Ethereum Wallet Dumps Hints Towards Potential Price Bounce, Reveals Santiment

Ethereum, the second-largest cryptocurrency by market cap, is facing a dynamic landscape as it sits at $1,700, capturing both attention and impatience within the trading community. The market sentiment revolves around the asset’s price movements and recent trading behavior.

ETH’s Price Sparks Trader Interest Amid Growing Impatience

Santiment, a leading crypto analytics platform, highlights Ethereum’s price at $1,700 and its significance among the top cryptocurrency contenders. The current state of ETH has traders growing increasingly impatient, a trend historically associated with potential price bounces. This pattern is caused by witnessed wallet disposals at lower price points, which historically increases the possibility of a price rebound.

Adding to the intrigue, Whale Alert, a platform tracking significant cryptocurrency transactions, reported a transfer of 55,050 ETH (valued at approximately $93.7 million) from an unknown wallet to Binance. This large-scale movement of Ethereum adds an air to the ongoing sentiment.

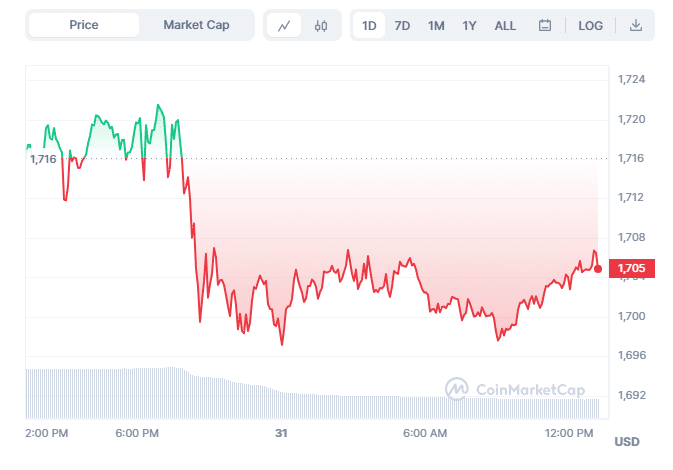

As of now, Ethereum is trading at $1,705.03, reflecting a marginal 0.08% decrease. The cryptocurrency now has a market capitalization of $205.02 billion. Notably, the attractiveness of Ethereum goes beyond its trading activities, as institutional investments continue to pour in. OnlyFans, a company known for its unique thinking, recently invested in Ethereum, reinforcing its status as an appealing investment option.

Also Read: Judge Sets Sept 1st Deadline for SBF’s Defense in Trial Delay Decision

ETH Also Low On Gas Fees

While Ethereum’s price journey gains attention, its transaction ecosystem is also changing. Ethereum’s gas fees, commonly referred to as gas fees, reached a yearly high in May due to a surge in meme-coin frenzy. However, these fees have since significantly decreased, sparking discussions among analysts. The availability of layer 2 solutions, contributing to the scalability of Ethereum, is seen as a potential reason for the fee decline.

Finally, Ethereum’s present price, trading dynamics, and evolving transaction landscape are on the minds of crypto aficionados. The interaction of market impatience, institutional investment, and fee changes presents a multifaceted picture of Ethereum’s role in the ever-changing cryptocurrency sector.

Also Read: Crypto Prices Today: Pepe Coin, KuCoin, And Major Altcoins Fails To Continue The Bull Run

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs