Ethereum Balance On Crypto Exchanges At 5-Yr Low; Can ETH Price Crash To $1400?

Ethereum (ETH) balance on the crypto exchanges has reached a new five-year low. ETH withdrawals from exchanges outpaced in 2023 as investors anticipate massive upside movement in ETH price. The move is triggered by an increase in ETH staking, which has surprisingly increased after the Shanghai upgrade on April 12. Will ETH price rise or fall under these conditions?

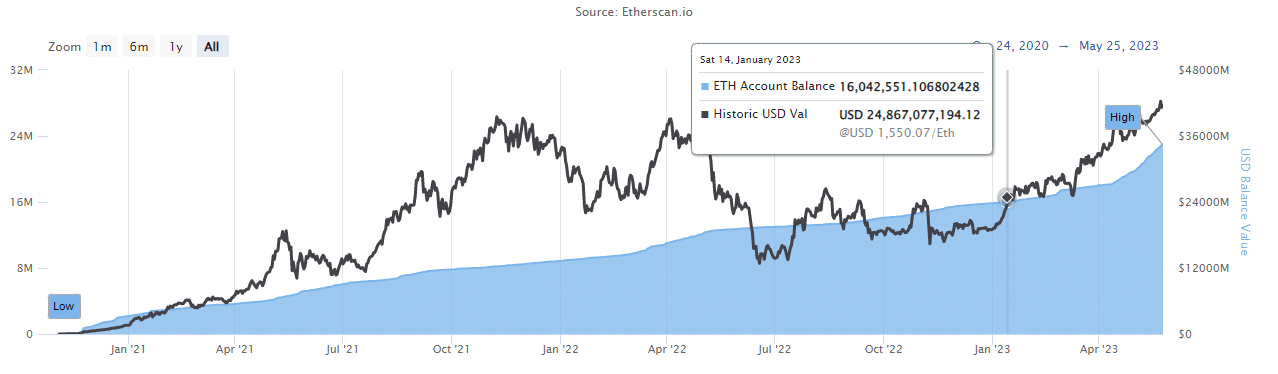

Ethereum Balance on Exchanges Drops to 16 Million Ether

CryptoQuant data indicates that the total amount of ETH held in the crypto exchanges has dropped to critical levels. ETH on exchanges now stands at almost 16 million, reaching levels not recorded since July 2018. It has declined 50% since the all-time high.

Ethereum reserves on crypto exchanges have decreased since mid-2020 but the rate of decline picked pace in September 2022 as the Ethereum network transitioned to proof-of-stake (PoS) with the Merge upgrade.

In 2023 alone, ETH balance on exchanges fell from 18.5 million to 16 million. The decline will continue as the rate of Ethereum staking rises after the Shanghai upgrade.

Etherscan data shows 22.98 million ETH worth $41 million is currently staked on the Beacon Chain.

Also Read: Binance Suspends Crypto Deposits As Multichain CEO Remains Missing

Will Ethereum Price Fall Below $1700?

Typically, low exchange reserves indicate less selling pressure and bullish momentum. Low supply in the market will cause ETH price to rise.

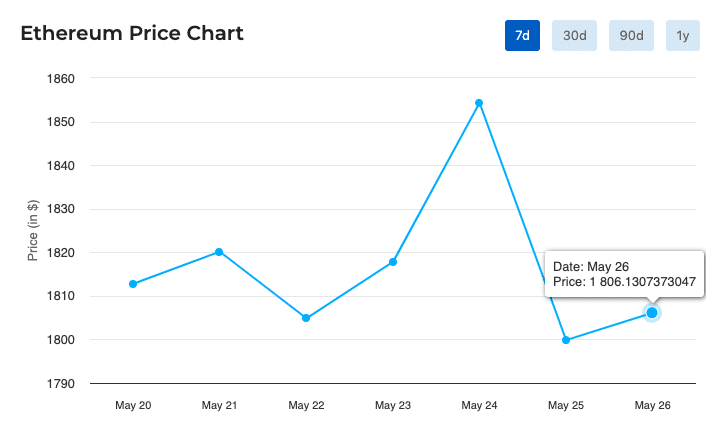

ETH price is up by small 0.5% in the past 24 hrs, with the price currently trading above the $1800 level. The 24-hour low and high are $1782 and $1817, respectively. The volatility remains lower and trading volumes has declined after the upgrade, bringing stability to ETH price.

Also Read: Ethereum Client Releases Major Upgrade To End PoW Support, ETH Price Jumps

Earlier, as reported by CoinGape Markets, defending the $1700 support is must for ETH bulls. Losing this support will signal a continuation of the correction and price may crash to $1400. From the local top at $2138, price got rejected at trendline resistance of wedge pattern and is currently at a crucial support range of $1740-$1714.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs