Ethereum Spot ETFs Record $447 Million in Outflows Amid Crypto Market Decline

Highlights

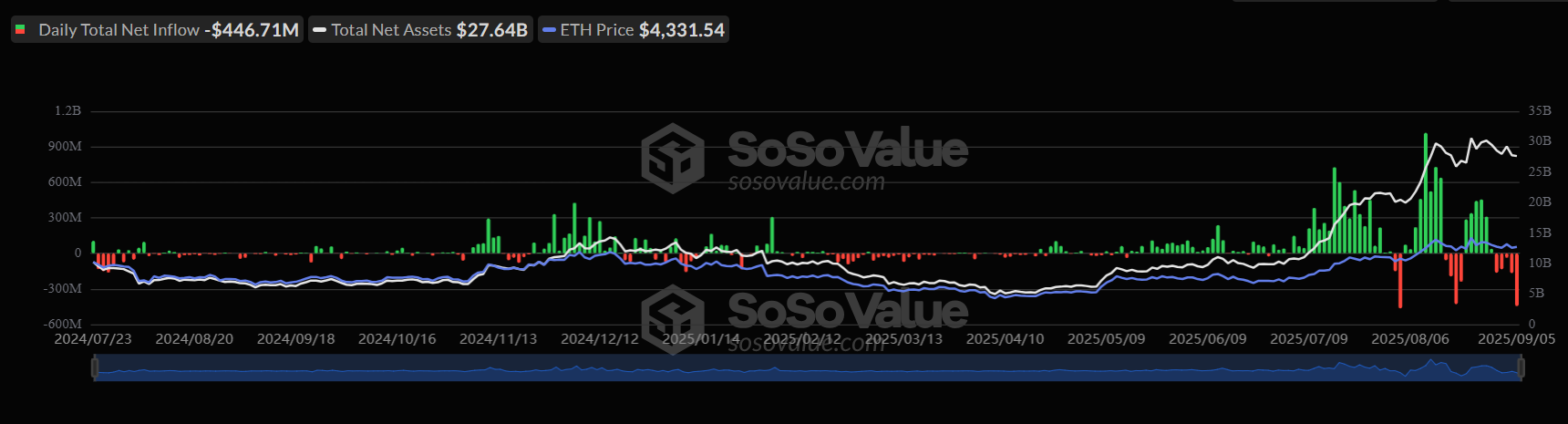

- Ethereum ETFs saw $446.7 million in net outflows on Sept. 5, led by BlackRock.

- This comes amid the drop in the crypto market.

- Weekly data shows $787.7 million were withdrawn from these funds this week.

Ethereum ETFs faced a sharp investor pullback this week, shedding nearly half a billion dollars in a single day. This comes amid a decline in the crypto market, with the ETH price also facing a pullback.

Ethereum ETFs See $447 Million In Outflows

Ethereum spot exchange-traded funds (ETFs) faced heavy redemptions on September 5, with institutional investors pulling nearly $447 million in a single day. The sell-off, led by BlackRock, marked one of the sharpest retreats since Ethereum ETFs launched, underscoring shifting sentiment in a volatile market.

According to SoSoValue data, trading activity across ETFs surged to $2.79 billion, suggesting the withdrawals reflected repositioning rather than a broad market exit.

The outflows coincided with a broader pullback across crypto ETFs, pushing cumulative net inflows down to $12.73 billion — the lowest since late August. With Ethereum’s price trading near $4,300 after peaking at $4,900 earlier in the month, Crypto analyst Ted Pillows, in a tweet, predicts Ethereum inflows will return if the outflow pump continues.

BlackRock Leads Heavy Redemptions

BlackRock’s ETHA fund led the withdrawals, accounting for $309.9 million of the day’s redemptions, while Grayscale and Fidelity recorded $51.7 million and $37.7 million in outflows, respectively. Smaller funds, such as Grayscale’s ETHE and 21Shares’ TETH, also posted losses, though on a smaller scale. Altogether, Ethereum ETFs shed $446.7 million, representing the second-largest single-day outflow on record, only behind the $465 million drawdown on August 4.

This marked a reversal from August’s strong performance, when Ethereum ETFs attracted $3.87 billion in net inflows. The August rally closed with a sharp $164 million outflow on August 29, ending a six-day streak of consecutive inflows and signalling that profit-taking had already begun. The September redemptions appear to have accelerated that trend, dragging ETF assets under management down to $27.64 billion.

Institutional Shifts Reflect Market Caution

The scale of the outflows highlights how institutions are reassessing risk exposure in response to Ethereum’s rapid price swings. Bitcoin ETFs also recorded $160 million in redemptions on the same day, suggesting a broader market pullback rather than an Ethereum-specific issue.

Traders remain divided on whether inflows will rebound. Some market participants argue that renewed strength in Ethereum’s price could reignite institutional interest, while others see the outflows as evidence of a cautious stance amid uncertain macroeconomic conditions.

On August 4, BlackRock alone moved $292 million in BTC and $372 million in ETH to Coinbase after ETFs recorded record withdrawals, fueling speculation that funds were offloading assets to meet redemptions. Analysts note that September’s sell-off resembles that pattern, with ETF issuers again adjusting exposure in response to redemption pressures.

Broader Implications for Ethereum and Crypto ETFs

Despite the sell-off, Ethereum ETFs remain a significant force in U.S. markets, holding billions in assets and accounting for 5.3% of Ethereum’s total market capitalisation. Trading activity also stayed high, with $2.79 billion worth of ETF shares exchanged on September 5, suggesting capital is rotating rather than exiting entirely.

Still, the latest withdrawals represent a pivotal moment for Ethereum’s ETF narrative. Sustained redemptions could dampen momentum for both Bitcoin and Ethereum ETFs, slowing institutional adoption. Conversely, renewed inflows would reinforce confidence in digital assets as a viable part of mainstream portfolios.

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?