Ethereum Price Rally Gains Momentum for $4000, Here Why?

Highlights

- Ethereum price defies crypto market moving strongly above $3,000

- Spot Ether ETF and decline in Bitcoin dominance driving rally to $4,000

- Analysts bullish on ETH price as Bitcoin goes into consolidation

Ethereum price is currently trading above the $3000 psychological level after nearly 2 years, backed by massive spikes in trading volumes. Experts predict spot Ether ETFs, rising open interests, and other reasons make a rally to $4,000 imminent, leaving behind Bitcoin.

Ethereum Price Gains Momentum Above $3,000

ETH price has rallied nearly 3% in the last 24 hours, defying broader crypto market correction. Bloomberg noted a shift in trends observed in 2023, where Bitcoin typically led the market. Ethereum (ETH) outpacing Bitcoin (BTC) this year with a remarkable 28% climb compared to Bitcoin’s 21% advance.

Bitcoin dominance has again declined to 51% as Ethereum gains momentum, triggering an upsurge in altcoins. Whale and crypto firms are mainly driving this upside momentum. Whales accumulated significant ETH when price breakout above the $2600 level after a retest to $2250.

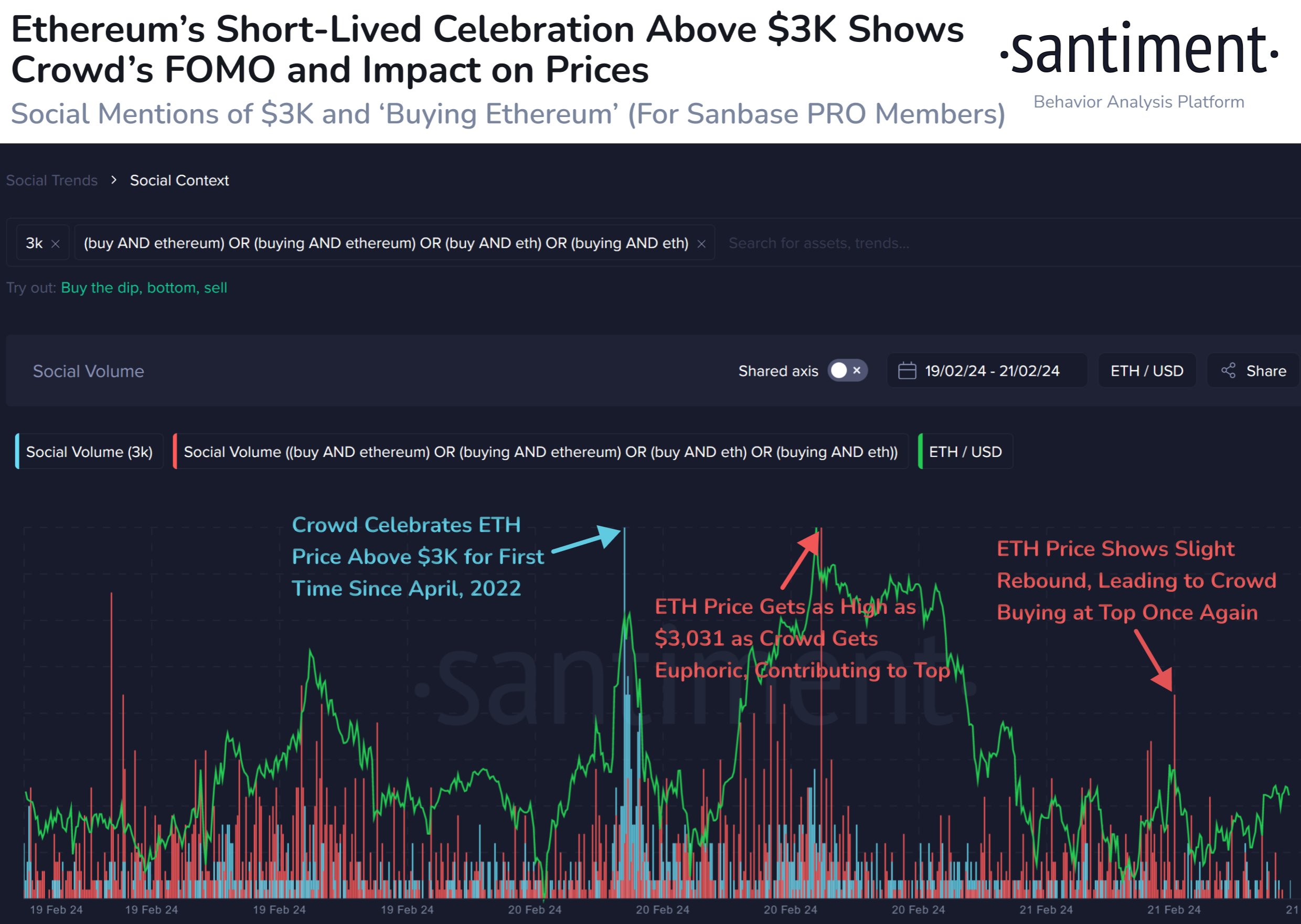

Sentiment data revealed a rise in ‘Social mentions of $3K and buying Ethereum’ in this week. While Ethereum price dipped amid the crypto market selloff yesterday, FOMO and its impact on prices are clearly visible. Meanwhile, Ethereum has an all-time high of 114.95 million holders as compared to 5.22 million holders of Tether (USDT)

Also Read: Terra Vs SEC: Court Sets Pretrial Deadline As Do Kwon Set for US Extradition

ETH Price Rally to $4,000

Experts including analyst Michael van de Poppe predict a consolidation in Bitcoin for the next coming months and suggest rotating much money to the Ethereum ecosystem. People will make profits just by holding ETH rather than day trading as a potential approval of spot Ether ETF looms in May.

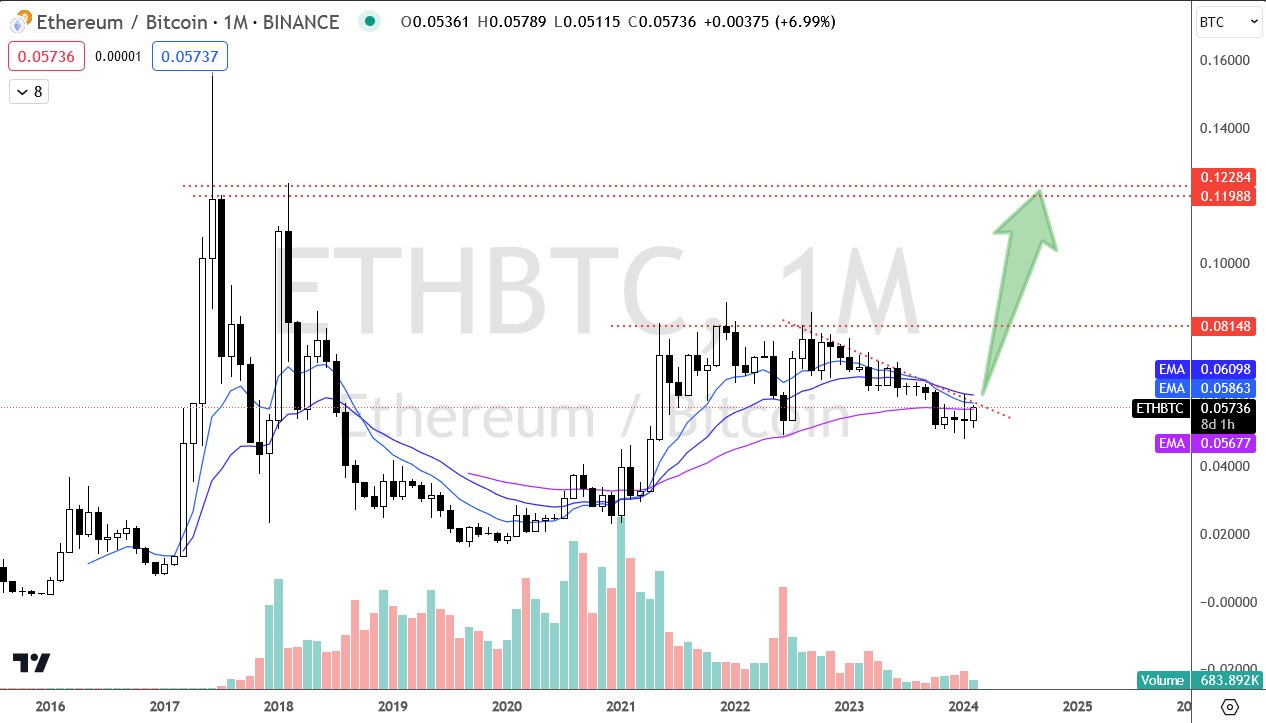

Combining spot Ether ETF narrative, Dencun upgrade, demand side for restaking airdrop farming, and strong ETHBTC charts in all timeframes, Ethereum price rally will continue for many weeks ahead.

ETH price jumped over 3% in the past 24 hours, with the price currently trading at $3,017. The 24-hour low and high are $2,875 and $3,021, respectively. However, the trading volume has declined slightly in the last 24 hours. As per a CoinGape Markets analysis, an ETH rally to $4000 is imminent.

Moreover, 792K ETH options of notional value $2.4 billion are set to expire, with a put call ratio of 0.49. The max pain point is $2,400. Options and futures traders are bullish on Ethereum, making higher bets

Also Read: Ethereum’s Vitalik Buterin Highlights Permanent Money Loss Risk in L2

- Breaking: U.S. Supreme Court Rules Trump Tariffs Are Illegal, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans