Ethereum Price Hidden Bullish Agenda Reveals Rup-Up to $2,400

Ethereum price is leading the volatile stint in altcoins, trading 1.3% down to $1,837. The most prominent smart contracts token, with $222 billion of market capitalization and $6.8 billion in the 24-hour trading volume, briefly dipped below support at $1,830, touched lows of $1,825 before recovering to $1,835 at the time of writing on Thursday.

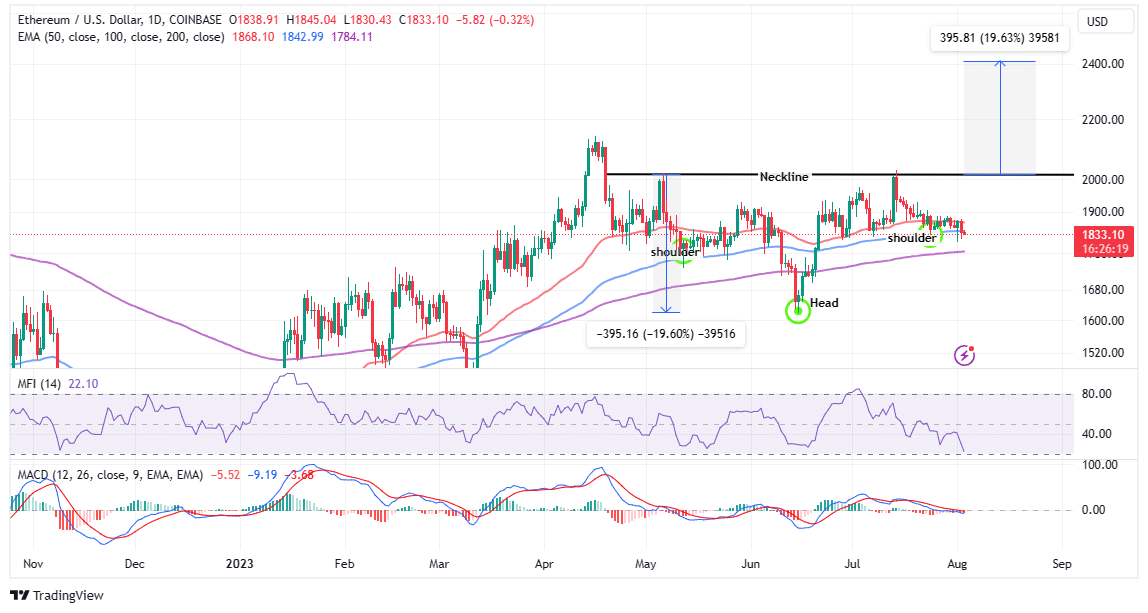

Ethereum Reveals 20% Inverse H&S Pattern Breakout

Ethereum price since mid-June is stuck in a narrow range, with movement on the upside barely touching $2,000, while the situation around the critical support at $1,800 seems to get dire for the bulls.

If a rebound above $1,900 does not follow swiftly, selling pressure will likely increase as more traders evaluate their positions. It is worth pointing out that Ethereum price is now trading below two crucial moving averages, starting with the 50-day EMA (red) and the 100-day EMA (blue).

Based on the prevailing technical picture tapping insights from other technical indicators such as the Relative Strength Index (RSI), which has since the beginning of July sustained a downtrend to the oversold region, and the sell signal from the Moving Average Convergence Divergence (MACD), a knee-jerk bullish reaction is highly unlikely.

That said, investors may want to start acclimatizing to Ethereum plunging below $1,800 and possibly revisiting support at the 200-day EMA (purple) at $1,785 before considering a trend reversal to $2,000.

If push comes to shove, declines may stretch to $1,600 allowing sidelined investors to get a lower-priced exposure to ETH, subsequently building the momentum for a larger trend reversal.

A deeper analysis of the daily chart reveals an inverse head and shoulders (H&S) pattern. It is a bullish reversal pattern that signals the end of a downtrend and the start of an uptrend.

The H&S consists of three troughs, with the middle one being the lowest and the other two being roughly equal in height. The pattern is confirmed when the price breaks above the neckline, which is a resistance level connecting the highs of the two shoulders at $2,000.

Traders should consider keenly following this pattern to identify a potential change in trend direction and enter long positions when the price confirms the breakout beyond the $2,000 level. The target price is usually calculated by adding the height of the pattern to the neckline, for instance, 19.30% to $2,412.

Propping Ethereum for a rally in the near future is the gradual increase in its DeFi total value locked (TVM), as shown by data from Coinglass. The value of all the crypto assets locked in Ethereum-based smart contracts has since mid-Jun has been rising following a longstanding downtrend from mid-April.

This increase in the TVL means Ethereum supply on exchanges is shrinking, thus reducing the potential selling pressure—and creating a suitable environment for a rally.

Related Articles

- New Backup Pool Solution: A Remedy For CRV Liquidation Crisis?

- Binance Announces Zero-Fee Bitcoin And Ethereum Trading, Bullish For Crypto Market?

- Australian Regulator ASIC Sues eToro for Offering High-Risk Derivative Products

Recent Posts

- Crypto News

Tom Lee’s Fundstrat Warns Clients Bitcoin Could Fall to $60,000 Despite His ATH Public Forecast

Top asset manager Fundstrat has advised its private clients to expect a pullback in Bitcoin…

- Crypto News

125 Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards

Over 125 cryptocurrency companies have joined forces to defend stablecoin rewards programs against banking industry…

- Crypto News

BlackRock Bitcoin ETF Ranks Among Top ETFs In 2025 Despite Crypto Downturn

The BlackRock Bitcoin ETF (IBIT) has emerged as one of the top exchange-traded funds (ETF)…

- Crypto News

Stablecoin Adoption Deepens as Klarna Turns to Coinbase for Institutional Liquidity

Klarna has taken a major step into crypto finance by partnering with Coinbase to accept…

- Crypto News

Ripple, Circle Could Gain Fed Access as Board Seeks Feedback on ‘Skinny Master Account’

The U.S. Federal Reserve has requested public feedback on the payment accounts, also known as…

- Crypto News

Fed’s Williams Says No Urgency to Cut Rates Further as Crypto Traders Bet Against January Cut

New York Federal Reserve President John Williams has signaled his support for holding rates steady…