Ethena Braces For Bitcoin Halving With $500M BTC Hedged In Binance, OKX

Highlights

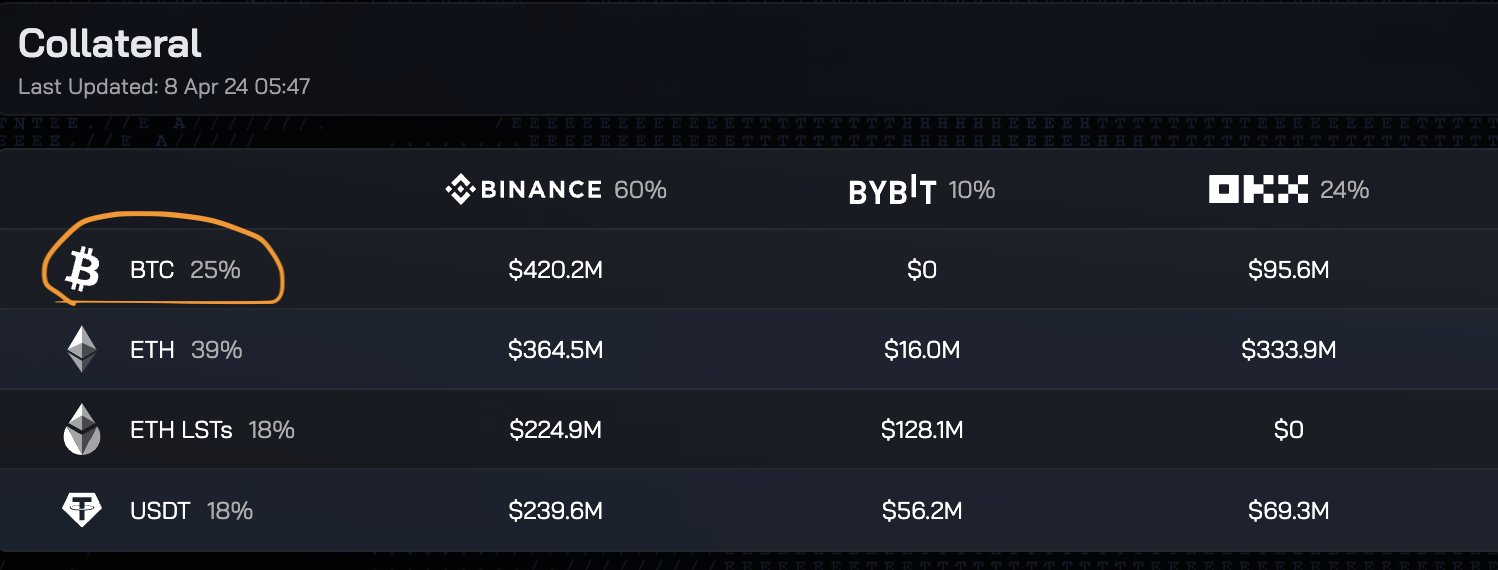

- Ethena hedges $500M in Bitcoin across exchanges, preparing for the upcoming halving event.

- Bitcoin integration enhances the stability and scalability of Ethena's USDe stablecoin.

- Ethena's strategic move underscores its commitment to fortify stability amid market fluctuations.

Ethena, a prominent player in the cryptocurrency realm, is making waves once again as it prepares for the upcoming Bitcoin halving. With a strategic move to hedge over $500 million in Bitcoin across major exchanges like Binance and OKX, Ethena is positioning itself for resilience amid market fluctuations.

Notably, this bold initiative underscores the platform’s commitment to fortifying its USDe stablecoin and scaling its offerings in the face of evolving market dynamics.

Ethena Fortifies Stability With Bitcoin Focus

In a recent X post, Ethena Labs’ Head of Growth, Seraphim, unveiled the platform’s latest move to hold a substantial Bitcoin hedge as it prepares for the upcoming Bitcoin Halving event. Seraphim, in his recent X post, stated:

“Ethena now holds more than half a billion in BTC hedged across Binance, OKX, and Deribit. Ready for the halvening.”

Notably, this move aims to bolster the stability and strength of Ethena’s USDe peg, a critical aspect for maintaining trust and reliability within the cryptocurrency ecosystem. In addition, Ethena Labs has strategically integrated Bitcoin into its holdings to reinforce USDe’s backing and enhance scalability.

With Bitcoin’s thicker liquidity and burgeoning open interest in exchanges, it presents an opportune asset for supporting and expanding USDe compared to Ethereum. Besides, this also aligns with Ethena’s vision to create a censorship-resistant stablecoin backed by robust on-chain mechanisms, as highlighted in its previous X posts.

Also Read: Ripple Partner Tranglo’s Game Changing Cross-Border Payment Solution Goes Live

Pioneering Innovation With BTC Integration

The decision to integrate Bitcoin into USDe’s backing signifies a pivotal moment for Ethena, unlocking new avenues for growth and adoption. By leveraging Bitcoin’s liquidity and market depth, Ethena aims to fortify its stablecoin’s resilience while capitalizing on the cryptocurrency’s broader appeal and utility.

Ethena’s embrace of Bitcoin as a backing asset reflects a forward-looking approach to navigating the evolving cryptocurrency landscape. Also, this diversification strategy enhances the stability and safety of Ethena’s offerings, ultimately benefitting users seeking reliable digital assets amid market uncertainties.

Meanwhile, the news from Ethena comes amid a time when the Bitcoin price rallied over 4% and traded near the $72,300 mark, with its volume soaring 66% from yesterday to $32.74 billion. On the other hand, the Bitcoin Futures Open Interest surged 7.60% over the last 24 hours to 528.48K BTC or $38.34 billion, CoinGlass data showed.

On the other hand, the Ethena price rallied over 6% and traded at $1.28, after a sharp decline recently. Its trading volume also soared 6.45% over the last 24 hours to $981.59 million.

Also Read: Top Cryptocurrencies Set for Pre-Halving Price Rally

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs