‘Every Crypto ETF You Can Imagine’: Expert Predicts Flurry of Filings After REX-Osprey’s 21 Applications

Highlights

- Nate Geraci predicted that there will be several crypto ETF filings with the SEC in the coming months.

- Over 30 crypto-related ETFs were filed yesterday.

- REX-Osprey alone filed for 21 crypto ETFs yesterday.

Nate Geraci, president of Novadius Wealth Management, has predicted that several crypto ETF filings could hit the SEC’s desk in the coming months. This came as REX-Osprey continued its hot streak, with a filing for 21 crypto-related funds.

Expert Predicts A Flurry Of Crypto ETF Filings With The SEC

In an X post, Geraci declared that any crypto ETF market participants can possibly imagine will be filed with the U.S. Securities and Exchange Commission (SEC) over the next several months. “You all have no idea [of] what’s coming,” he added.

This came as he highlighted how asset managers had filed over 30 crypto-related ETFs with the SEC yesterday, a development which he claimed is just the beginning. As CoinGape reported, REX-Osprey accounted for most of these filings, with REX Shares and Osprey Funds collaborating to file for 21 crypto ETFs.

This filing included funds that will hold altcoins such as Cardano, Hyperliquid, Chainlink, Sui, Hedera, among others. REX-Osprey is also looking to involve staking for the proof-of-stake (PoS) assets, similar to their Ethereum and Solana staking ETFs. The asset managers also filed for these 21 ETFs under the 40 Act, as they look to launch these funds as soon as possible.

Meanwhile, thanks to regulatory clarity under the current administration, there has been a flurry of ETF filings. Bloomberg analyst James Seyffart once highlighted how there were 92 crypto ETFs awaiting approval from the SEC.

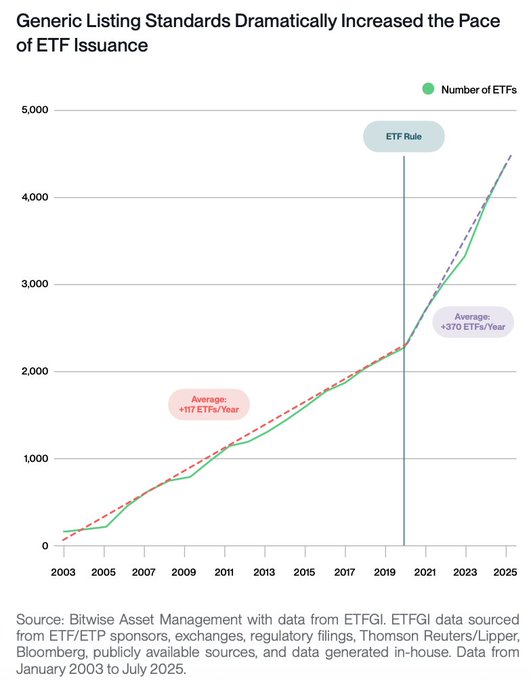

The SEC’s approval of the generic listing standards could also contribute to this projected flurry of filings in the coming months. Bloomberg analyst Eric Balchunas had outlined up to 15 coins that have futures on Coinbase, which could qualify them for approval under the new rule.

100 Crypto-Related Funds To Launch In The Next 12 Months

Balchunas remarked that there is a good chance the market will see up to 100 crypto ETFs launched in the next 12 months, thanks to the generic listing standards. He noted that the last time they implemented a generic listing standard for ETF, launches tripled in the following months.

The Bloomberg analyst echoed Bitwise Chief Investment Officer (CIO) Matt Hougan’s prediction of an expansion for crypto funds with the listing standards. Meanwhile, it is worth mentioning that the crypto ETFs haven’t been limited to just spot filings. Asset managers have also begun to incorporate crypto and stock exposure under a single wrapper.

CoinGape recently reported that Cyber Hornet filed for a fund that offers both exposure to XRP and the S&P 500. The asset manager also filed similar funds for Ethereum and Solana.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs