After Ethereum Fees, Stablecoins Shadows Bitcoin [BTC] Transactions for the First Time

Data analytics portal, Coinmetrics, reveals that the daily transaction value surpassed Bitcoin for the first time in history. The last 7-days adjusted value of stablecoin transfers is $2.1 billion, while that of Bitcoin is $1.9 billion.

The rise of stablecoins continues, this time with the adjusted daily transaction value (7 day average) surpassing that of #Bitcoin for the first time.https://t.co/dMZFs4zXhd pic.twitter.com/1TM8INTwLK

— CoinMetrics.io (@coinmetrics) June 25, 2020

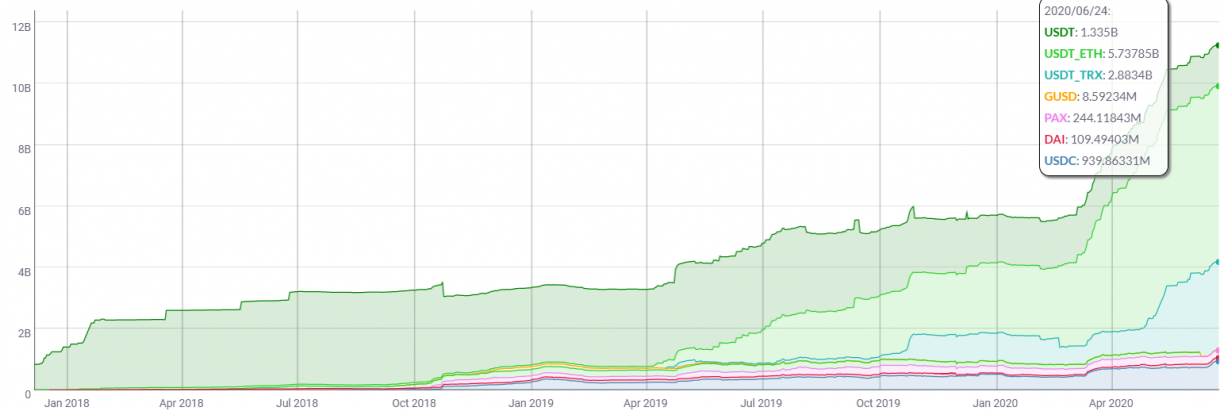

The supply of stablecoins has surpassed $11 billion for the first time with USDT dominance around 88.75%.

This comes after the reports of Ethereum fees overtaking Bitcoin with the rise of DeFi and other decentralized applications. Hence, while attention towards cryptocurrency transfers seems to be increasing, high transaction fees on Bitcoin [BTC] seems to be acting as a deterrent. Moreover, the higher volume of stablecoin volume, not cheaper crypto suggests risk-off from crypto investments as well.

Store of Value Vs. Decentralized Applications

One of the leading USPs of cryptocurrency is permissionless and border transactions. The security, on the other hand, is provided by the strength and distribution of the validators (or miners on the network).

With a plethora of blockchain platforms gaining recognition, the future of Ethereum seems dicey as well. As AVA Labs procures a private sale of $12 million AVAX tokens led by Galaxy Digital, Bitmain, Initialized Capital, NGC Ventures and Dragonfly Capital, Max Keizer, notes,

In 2020 we learned that #Bitcoin is impossible to knock-off, but ETH is very easy to knock-off ETH’s market cap will cede to others in that space.

This is a significant feat as 2020 saw high transaction fees on Bitcoin close to halving. Nevertheless, the traders have remained oblivious to concentrating only on the Store of Value (SoV) properties of Bitcoin.

The realized market capitalization is calculated on the basis of units of supply at the price it last moved on-chain. It recently reached an All-Time High above $106 billion, which is 17.5% greater than the value attained during the 2017 high at $20,000. This suggests that more than twice the volume is moved on-chain that it was during the maximum hype.

However, as we move ahead in time, blockchain and cryptocurrency users will look for cheaper methods of transfers. While Bitcoin is the most secure network, it is not the cheapest by a fair amount.

Do you think that other cryptocurrencies will take over Bitcoin or second layer solutions will uphold Bitcoin’s dominance? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs