Ethereum (ETH) Overtakes Bitcoin (BTC) In Monthly Trading Volumes, Exchange Supply Drops

The classic ETH vs BTC rivalry is seeing Ether gain strength over the world’s largest cryptocurrency Bitcoin (BTC). While Bitcoin and Ethereum have been subjected to massive volatility in this market crash, ETH’s on-chain data is once again showing up strength.

Messari’s research analyst Ryan Watkins showed that investors’ interest in Ethereum is higher than that of Bitcoin. The Ethereum volumes have surpassed Bitcoin’s over the last month.

#Ethereum volumes have been exploding recently and have surpassed #Bitcoin volumes for the past month.

h/t @RyanWatkins_ pic.twitter.com/8LUT2ESk6x

— unfolded. (@cryptounfolded) May 26, 2021

On the other hand, the Ethereum supply at exchanges has dropped further and returned to pre-correction levels seen before the last week’s dumping. The drop in the ETH supply suggests higher demand for crypto which is a bullish indicator.

I hate it to say, but $ETH seems more attractive than $BTC. $ETH Balance on exchanges are back on pre-dump levels. Combined with the break of the daily price levels (2775$), it is stronger than $BTC which hasn't recovered inflow levels & is at daily resistance@cryptoquant_com pic.twitter.com/MxzMrRb9yR

— Maartunn (@JA_Maartun) May 26, 2021

Also, on-chain data provider Glassnode reports that the supply of ETH in smart contracts remained healthy during this recent correction. The data provider notes:

“Percentage of Ethereum supply locked in smart contracts has remained very healthy, with 23%+ of the supply remaining in contracts throughout the duration of the selloff. Supply on exchanges jumped from 11.13% to 11.75%.”

ETH/BTC Pair Showing Strong Resilience During the Market Correction

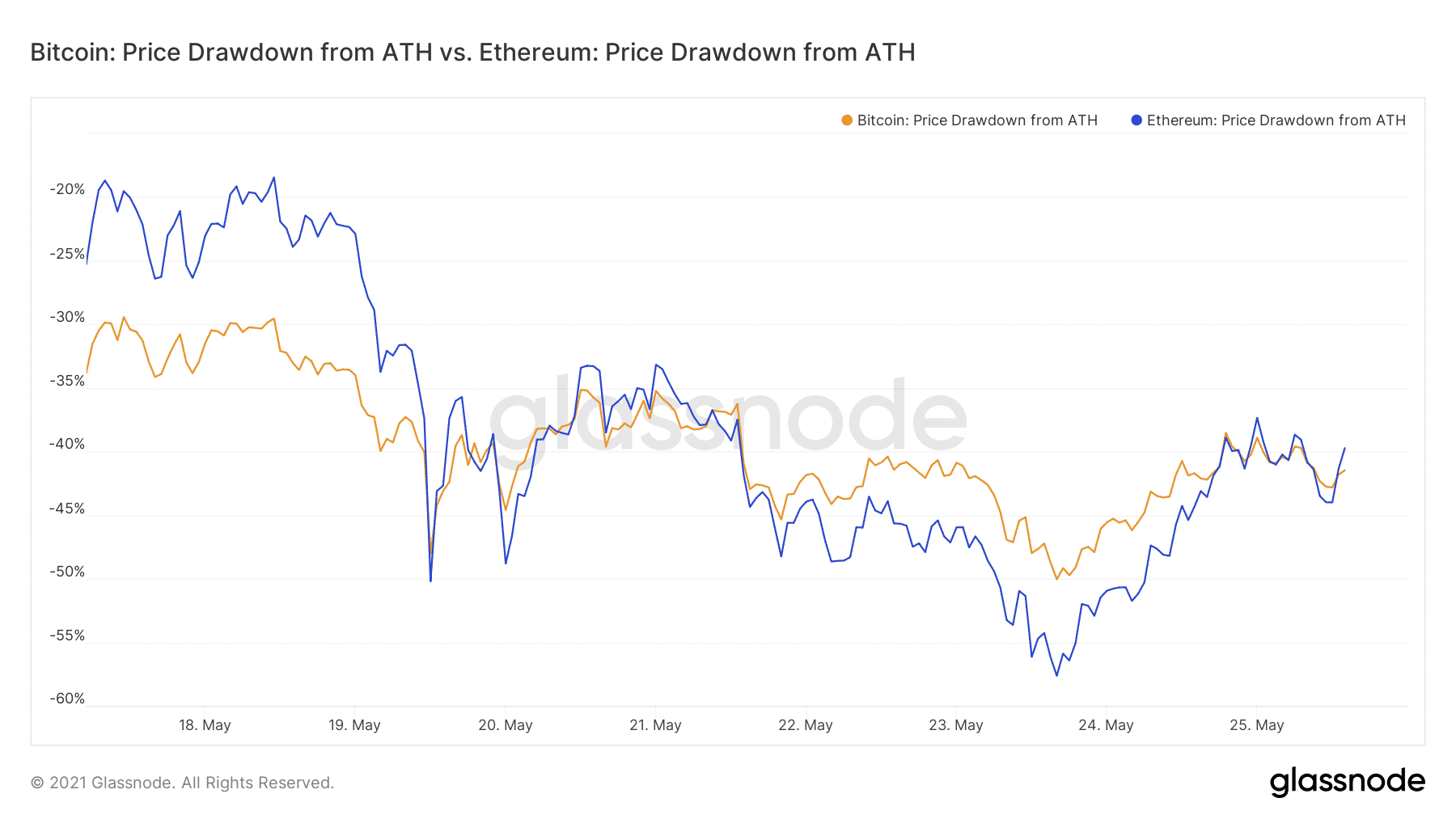

During the recent market correction last week, the ETH/BTC pair has shown a strong resilience compared to its previous performances. During previous crashes, Ethereum (ETH) has experienced significantly larger drawdowns.

As Glassnode mentions: “As ETH shows resilience to market declines over time vs BTC, it is possible DeFi participants flee to ETH as a strength instead of BTC and stablecoins”.

However, Ethereum (ETH) continues to face strong resistance at $3000 levels. At press time, the ETH price is 4.84% down trading at $2683 with a market cap of $307 billion. There are some major developments ahead to watch for the Ethereum blockchain.

Ethereum founder Vitalik Buterin has suggested an early transition to Ethereum 2.0 Proof-of-Stake (PoS), then the expected timeline. Besides, PoS Ethereum will also reduce the network’s energy consumption by over 90%.

On the other hand, the upcoming London hard fork and EIP-1559 implementation will further reduce the ETH supply and could possibly fuel a surge in the ETH price.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs