Ethereum’s Vitalik Buterin Believes Yield Farming Is Short-Termed

While several have been jumping on to the DeFi bandwagon to explore yield farming, Vitalik Buterin, the creator of Ethereum suggested that it wouldn’t last long.

‘Boring Apps Are The Most Valuable’

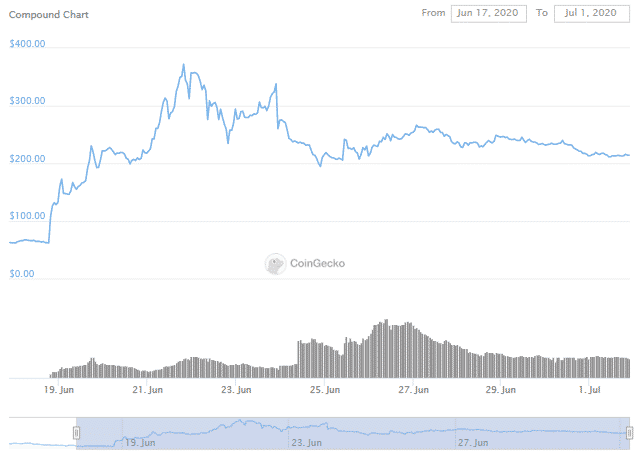

The Decentralized Finance [DeFi] space is undoubtedly the talk of the crypto town. The term “Yield Farming” has taken the crypto world by storm. Soon after the lending protocol Compound Finance, dropped its COMP governance token into the cryptocurrency market, the price of the token witnessed a significant surge. Investors even acquired an APY of more than 100 percent. This further led to several members earning interest via DeFi applications.

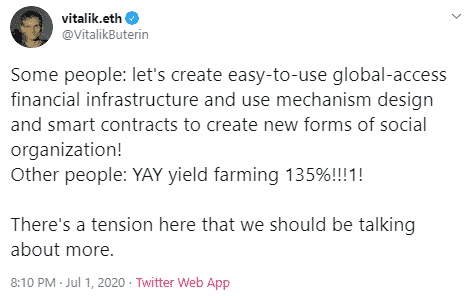

Most of the applications on DeFi run on the Ethereum blockchain. While several have been jumping on to the DeFi bandwagon, Ethereum’s creator, Vitalik Buterin tweeted about the same.

In a thread of tweets, Buterin explained how yield farming was short-termed. He suggested that despite the fruits of the latest concept, it is short-lived. “A lot of the flashy stuff is very exciting” however, giving the users a reality check, Buterin suggested that there was no way that the interest rates on DeFi could exceed a percentage point in the long run.

Furthermore, Buterin pointed out that a lot of the “most valuable parts of DeFi” are usually the most boring. He tweeted,

“…just giving anyone in the world access to a crypto-dollar with an interest rate that matches inflation is already a huge boon to so many people. And we have that; we just need to improve it.”

Additionally, many members of the Ethereum community were seen sharing their opinion about the same on Buterin’s comment section. Anthony Sassano, the Co-founder of the EthHub wrote,

“The yield farming is simply the gateway drug to the other things on Ethereum.”

A lot of the other members of the community seemed to agree with Buterin.

Adam Back, the CEO of Blockstream indicated that yield farming was a possible bubble in the making. He tweeted,

is it just me or is "defi yield farming" scam 3.0 / ICO^3 when ICO^2 (ICO funded ICO platform) ran out suckers to rekt and spooked by regulator ire?

— Adam Back (@adam3us) June 26, 2020

COMP Token’s Downhill Journey

The COMP governance token had caused fervor in the crypto market. The token’s price movement during its initial days was immensely lauded by the community. However, the token’s price has decreased by over 11.1 percent over the past seven days. At the time of writing, the token was trading at $214.27 with a 1.6 percent decrease in its price.

COMP token’s latest price movement has led to several members speculating that it was nothing more than a fad that wouldn’t last very long.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Why Experts Are Warning Bitcoin Rally Could Be A “Dead Cat Bounce”

- BTC and Gold Price Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

Buy $GGs

Buy $GGs