Ethereum, Harmony and Spell Token Price Analysis: 07 December

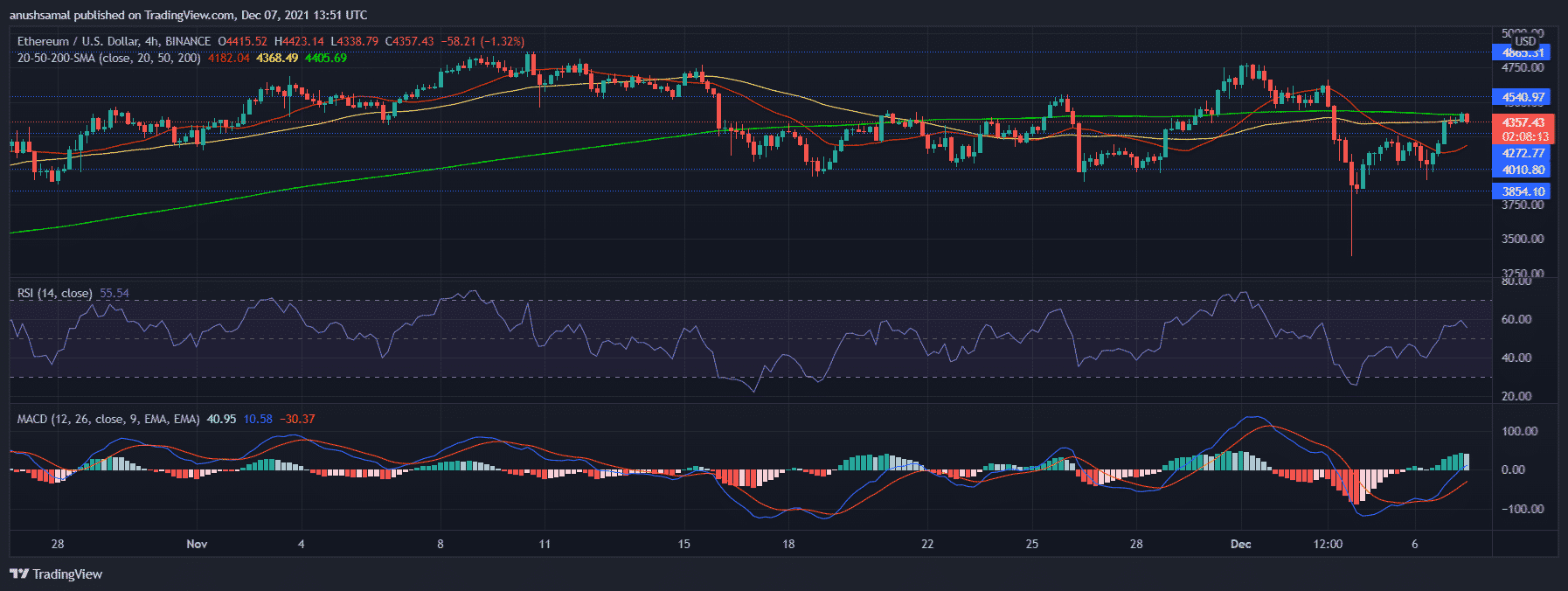

Following the crash on December 4, Ethereum has risen to trade above the $4000 level again. At press time, the coin was trading for $4357.43. The alt-king propelled above the $4272.77 mark and could attempt to trade near the resistance mark of $4540.97, Ethereum’s additional resistance stood at its multi-week high of $4865.31. Over the last 24 hours, the coin registered a 6.2% increase in value. The trading volume of Ethereum also crept up over the last day.

Ethereum Price Analysis

Ethereum’s technicals portrayed a bullish outlook, the coin’s price was seen above the 20-SMA line which indicated that price momentum was still controlled by the buyers in the market.

MACD signalled a bullish crossover and displayed green histograms. The Relative Strength Index was above the half-line in correspondence to the 20-SMA line, although the indicator flashed a downtick, this signalled a possible dip in prices over the upcoming trading sessions.

In case of a price reversal, the support region for Ethereum awaits at $4010.80 and then at $3854.10.

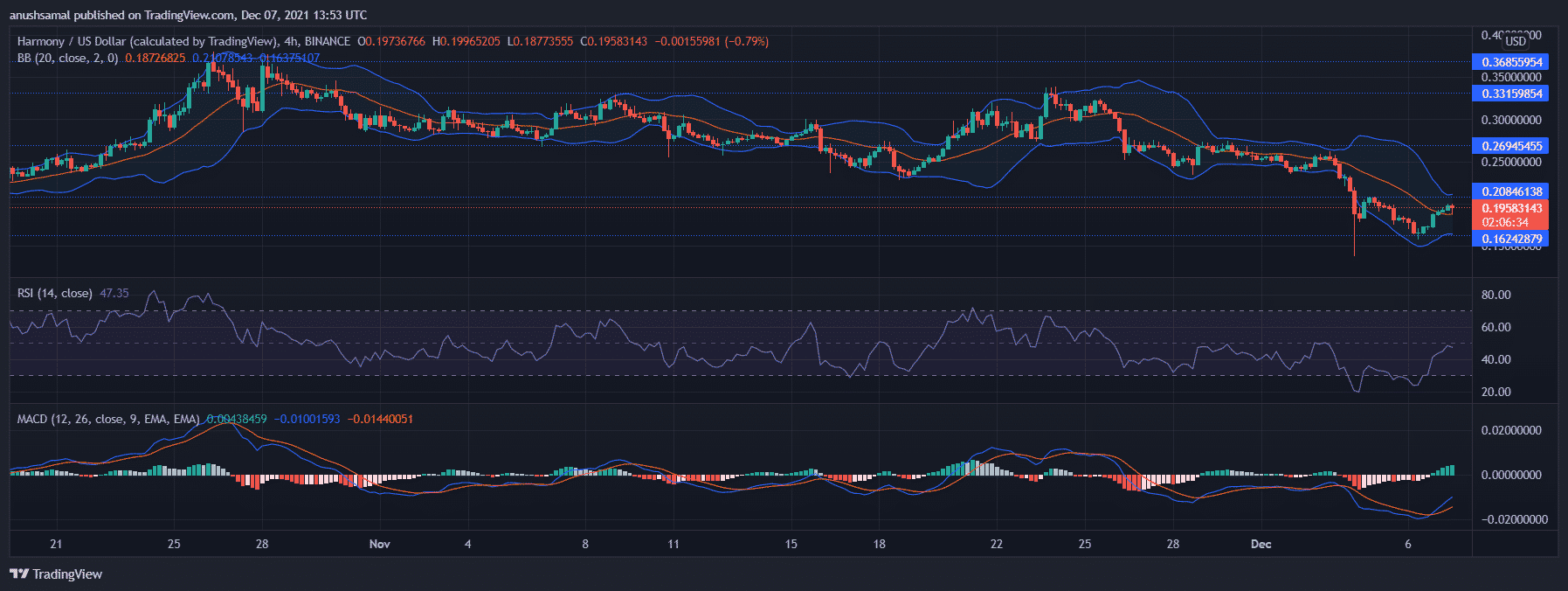

Harmony Price Analysis

Harmony was priced at $0.195 after it surged 16% over the last 24 hours. Harmony was among the top gainers that showed double-digit appreciation. Over the past 72 hours, the token displayed a steady recovery, however, in the last 24 hours the prices have seen a considerable increase. The technical outlook was also positive at the time of writing.

Buying pressure as indicated on the Relative Strength Index also showed a surge, the token also recorded a hike in the trading volume over the past day.

MACD’s bullish crossover agreed with the bullish price action. A continuous upward push will cause Harmony to encounter resistance at $0.208 and then at $0.269, a level that bulls have not gotten past in the last few days. Additional price ceilings awaited the coin at $0.334 and at $0.368, a level the coin last touched in October.

Bollinger Bands displayed constriction, however, it also flashed a little relaxation which is usually indicative of volatile price action.

On the flip side, the major support level was at $0.162.

Spell Token Price Analysis

Spell Token surged by a massive 60.9% over the last 24 hours, it is the native token of Abracadabra.money DeFi protocol. The token depicted an enormous growth in its trading volume by 97.83% over the last 24 hours. Major technicals have pointed towards a massive bull price action.

Relative Strength Index in the last 24 hours revisited its monthly high which is indicative of a growth in the number of buyers in the market. MACD also underwent a bullish crossover.

Capital inflows were in surplus as seen on the Chaikin Money Flow, which also was the monthly high for the token.

The tremendous surge in prices could be a consequence of the increase in the growth of decentralized stable coins. Abracadabra.money is powered by the SPELL Token which is a stable coin, the total value locked of which has been increasing along with its circulating supply.

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?