Ethereum (ETH) Exchange Data & Whale Behaviour Suggest Further Rally Ahead. Buy the Dips?

With a brief recovery to $2200 levels earlier this week, Ethereum is facing a strong pullback amid broader market volatility. At press time, ETH is trading over 8% down at $2033 with a market cap of $239 billion. However, on-chain data suggests that this could be a good opportunity to stack up more ETH coins in the wallet.

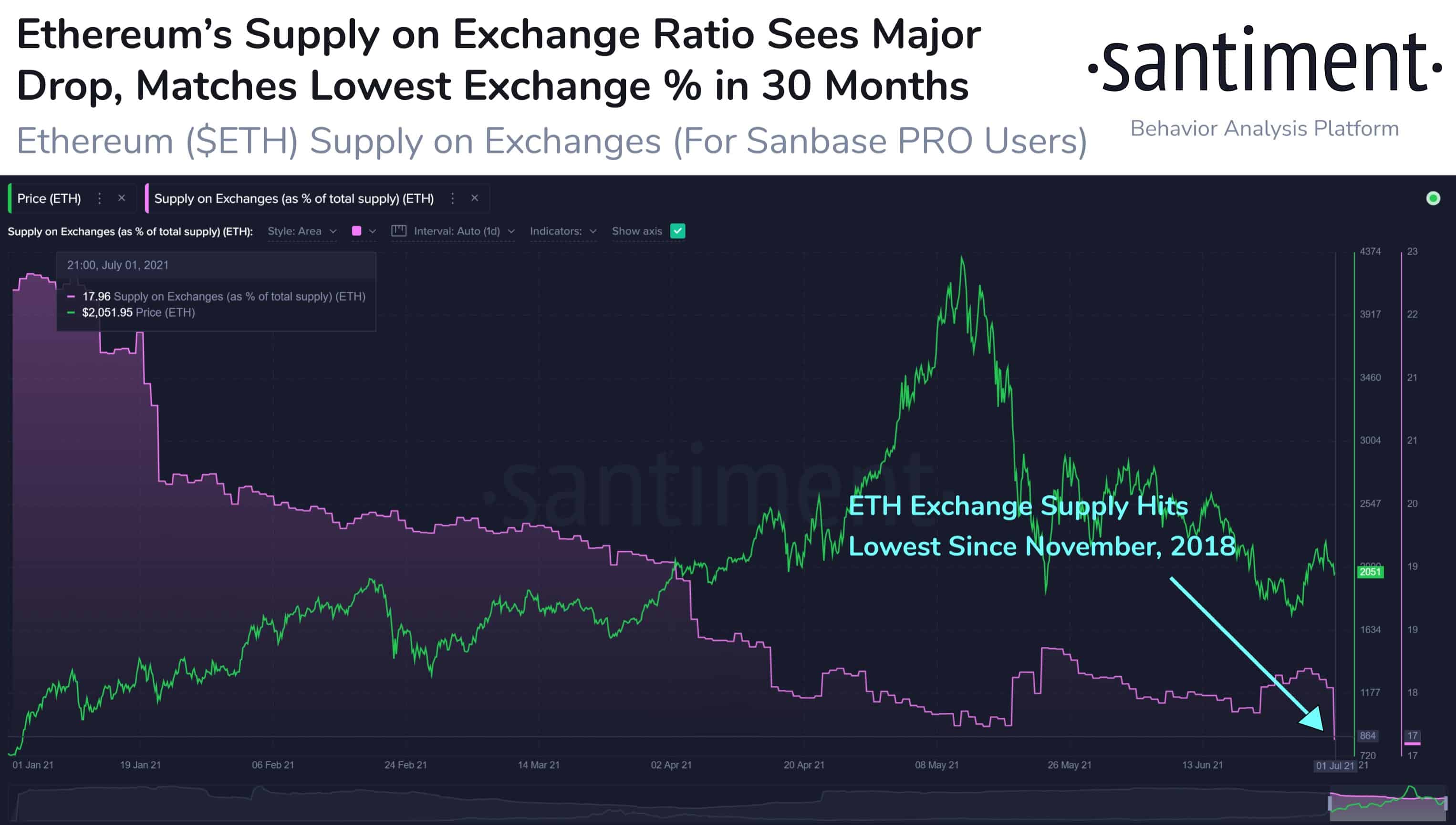

As per on-chain data provider Santiment, the ETH supply at exchanges has hit a near 3-year low. The ETH exchange supply has dropped to the lowest under 18% for the first time in 31 months since November 2018.

The declining exchange supply is a bullish sign as a shortage of supply can drive the price higher. On the other hand, the Ethereum network continues to hit major milestones. Earlier this week, the Ethereum address activity surpassed that of Bitcoin’s for the first time in history. This suggests a massive acceptance of ETH among investors.

On the other hand, a lot of ETH coins have been moving to Ethereum 2.0 Deposits Contracts. More than 5 million ETH coins worth a massive $11 billion have been staked in Ethereum 2.0.

ETH Whales Hold 70% Supply

While Ethereum has been trading sideways over the last few weeks, whales have been buying in huge quantities at every dip. The whale tracking data from Santiment shows that the ETH whale addresses holding more than 10K+ coins now have control on 70% of the total ETH supply, the highest ever in 4 years.

🐳 #Ethereum has been volatile since surpassing #Bitcoin's daily address activity for the first time. Our whale tracking data indicates that $ETH whale address holding 10k+ coins now hold 70% or more of the supply for the first time since September, 2017. https://t.co/1xiJJio6Lq pic.twitter.com/EPApsfEAOr

— Santiment (@santimentfeed) June 30, 2021

It is clear that supply has been moving from the weak hands to the strong hands. At the same time, institutional players continue to warm up to Ethereum. Anthony Scaramucci, founder of SkyBridge Capital recently revealed that his company is now planning to expand its crypto portfolio to Ethereum.

SkyBridge Capital will be launching its own Ethereum fund with a future plan of introducing an Ethereum ETF. CNBC analyst Jim Cramer also stated that he’s bullish on Ethereum since it fits into broader financial utility.

"Bullish. Have to be. There's too much money coming in," says @JimCramer. "I went back into #ethereum because #bitcoin held $30K. I like ethereum because people actually use it much more to be able to buy things." pic.twitter.com/IIAeUL4BNL

— Squawk Box (@SquawkCNBC) June 28, 2021

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- $2T Barclays Explores Blockchain to Tap Into Stablecoin and Tokenization Boom

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs