Ethereum Sees Massive Demand As 8 Million ETH Purchased Between $1600-$1650

The world’s second-largest cryptocurrency Ethereum (ETH) has been showing great strength during this market recovery. Since the beginning of 2023, ETH has been up by more than 40% and is currently within a strong demand zone.

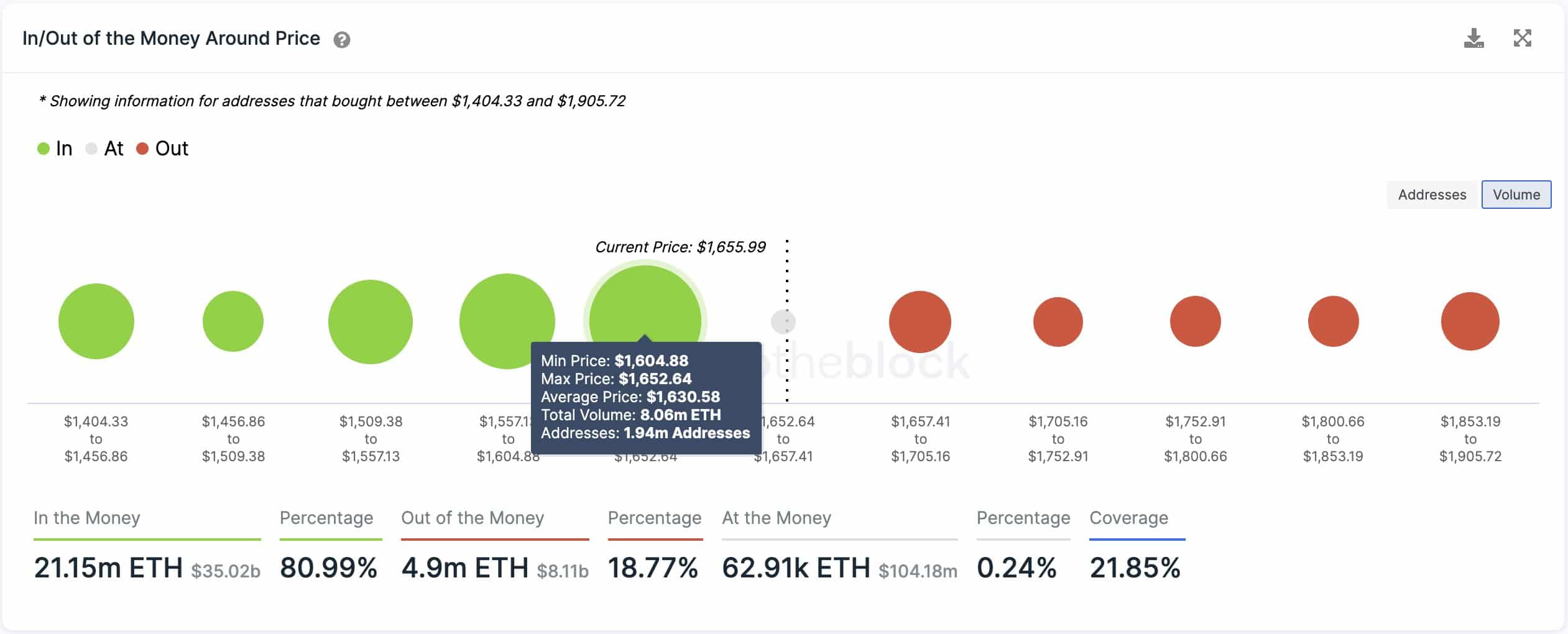

As of press time, ETH is trading 2.9% down at a price of $1627 and a market cap of $199 billion. The recent activity shows that $1600 could serve as strong support for ETH going ahead. Citing data from IntoTheBlock, popular crypto market analyst Ali Martinez reported:

Note that the $1,600-$1,650 level represents a significant area of support for #Ethereum. Onchain data shows that 1.94 million addresses purchased 8 million $ETH between $1,600 – $1,650. As long as this important demand wall holds, #ETH has a good chance of advancing further.

ETH has been currently facing strong resistance at $1,700. However, any breakout above these levels could help in pushing the ETH rally further.

Ethereum On-Chain User Activity Jumps

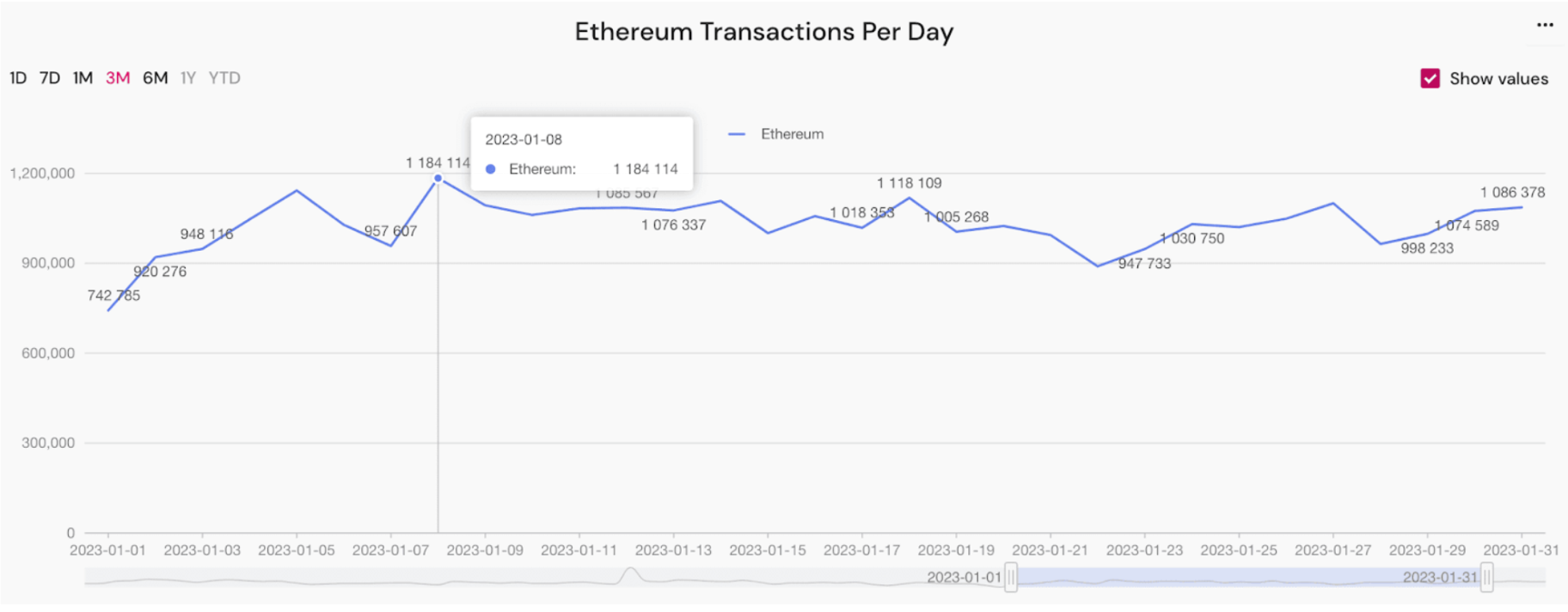

As per a data report from Analytex, user activity on the Ethereum platform surged significantly in the last month of January 2023. This has ultimately translated into the surge of average gas prices on the Ethereum blockchain network.

Calculated in gwei, the smallest Ethereum denomination, the average gas price jumped by 29.27% in January 2023, in comparison to its previous month. The report also adds that the average number of unique Ethereum active wallets per day dropped by 10% to 387,475.

Furthermore, there’s a drop in the daily Ethereum transaction data by 0.8% from December to January. The average ETH transactions per day have been on a decline for eight months now.

The recent surge in user activity on Ethereum could also be due to an uptick in the DeFi activity recently. The total value locked (TVL) across different decentralized finance protocols surged during the last month of January 2023.

The upcoming Ethereum Shanghai hardfork is also driving staking in DeFi due to the expected opening of withdrawals from the Ethereum staking contracts in March 2023. It will be interesting to see if ETH can surge to $2,000 by the time of the Shanghai hardfork.

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum