Ethereum (ETH) Price Shoots Past $2,100, Here’s the Bull and Bear Case Scenarios

Amid a strong rally in the broader cryptocurrency market, the world’s second-largest cryptocurrency Ethereum (ETH) has surged more than 10% in the last 24 hours shooting past $2,100. This comes with the successful implementation of the Shanghai hardfork with the Ethereum blockchain continuing to show strength and stability.

It is for the first time since August 2022 that the Ethereum price has shot past $2,000. With the ETH price extending the weekly gains to more than 12%, the question on investors’ minds is what’s next ahead. To understand this, let’s discuss both – the bear and the bull case scenario for Ethereum.

The Bear Case Scenario for Ethereum

On-chain data provider Santiment pointed out the popular MVRV ratio (Market Value/Realized Value). It notes that the MVRV score of 15% or more is a warning sign indicating the probability of a correction. Currently, the MVRV score for Ethereum (ETH) is 9.95%. Although an MVRV score above 0 indicates the risk of a drop, the current score is not something that’s very concerning.

But on the other hand, the 365-day MVRV score is at 29%, which is at the highest level since December 2021.

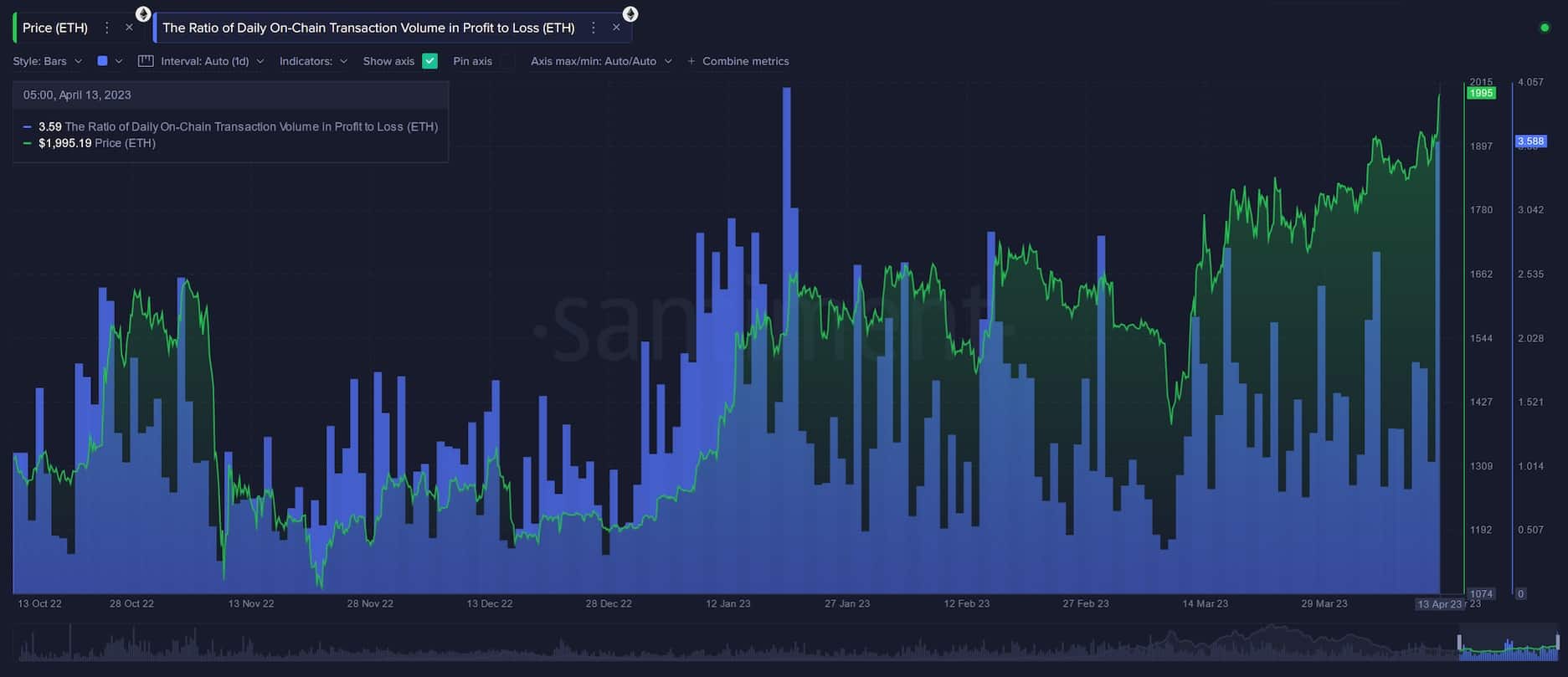

On the other hand, there’s a strong spike in the profit vs loss transaction ratio for Ethereum (ETH). The Santiment report notes:

There are 2.59 times as many transactions in profit vs. transactions in loss today. And this is the highest ratio since January 20th, when we did see a minor correction following. We do interpret this as a short-term bearish signal, as this heavy profit taking can temporarily push prices down, historically.

Looking at the shark and whale addresses i.e. addresses holding anywhere between 10 to 100k ETH, it shows that the amount of ETH held by this cohort has been declining over the past month which is a bit disappointing and shows signs of bearishness.

The Bull Case Scenario for Ethereum (ETH)

The total number of Ethereum staying on the exchanges has continued to drop. On the other side, the total ETH in staking has also shot up. Popular crypto analyst Lark Davis notes:

Ethereum on exchanges 18.05 million Ethereum staking 18.15 million Currently, 16% of ETH is staked, a low number compared to others like SOL or ADA. If ETH staking doubles to 32% it will require the purchase of EVERY SINGLE ETH on exchanges. B U L L I S H ! ! !

As Ethereum conducted the Shanghai upgrade, some investors started to unstake their ETH. This is especially true for exchanges like Kraken which recently faced an SEC lawsuit and a penalty of $30 million for offering staking service. But Lark Davis explains that the ETH deposits have been growing significantly on the other hand.

Some people are indeed unstaking their Ethereum (a lot of it is Kraken, thanks SEC), but look at all of the incoming deposits! pic.twitter.com/LzJ1FEtcVI

— Lark Davis (@TheCryptoLark) April 13, 2023

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise