Ethereum Whales Buy $204M ETH Amid Rebound Above $4,400

Highlights

- Whales purchased $204M ETH as ETFs inflows reached $171 million a day.

- Whales and institution accumulations corresponded to ETH price rebound above $4,400.

- The combined $375 million ETH purchases underscore the increasingly important status of Ethereum among institutional holders.

Ethereum (ETH) whales raised their holdings by buying $204 million ETH while ETFs received $171 million inflows. This pushed ETH price over $4,400, and this points to a high level of institutional demand.

Ethereum Price Soars as Whale Purchases Add to Market Momentum

According to blockchain transactions tracker Lookonchain, three newly created wallets received 46,347 ETH valued at $204.4 million from FalconX hot wallets in three hours. The biggest single transfer moved over $82 million ETH and two other wallets received over $40 million ETH. The buys emphasize significant institutional buyer demand, and the long-term accumulation plans by whales.

Institutions keep buying $ETH!

3 newly created wallets received 46,347 $ETH($204.4M) from #FalconX in the past 3 hours.https://t.co/83fR9p850Bhttps://t.co/1fqQehZV0mhttps://t.co/kFholMdME1 pic.twitter.com/rowWv0dD87

— Lookonchain (@lookonchain) September 11, 2025

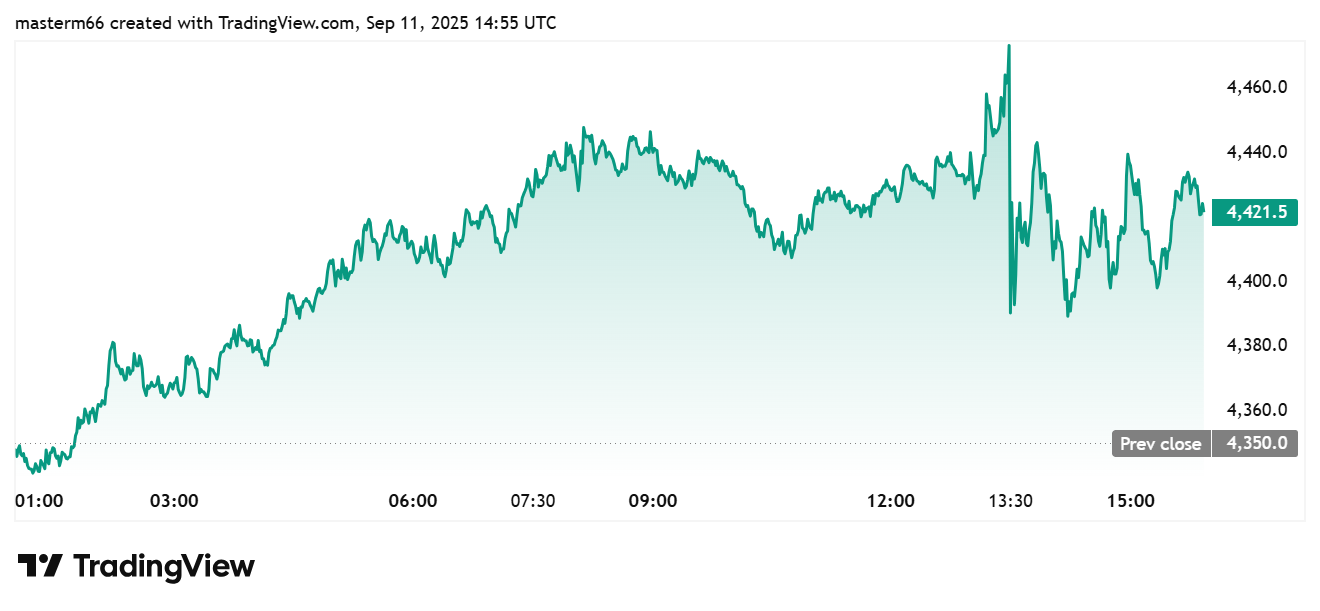

Ethereum price reacted to the development as it rose to $4,423, an increase of 1.68% in the last 24 hours. The token gained $73 since the close of the past day. According to data by TradingView, ETH price increased throughout the day, although there were moments with steep market fluctuations.

Over the longer timeframe, ETH has increased by 4.64% in the last one month. In addition, it is up 131.23% in six months, and 85.07% in the last year. Ethereum resilience and power in the crypto market is also evident in its year-to-date increase of 32.7%. The next resistance for ETH now stands at $4,500. Further institutional demand will likely ensure that token’s price does not drop below $4,300.

Spot ETH ETFs Attract $171 Million as Institutional Demand Grows

There was also much activity among institutional ETH products. Spot Ethereum ETFs recorded total inflows worth $171.5 for the day, raising the total net assets to $27.73 billion, per SoSoValue data.

ETHA owned by BlackRock recorded the highest inflows of $74.5 million and Fidelity-owned FETH registered $49.55 million. A total of VanEck, Grayscale, Bitwise and Invesco products had combined inflows worth $40.38 million. This is indicative of widespread institutional involvement.

These continuous inflow in regulated funds validate the increasing value of Ethereum among asset managers and conventional investors. Some analysts have projected a $10,000 price after Ethereum ETFs hit $2.8 billion inflows in August.

The increased purchases from both ETFs and whales indicate an increased in Ethereum among institutions. The combination of these inflows was almost $375 million in one day, which suggests an increase in Ethereum holdings among institutional portfolios.

Liquidity will be enhanced because of the regular ETF inflows. Furthermore, the accumulations by whales are proof of a belief in Ethereum as the foundation of financial invention worldwide.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs