Ethereum News: Latest On-chain Activity Hints Massive ETH Purchase by Bitmine (BMNR) and SharpLink (SBET)

Highlights

- Bitmine Immersion purchased 46,255 ETH worth $200.43 million.

- SharpLink Gaming hints at buying more ETH as it moves 379 million USDC.

- ETH price gains upside momentum after the U.S. PPI inflation cooled significantly.

In the latest Ethereum news today, top Ethereum treasury companies Bitmine Immersion and SharpLink Gaming have reportedly scooped up a massive amount of ETH. This comes as ETH price started upside momentum after the US PPI data showed inflation had significantly cooled.

Bitmine Immersion Adds Over $200 Million in ETH

Tom Lee-backed Bitmine Immersion purchased 46,255 ETH worth $200.43 million, on-chain data platform Lookonchain reported on September 11. With the latest purchase, Bitmine expanded its total ETH holdings to 2,126,018 ETH worth $9.27 billion.

On Wednesday, Bitmine bought another 10,320 ETH worth $44.57 million. On Monday, the ETH treasury firm disclosed a massive 202,469 ETH purchase worth $881 million in a week. Tom Lee predicted ETH to hold support at $4,300 as Wall Street moves on-chain and AI building a token economy will result in an Ethereum supercycle.

BMNR stock closed 2.24% higher at $45.60 on Wednesday. The stock has rallied more than 551% year-to-date, as per Google Finance.

SharpLink Gaming Hints at Buying More ETH

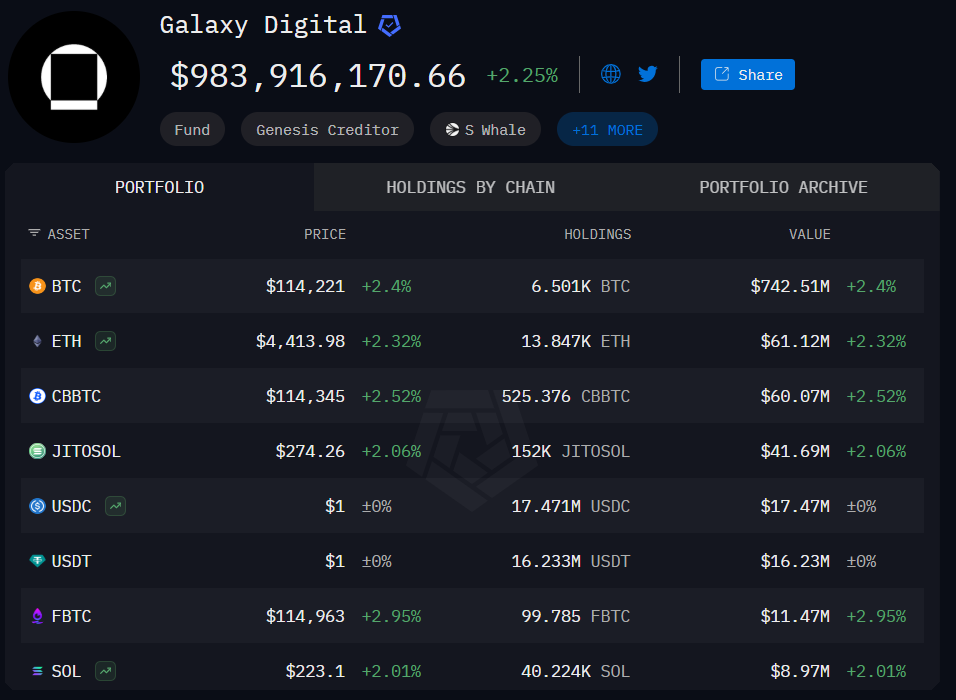

Second-largest Ethereum treasury company SharpLink Gaming looks to boost its Ethereum holdings today. The firm moved 379 million USDC to Galaxy Digital, as per Lookonchain data.

Further on-chain analysis revealed that Galaxy Digital wallet held $17.47 million USDC. The stablecoins transferred from SharpLink were deposited to crypto exchange Binance. It was not clear yet whether the firm would likely buy more ETH from the proceeds. However, similar on-chain transactions followed ETH purchases by SharpLink Gaming. The firm has a total Ethereum treasury of $3.6 billion in ETH.

Moreover, SharpLink acquired 939,000 SBET shares under the $1.5 billion share repurchase program. The firm purchased the shares at an average price of $15.98. SBET stock price closed 3.59% lower at $16.09 on Wednesday.

ETH Price Surges After PPI Inflation Data

ETH price jumped more than 2% in the past 24 hours, with the price currently trading at $4,411. The 24-hour low and high are $4,296 and $4,450, respectively.

Furthermore, the trading volume has increased by 36% in the last 24 hours, indicating a rise in interest among traders. This happens as the headline PPI inflation in the United States cooled to 2.6%, way below expectations of 3.3% and the previous reading of 3.3%. This prompted institutions, including Bitmine, to increase its ETH holdings.

Analysts expect a sudden big move in ETH price as the Bollinger Bands squeeze. As per IncomeSharks, ETH signals a good long opportunity as on-balance volume (OBV) is rising ahead of price.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- ‘Gambling Is Not Investing’: New Group Pushes Crackdown on Prediction Markets

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs