Ethereum [ETH] Rides High on DeFi, Break-out of Yearly High in View

Ethereum [ETH] has moved towards its yearly highs, as the market sentiments are starting to turn back bullish.

The recent pullback (last ween on Tuesday and Wednesday) saw swift recovery with a 7.6% rise yesterday. The price of Ethereum [ETH] on 14: 3o hours UTC on 31st August 2020 is $232.

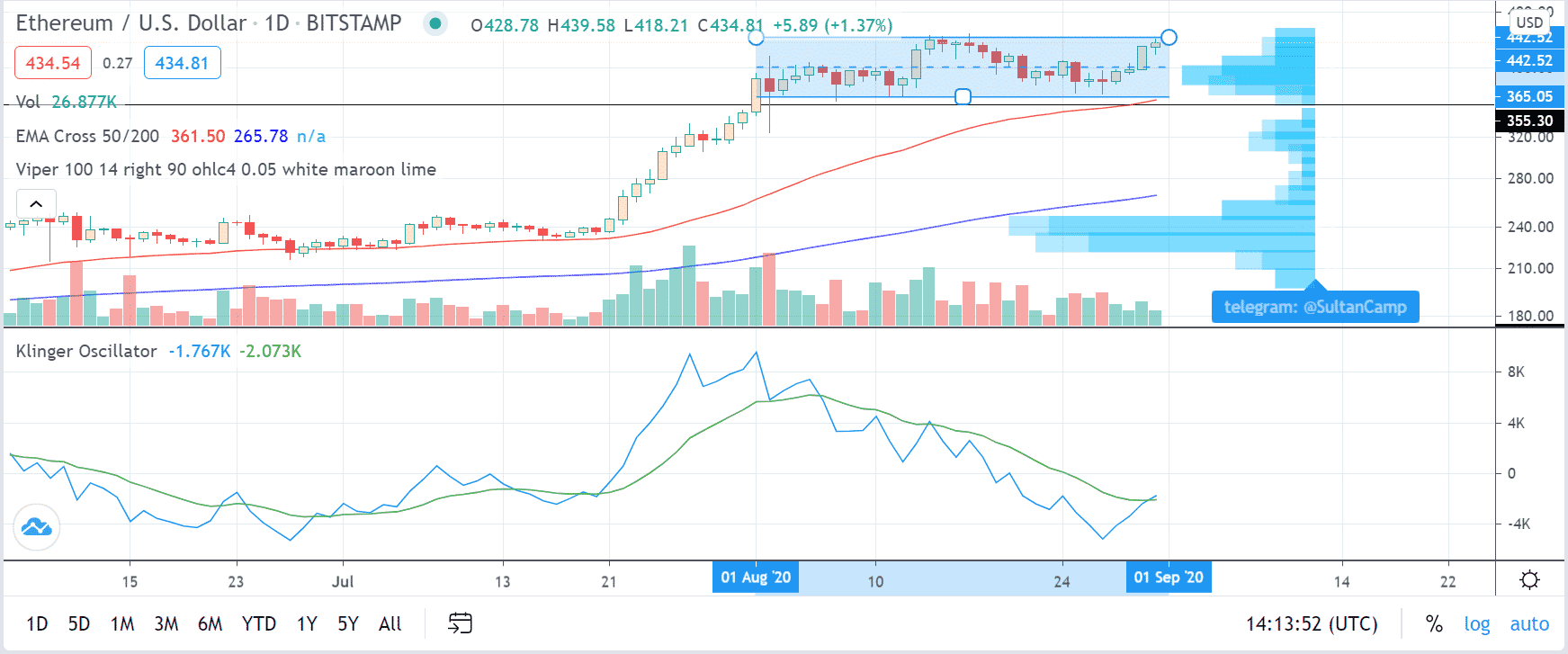

The volume-profile ratio indicator suggests that the price has moved towards a lower volume profile. Hence, a break-out above the current range is paramount for a renewed buying interest.

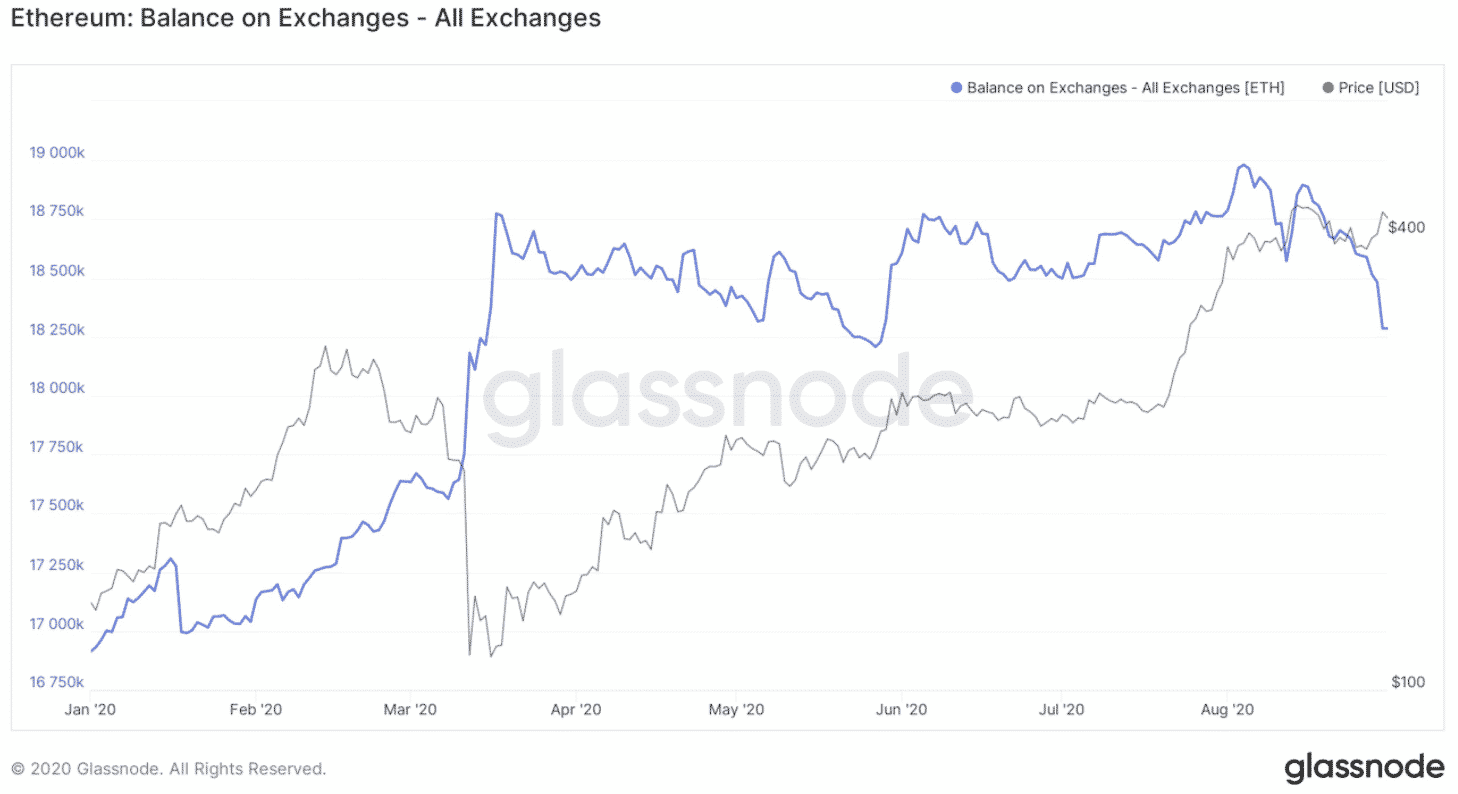

ETH/USD 1-Day chart on Bitstamp (TradingView)The funding rate on BitMEX for Ethereum perpetual has crept back to 0.2% daily. During extremely bullish phases, the funding rate runs high as 0.5-0.6%. Hence, there is still room for leveraged derivates buyers. On-exchange activity is seeing a decline since mid-August. An increase in Ethereum on exchanges is usually indicative of an impending sell-off. Data analytics firm tweeted,

The amount of $ETH held on exchange addresses has been on the decline since mid-August. Investors are holding onto their #Ethereum as a value holder during times where inflation is on the rise.

The DeFi Pump

The DeFi composite index on Binance is projecting a highly bullish stance of the market. According to a recent update, more than 85% of the participants continue to hold long positions on DeFi.

However, the high fees on for sending Ethereum [ETH] transactions remains to be a recurring concern for the market. The average GAS prices on top DeFi platforms is around 120 Gwei. As long as the yields are higher to compensate for the fees, the fees are not a big concern. However, the hysteria inches closer to a subsequent blow-out.

How long do you think that Fees Vs. farm yield discrepancy will continue? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs