Ethereum Accumulation Signals Strong ETH Price Rally Above $4000

Highlights

- Ethereum's price rally near $4,000 driven by substantial accumulation sparks market optimism.

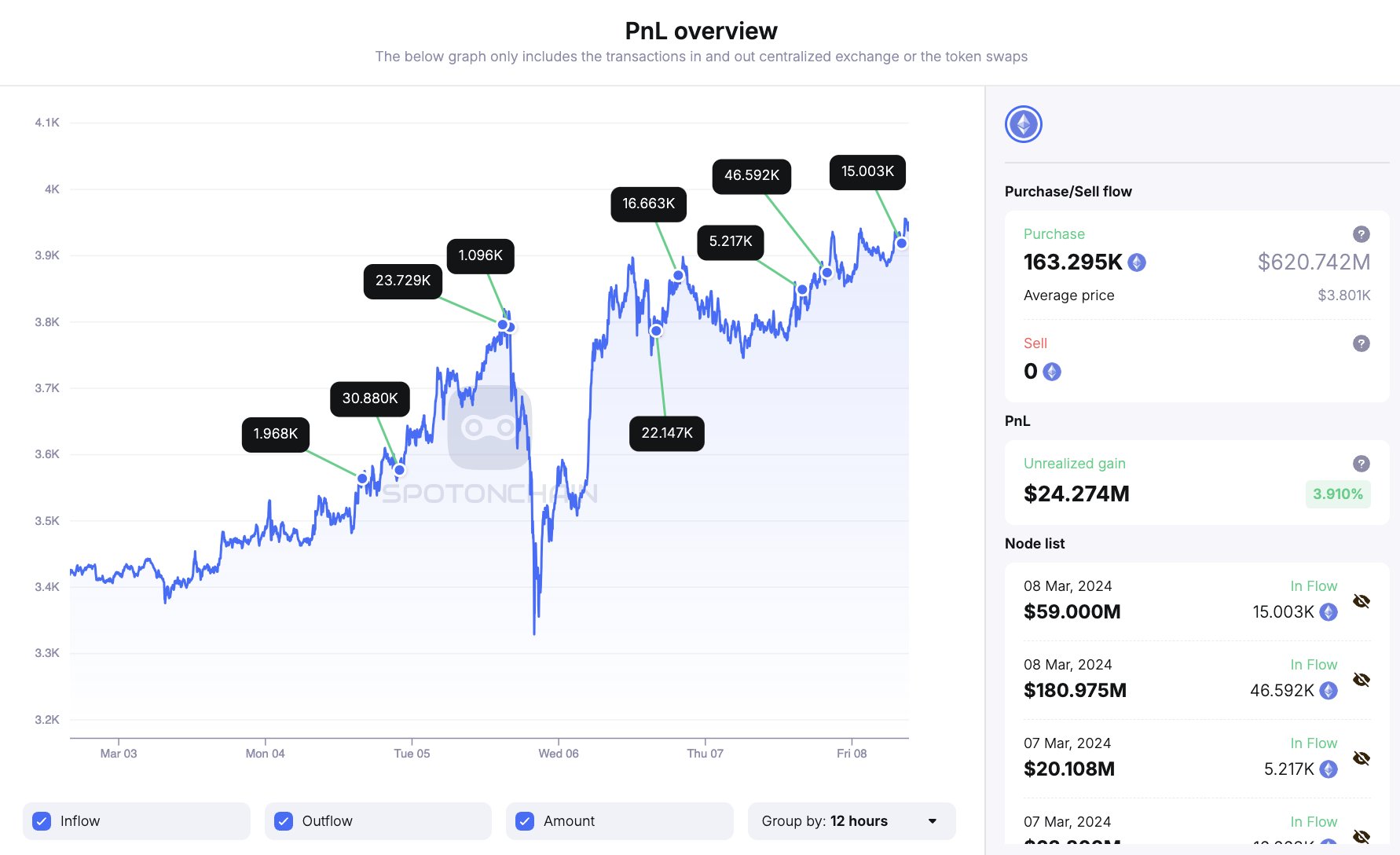

- Spot On Chain data reveals Pulse Chain/X wallets bought over 163,000 ETH in four days.

- Upcoming Dencum upgrade and Ethereum ETF anticipation fuel positive market sentiment.

Ethereum enthusiasts are celebrating today as the cryptocurrency’s price surges by 5%, edging closer to the $4,000 milestone. This impressive rally is fueled by substantial Ethereum accumulation and positive market sentiment, signaling a potential upward trajectory for ETH.

Besides, the strong accumulation of the second-largest crypto has also sparked discussions over a further rally in Ethereum price in the coming days.

Massive Ethereum Accumulation Boosts Market Confidence

Recent data from the blockchain tracking platform, Spot On Chain, reveals a surge in Ethereum accumulation, providing a strong foundation for the cryptocurrency’s price rally. Over the past few days, wallets associated with Pulse Chain and Pulse X have purchased a staggering amount of ETH, totaling 163,295 ETH worth approximately 620.7 million DAI.

Notably, the blockchain tracking platform, Spot On Chain, reveals significant on-chain ETH purchases linked to Pulse Chain/X wallets. In the latest update, 15,003 ETH were acquired using 59 million DAI today, totaling 163,295 ETH over four days. This marks an average price of $3,801 and an estimated unrealized profit of $24.3M.

Meanwhile, in a previous report, Spot On Chain noted a surge in ETH purchases, with 51,809 ETH bought using 201 million DAI, driving prices above $3,900. In just three days, 21 Pulse Chain/X wallets bought 148,288 ETH with 561.7M DAI at approximately $3,788, resulting in a profit of $21.8M. These transactions underscore the active engagement of Pulse Chain/X wallets in the cryptocurrency market, influencing ETH prices and generating substantial profits.

Also Read: BONK Price Rallies 10% Amid BitMEX’s Listing and Airdrop Announcement

Market Sentiment Signals Positive Road Ahead

A flurry of other factors like the upcoming Dencum upgrade, Ethereum ETF anticipation, and others, has also sparked market optimism over Ethereum’s future performance. Notably, the impending Dencun upgrade is set to revolutionize ETH’s proof-of-stake protocol on March 13.

Meanwhile, the upgrade aims to address congestion, enhance scalability, and reduce transitions on layer networks. In addition, anticipation for an Ethereum ETF, pending SEC approval, boosts investor confidence. Drawing inspiration from the success of Bitcoin ETFs, market watchers predict a potential Ethereum price rally.

In addition, Ethereum’s Open Interest surged by 3.71% to $13.25 billion, with Ethereum Options Open Interest also rising by 1.63% to $6.38 billion, as per CoinGlass data. With the upgrade promising significant improvements and ETF hopes on the horizon, Ethereum’s market outlook remains optimistic.

As of writing, the Ethereum price was up 4.53% over the last 24 hours and traded at $3,956.53, while its one-day trading volume fell 20.65% to $21.63 billion. Notably, over the last 24 hours, the ETH price has seen a high of $3,958.81 and a low of $3,768.02.

Also Read: Conflux Network Announces First Hong Kong Dollar-Backed Stablecoin

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act