Ethereum (ETH) Exchange Supply At 38-Month Low, CME Ether Futures Open Interest Skyrockets

The crypto community and investors are closely watching Ethereum (ETH) at this point as it holds itself comfortably above the $200 support levels. As the ETH price hovers around its all-time high, its on-chain fundamentals continue to show strength.

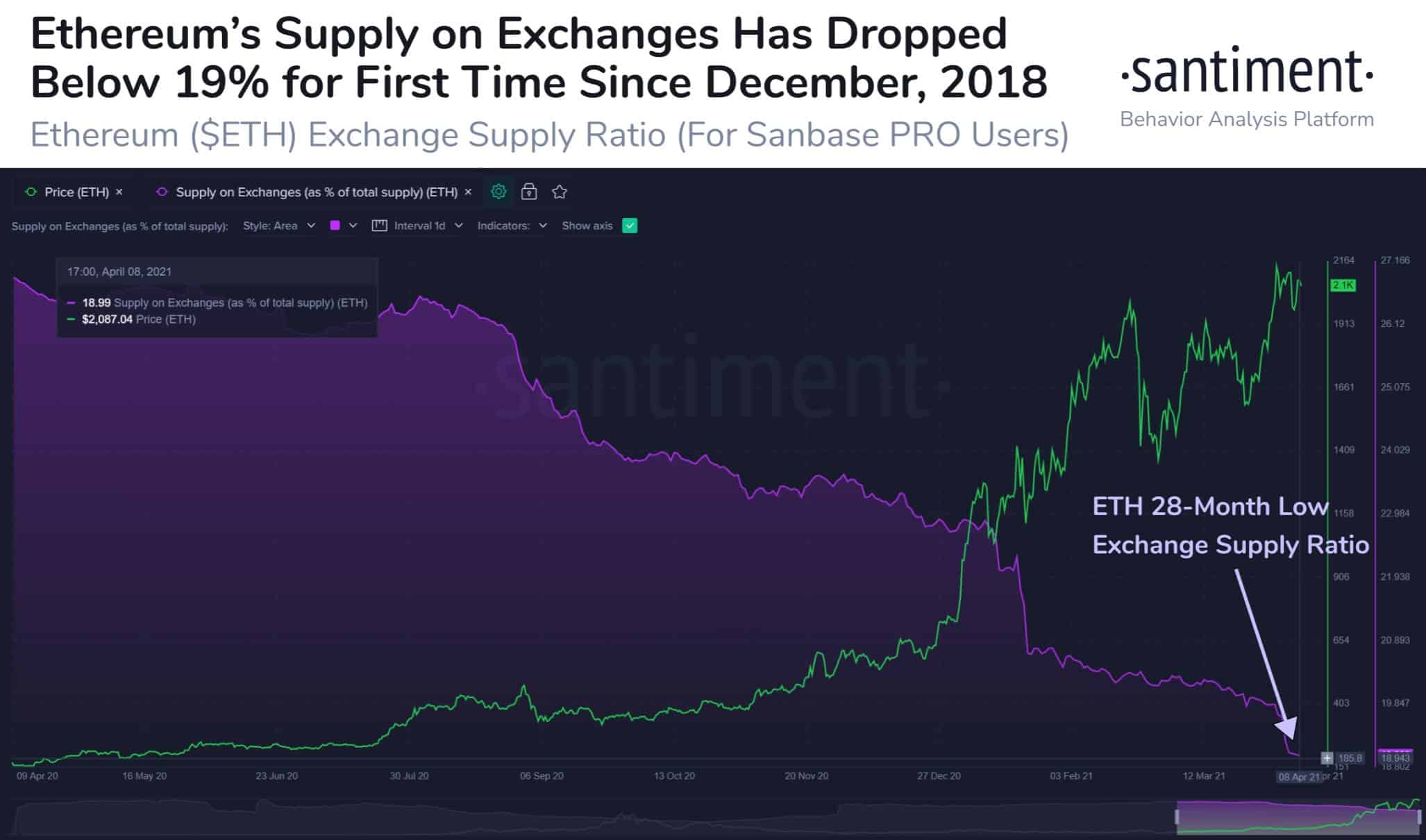

On-chain data provider Santiment notes that the amount of Ethereum sitting on exchanges continues to drop further. As per the latest data, Ethereum (ETH) supply at the exchanges has touched a 28-month low going below 19% for the first time since December 2018. This has happened as more and more ETH continue to move either to DeFi-based options, cold storage or for staking into the Ethereum 2.0 deposit contract.

Well, the reduced supply and high demand certainly point to a further surge ahead for the ETH price. Besides, the rising institutional interest in Ethereum is likely to drive the ETH price higher to the north.

CME Ether Futures Volumes and Open Interest Skyrocket

As per the latest data from Skew Analytics, the CME Ether Futures volumes surged over the last week. The report shows that the CME ETH Futures registered a record volume of $228 million on Wednesday, April 7.

CME Ether futures had a record volume day this week pic.twitter.com/zchWxeA4O5

— skew (@skewdotcom) April 9, 2021

CME launched its Ether Futures earlier this year on February 8, 2021. However, since then, the institutional interest in this Ether-derivative product has surged significantly. Another data by CryptoCompare for the month of March 2021, shows that while the institutional interest for CME Bitcoin Futures dropped 15%, the interest for CME Ether Futures surged a massive 66%.

Institutional investors on #CME were more cautious in March as open interest for #BTC futures dropped 15% to $2.1bn. In contrast, open interest for newly-launched CME #ETH futures grew 66%. See how the #crypto markets fared in our latest Exchange Review: https://t.co/R2MFRSUlQ6 pic.twitter.com/LTur4mEKsc

— CryptoCompare (@CryptoCompare) April 9, 2021

Since the beginning of 2021, Ethereum (ETH) has certainly performed well with more than 150% returns year-to-date. The ETH valuations have surged past that of several of the U.S. banking firms on Wall Street.

However, one read where ETH investors are facing the heat is the rising gas fee. With a massive surge in the DeFi activity, the gas fee on Ethereum (ETH) has skyrocketed to new highs. Ethereum (ETH) competitor Binance Smart Chain (BSC) has gained significantly from this point while registering a record of 5 million daily transactions, 4x that of Ethereum.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs