Ethereum DeFi TVL Plunges $10B From 2023 Peak, Is The Bull Run Still In The Cards?

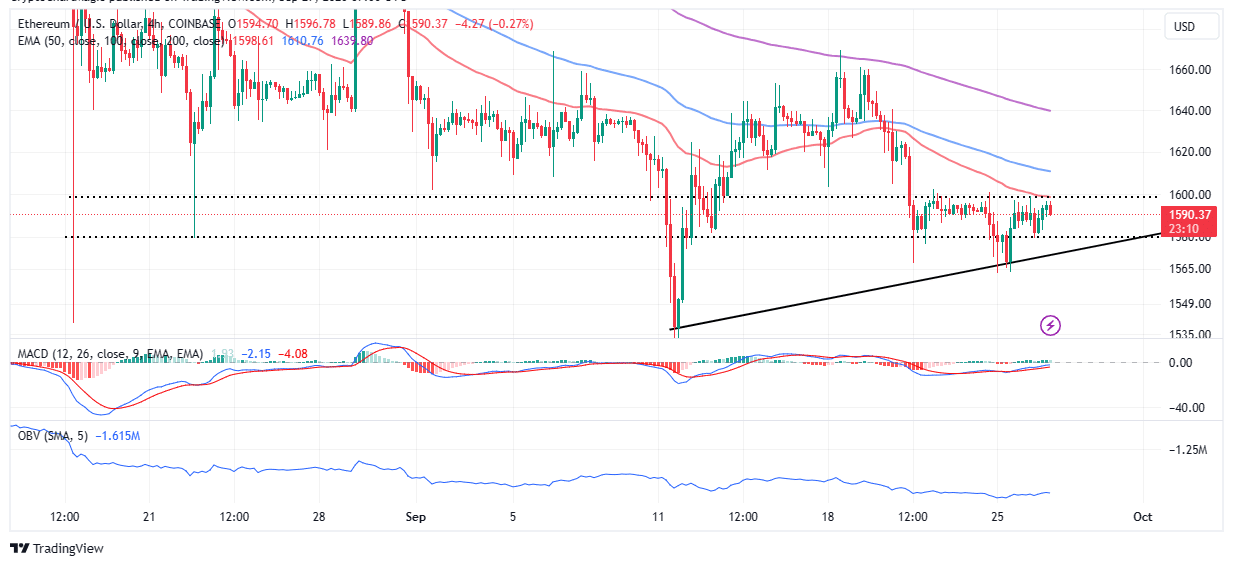

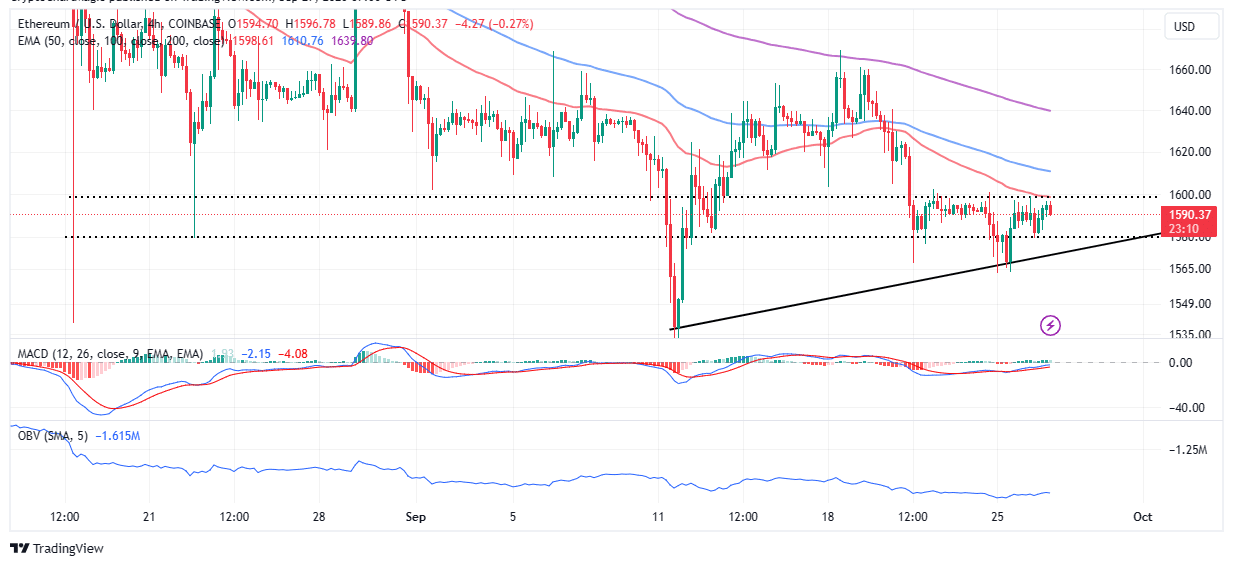

Ethereum is generally sliding in a wide descending trendline amid extremely low volatility and dwindling trading volumes. It has become increasingly difficult for bulls to sustain the uptrend since June, with recovery attempts quickly giving back accrued gains. The latest dip below $1,600 saw ETH plunging to $1,564 before a minor rebound to $1,598 on Monday.

Coingape’s live market tracking software shows Ethereum price trading at $1,592, 0.3% higher on Wednesday, with $3.1 billion in 24-hour trading volume and $192 billion in market capitalization.

Ethereum Price Prediction: Are Bulls Capitalizing On Falling Wedge Pattern Breakout?

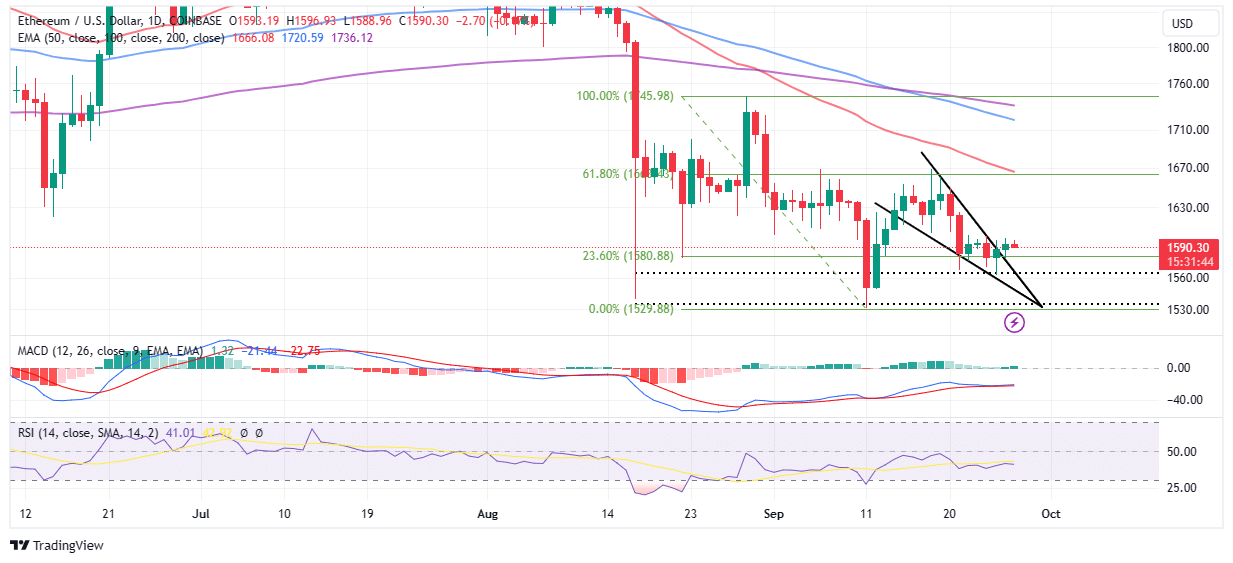

A short-term falling wedge formed on the daily chart allowed Ethereum to bounce off support at $1,564 before stalling at $1,598. As a reversal pattern, the falling wedge forms toward the end of the downtrend.

It signals that the downtrend is ending and a trend reversal is nigh. However, the price must swing above the wedge to validate the breakout accompanied by an increase in trading volume.

Despite the slow recovery momentum, Ethereum is mainly in bullish hands. The 23.6% Fibonacci retracement level provides much-needed immediate support. This support coupled with the bullish outlook from the Moving Average Convergence Divergence (MACD) indicator confirms ETH is ready for a rebound.

A buy signal manifesting with the blue MACD line holding above the red signal line will continue to call upon traders to hold onto their long positions. Demand for ETH must increase to build the required momentum to start a new recovery phase above $1,600.

The Relative Strength Index (RSI) is gradually recovering from August’s oversold conditions and this signals that odds are in favor of Ethereum price climbing into the $1,600 range. Note that bulls will continue to struggle under the overbearing sellers until ETH rockets out of the descending channel to mark the beginning of a new bullish era.

Resistance at $1,600 is quite elaborate on the four-hour chart, reinforced by the 50-day EMA (red). The On-Balance Volume indicator confirms the lack of volume which explains why bulls have been struggling to break above this crucial level despite the MACD maintaining the bullish outlook.

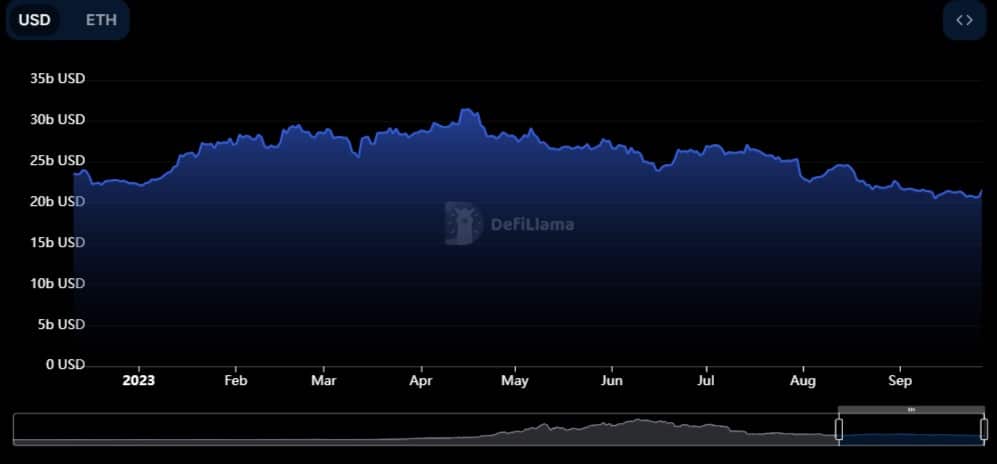

Ethereum TVL Tanks $10 Billion From 2023 High

The largest smart contracts token has experienced a massive drop in its decentralized finance (DeFi) Total Value Locked (TVL) from approximately $31 billion to the current $21 billion.

TVL is a metric used to track the total value of digital assets that are staked in a DeFi protocol like Ethereum, Solana, or Cardano.

A persistent drop in the TVL could signal increasing selling pressure and vice versa. This means that investors are getting restless with the crypto winter and are withdrawing their staked digital assets from the Ethereum protocol in favor of other staking protocols or assets.

Related Articles

- Shiba Inu Price Prediction As Shibarium Transactions Cross 3M Mark, Time To Buy SHIB?

- Solana Price Prediction As Network Revives Focus On DeFi, Will SOL Rally?

- US SEC Delays ARK Spot Bitcoin ETF Filing; Blackrock Decision Soon?

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act