Ethereum Realized Price At 6-Month High As ETH Staking Tops 24 Mln, Is $2500 Next?

Ethereum staking increased significantly after the Shanghai upgrade on April 12, with deposits outpacing withdrawals. According to Etherscan, ETH staking deposits on the Beacon Chain reached another all-time high, with 24.17 million ETH worth $46.03 billion at a price of $1903 as of June 3.

Moreover, total ETH deposits post-Shanghai upgrade is 6 million ETH, while total withdrawals accounts for only 3 million, as per Nansen deposit contract data.

Moreover, Ethereum (ETH) balance on the crypto exchanges has reached a new five-year low. CryptoQuant data indicates that the total amount of ETH held in crypto exchanges dropped to critical levels. ETH on exchanges now stands at almost 16 million, reaching levels not recorded since July 2018. In fact, it has declined 50% since the all-time high.

Interestingly, Nansen data indicates ETH locked has also reached an all-time high of 22.4 million. ETH locked means all ETH that is out of circulation, it includes ETH staked on the Beacon Chain, ETH deposited to the Beacon contract but not validating yet, and rewards on the Beacon chain.

Typically, an increase in the amount of ETH locked and staking led to a decrease in the overall supply of Ethereum tokens available in the market. The decrease in ETH will cause prices to rally higher.

Also Read: Celsius $800M ETH Staking Extends Ethereum Queue

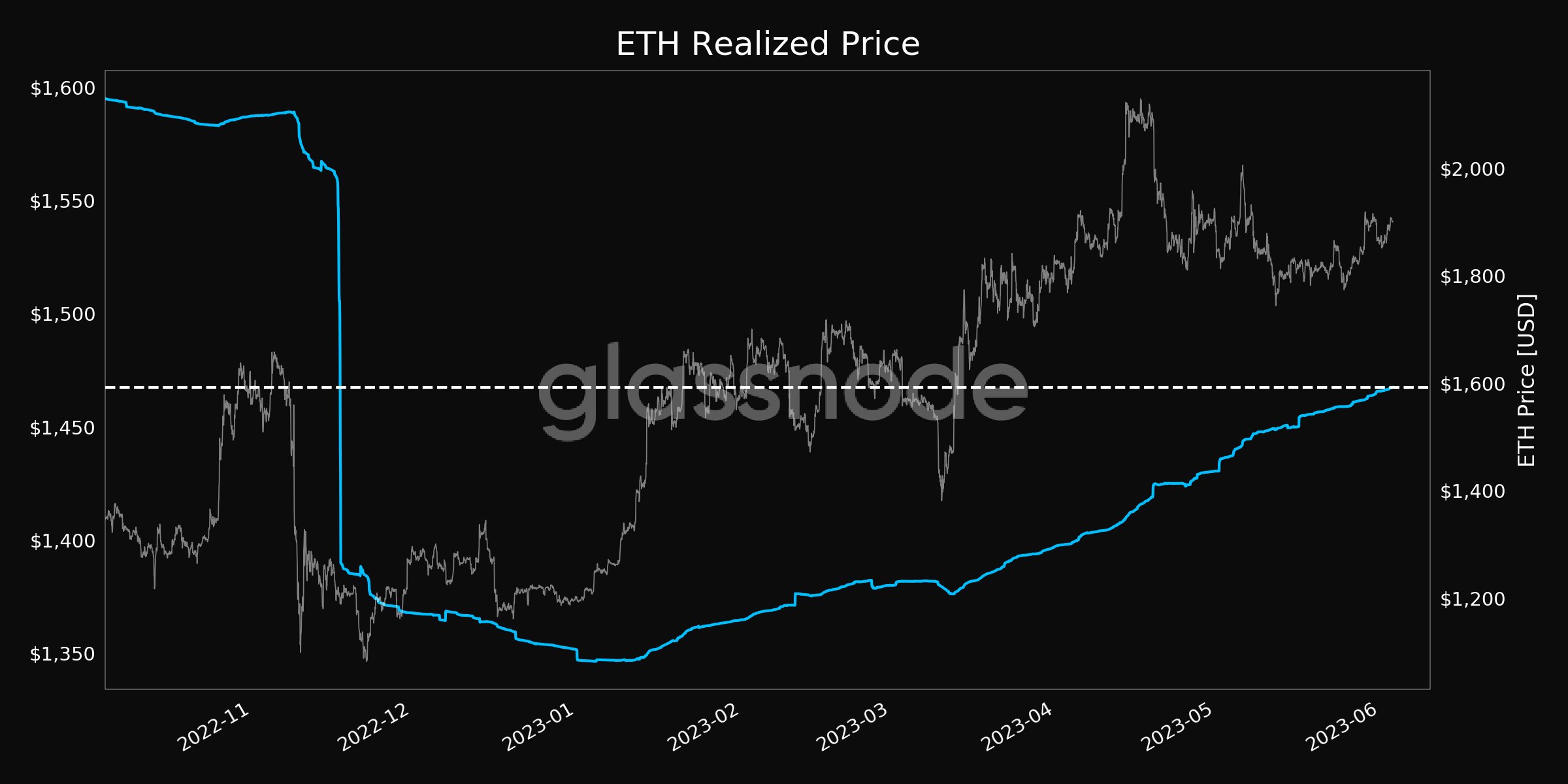

Ethereum Realized Price At 6-Month High

As a result of low ETH supply in the market, Ethereum realized price has hit a 6-month high of $1470. It can be interpreted as the on-chain support for ETH price. The price has now less probability of falling below the level, making institutional investors more inclined to Ethereum than Bitcoin.

As per CoinGape Markets, ETH price can hit $2500 due to the bullish morning star candlestick pattern formed after ETH breakout above the 2-month resistance trendline. In addition, a bullish breakout from the wedge pattern has set the Ethereum price on a recovery track.

ETH price currently trades above $1900, up 5% upside in a week. It indicates that investors are buying on dips in anticipation of a major upcoming rally.

Also Read: Terra Classic Officially Releases Its Biggest v2.1.0 Parity Upgrade Proposal

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

Buy $GGs

Buy $GGs