Ethereum’s Popularity Forces NYSE Listed Company to Change its Ticker Symbol

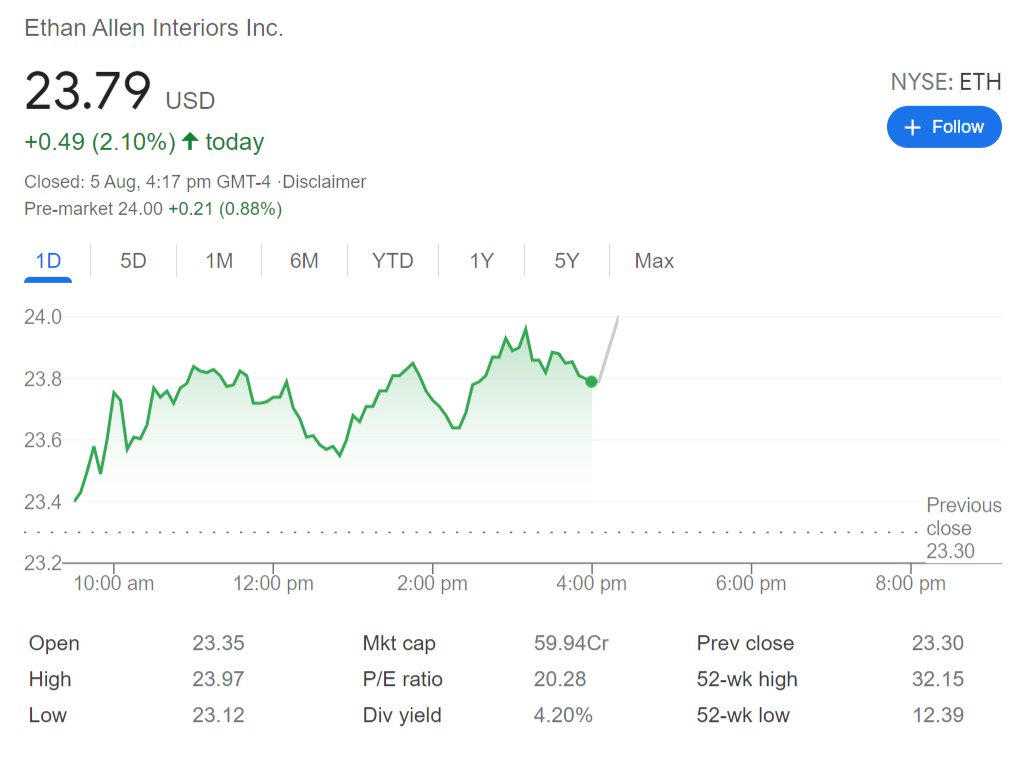

A New York Stock Exchange (NYSE) listed furniture company, Ethan Allen has decided to change its ticker symbol from “ETH” to “ETD” to avoid a clash with Ethereum cryptocurrency represented as “ETH” as well. The popularity of Ethereum cryptocurrency often leads to confusion between the two in search results. This was evident from the stock price pattern of the furniture company which rose by 50% during the peak of the crypto market in March-April.

The firm released a press release to make the announcement and said that the ‘D’ in its new ticker symbol would stand for Design. Farooq Kathwari, Ethan Allen’s CEO said the change in ticker symbol would help “differentiate Ethan Allen news from Ethereum news in search results.”

“The Company is changing its ticker symbol to ETD, using the “D” for Design, to reflect our focus on interior design and the personal services of our design professionals throughout our global retail network of over 300 design centers. We also believe this change will better differentiate Ethan Allen news from Ethereum news in search results, as Ethereum is often abbreviated as ETH.”

The stock price of the furniture company also saw a decline over the past couple of months coinciding with Ether’s price decline, indicating a lot of investors were mistaking it to be the second-largest crypto asset.

Ethereum Has Burnt Over $6 Million in ETH After London Upgrade

Ethereum completed its London upgrade successfully yesterday implementing key changes to transaction fees and also made Ether a defaltionary asset. After the upgrade, users would have a fair idea of the amount of gas that would be required for the transactions instead of blindily bidding to get it cleared. The gas fee would be paid to the network who would forward it to the miners as per the decided rate. The remaining ETH will be burnt making it a deflationary token.

A total of $6.1 million worth of ETH has already been destroyed till now and the network has started producing deflationary blocks where the amount of ETH being burnt are higher than the amount of token paid out to miners. The defaltion is expected to have a bullish impact and make Ether more valuable. ETH price is $2,770 seeing a 18% rise over the past week.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs