958M in stablecoins from #Aave.

Based on the on-chain $ETH withdrawal prices from #Binance, the average purchase price is… pic.twitter.com/MLNVeN8r2l

— Lookonchain (@lookonchain) December 29, 2025

As a means of funding this plan, the firm has largely depended on borrowing using stablecoins. The company has borrowed about $958 million from the Aave lending market using the USDT stablecoin.

They proceed to purchase ETH using the borrowed money from the CEXs. From the withdrawal data, the purchase value of the token acquired is approximated at $3,265.

Soon after, Jack Yi, the founder, stated that the company is committed to its plan of buying more assets. Trend Research started purchasing the token after a big drop in the market and has continued to buy more at regular intervals since then.

Yi pointed out that the fund is not trying to time the market bottoms but is working to position itself before the structurally positive market outlook of 2026.

“First, we’re bullish on the 2026 bull market, especially the first quarter; it’s hard to concentrate large positions at the absolute lowest point, so we’re not worried about fluctuations of a few hundred dollars,” he said.

He also referred to the derivative market as one of those determinants that set market prices. He noted that the opening interest in ETH futures contracts has reached new records.

Meanwhile, BitMine has also been accumulating the token systematically. The firm has recently made its move into staking its ETH holdings. They have reportedly deposited $1 billion worth of the altcoin from its ETH treasury into the Ethereum Proof-of-Stake consensus algorithm to earn interest.

Ethereum Price Performance Amid Network Upgrades

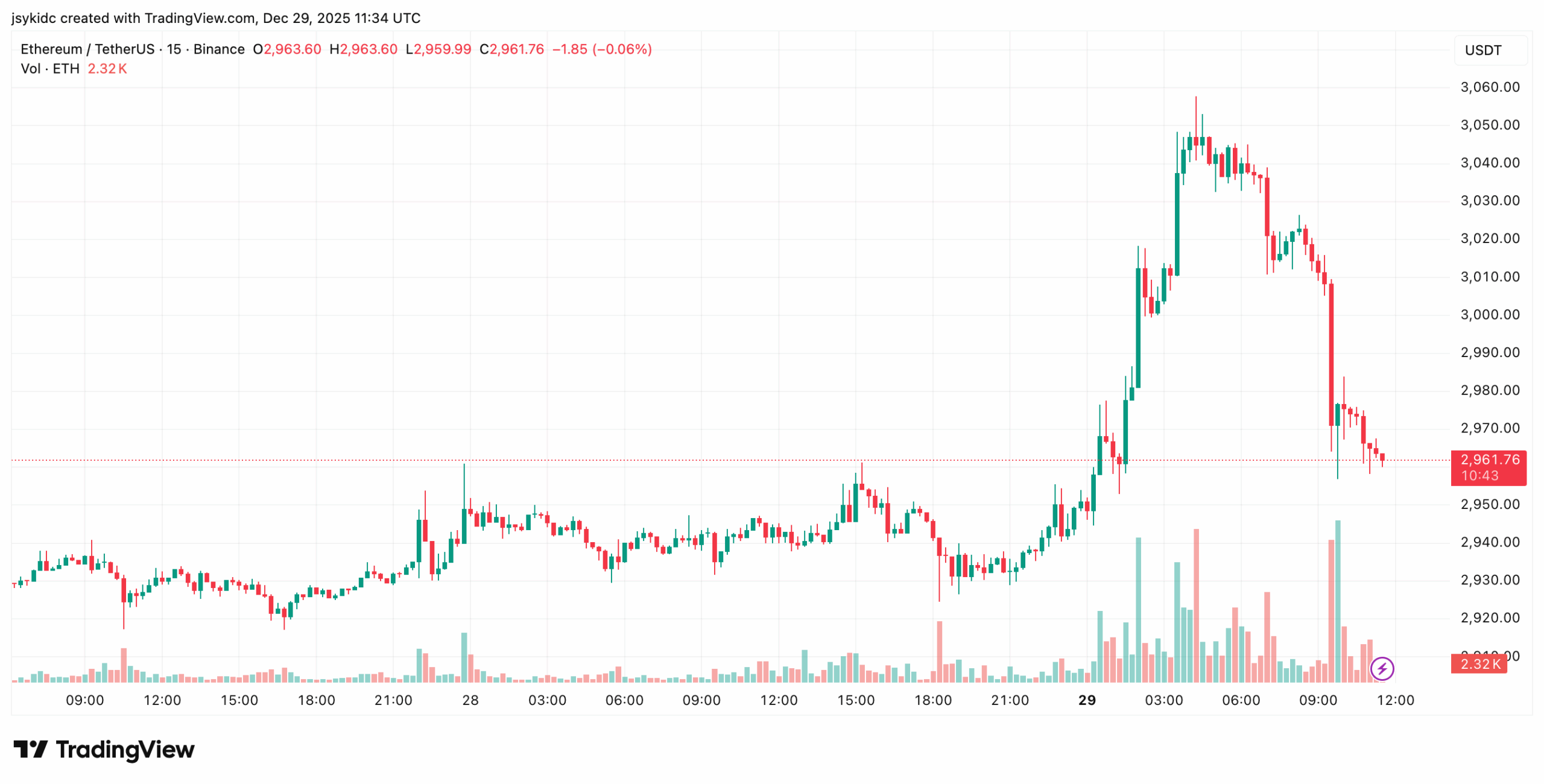

Over the past day, Ethereum recovered the $3,000 marker but has pulled back to trade at $2,964. This recovery takes place during a period of more activity among ETH treasury companies and the progress of the upgrades.

It was said that the Glamsterdam upgrade will happen in the first half of 2026. This update would make MEV more fair by splitting proposers and builders into separate roles.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs