Ethereum Miners Vote To Raise Gas Limit To 12.5 Million

There are three main aspects of Ethereum: Gas, Gas Limits, and Gas price. All of these are tracked by developers. If Bitcoin evolved to be a peer-to-peer network and electronic money, Ethereum is a distributed network for creatives seeking to deploy decentralized applications (dApps) enabled by a virtual machine. Since fees must be paid, Gas price and limits could determine how easy—and competitive, it is for developers to launch dApps on Ethereum.

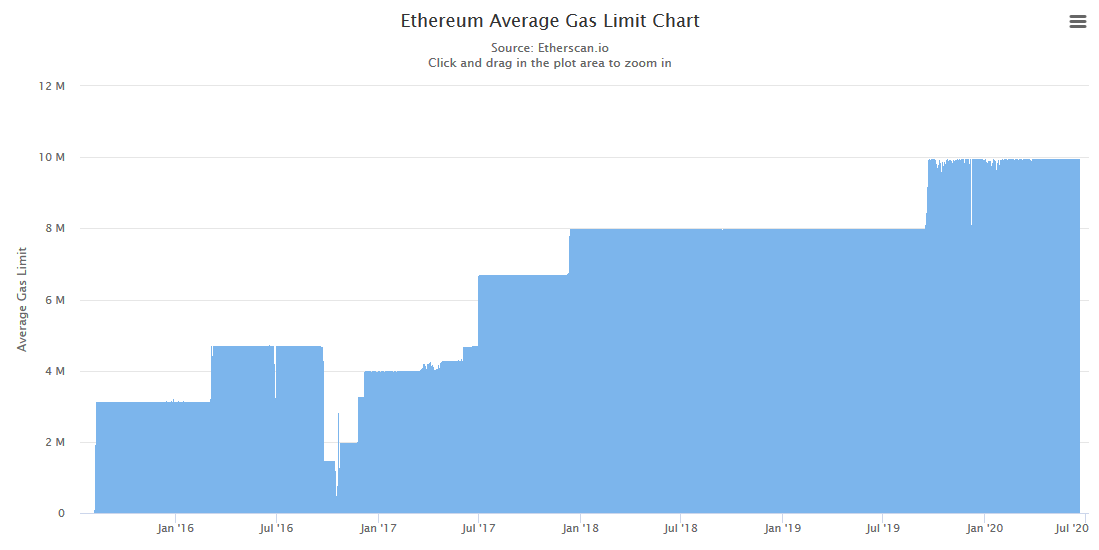

The #Ethereum miners are voting to increase the Block Gas Limit from 10,000,000 to 12,500,000. ⛏️

In theory, this means that the Ethereum network now has the capabilities to handle ~44 transactions per second, instead of ~35.

Another huge milestone for the community.??

— Bitfly (@etherchain_org) June 19, 2020

Gas and Gas Limits in Ethereum

Voting is ongoing and the result would determine whether Ethereum will move the Gas limit to 12.5 million from the current 10 million.

As a public chain with different views and developers holding different stances, this vote has been lauded in some quarters—termed as a milestone, which in the opposite corner, Peter Szilagyi has admonished voters saying this will open up the network for DDOS attacks.

TL;DR: The #Ethereum miners don't give a fuck about the long term health of the network nor about DoS attacks. https://t.co/qamT0nakFA

— Péter Szilágyi (@peter_szilagyi) June 19, 2020

If passed, the general health of the Ethereum network could deteriorate as the network users prefer speed over security.

Security, transparency and control over speed.

You chose the latter. In time, many people will choose the former. Just like internet speeds in the 90s, it needs to speed and scale up.

If we were in the 90's you would most probably be like Letterman. https://t.co/OBhyqHqKoH

— Malcolm Cauchi (@MalcolmCauchi) June 19, 2020

Gas is the “fuel” of Ethereum and is used to settle transactions, execute smart contracts, and even launch dApps.

With the Gas limit representing the maximum amount of ETH one is willing to pay or confirming a transaction—each at 21,000, and the higher the amount one is willing to pay per transaction, the faster it will be executed.

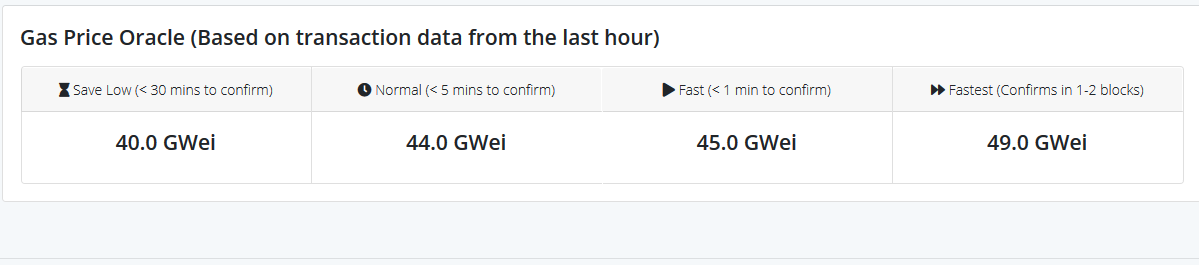

According to Gas Price Oracle, a 49 GWei transaction will be settled in less than two minutes while the one with 40 GWei will take less than 30 minutes to settle.

Vitalik: It’s a Vote of Trade-offs

Still, as Vitalik Buterin puts it, it’s a vote of trade-offs.

If the Gas limit is pushed to 12.5 million on the mainnet, it will insinuate that the network can process 44 transactions per second. However, as it is evident, the vote is beyond throughput but more of the state of the network.

Some observers opine that if Ethereum runs away with the 12.5 million Gas limit, the worst-case scenario is a state when it fails to produce blocks. Blocks are key since they contain validated transactions and its continuous generation is the pulse of Ethereum.

The Gas limit is changed every block. Algorithms that fix the minimum and max Gas limit per block. This way, block generation time is kept at a minimum and the network remains decentralized.

Although it can be reset by the miner by a factor, it helps protect a mining node from attackers who would make an effective infinite transaction loop.

Whether the vote to increase the mainnet Gas Limit to 12.5 million will help prevent congestion as miners earn more from fees isn’t clear yet. What’s clear is that ETH related fees will spike, rising above Bitcoin’s.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- How BTC, ETH and XRP Prices React as Crude Oil and Safe Havens Surge After Khamenei’s Death

- BREAKING: Iran Refutes WSJ’s Claims on Push to Resume Nuclear Talks with US, Bitcoin Slips

- Crypto Market Crash Deepens as Trump Confirms More Airstrikes to Hit Iran

- US CLARITY Act Likely to Pass by Mid-Year, JPMorgan Signals Major Crypto Shift

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs