Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Highlights

- XRP ETF approval is now seen as imminent, with Polymarket predicting an 87% chance by the end of 2025.

- Ripple's court win cleared a major hurdle for XRP ETFs, boosting market confidence and institutional interest.

- BlackRock and Fidelity could soon lead the XRP ETF market, following regulatory approval from the SEC.

The possibility of an XRP exchange-traded fund (ETF) gaining approval is quickly becoming a reality, with experts predicting it is now only a matter of time before the U.S. Securities and Exchange Commission (SEC) gives the green light. Following a significant boost in market confidence, betting platforms, like Polymarket, show an 87% chance that the SEC will approve an XRP ETF by the end of 2025.

Ripple SEC Case End Sparks Optimism for XRP ETF

A positive outlook about an XRP exchange-traded fund’s approval has emerged after Ripple won its recent court battle. Ripple’s victory against the SEC dismantled a major barrier that prevented financial institutions from adopting its cryptocurrency. The court settlement has raised investor trust in the SEC’s approval process for an XRP Exchange-Traded Fund (ETF) thus many investors now expect approval.

According to Nate Geraci the president of The ETF Store an XRP ETF approval seems destined to happen. He predicted asset managers like BlackRock and Fidelity would dominate the space while asserting that the approval process stood just a matter of time away from completion. Geraci explains that XRP’s rising market cap position as the third non-stablecoin cryptocurrency provides institutional investors with an appealing opportunity.

“With Ripple’s legal troubles now behind it, the path to an XRP ETF approval seems clearer than ever,” Geraci noted.

XRP Market Sentiment and Polymarket Data

An increasing number of market participants expect XRP ETF approval as shown by Polymarket’s statistical analysis. Polymarket data shows investors believe the SEC will approve a spot XRP ETF before the year ends with an 87% probability.

This indicates widespread belief that the regulatory hurdles for the cryptocurrency are nearly cleared.

The introduction of an XRP ETF could trigger increased institutional interest much in the same way Bitcoin and Ethereum ETFs gained investor attention. An XRP ETF’s market entry would help traditional investors view digital assets more favorably because Bitcoin and Ethereum already demonstrated successful ETF integration.

Major Financial Firms Exploring XRP ETF

Major financial institutions like BlackRock and Fidelity among others will be instrumental in creating an XRP Exchange-Traded Fund Analysts predict BlackRock will shift its focus from Bitcoin and Ethereum to XRP ETFs because the cryptocurrency exhibits strong institutional appeal.

BlackRock’s head of ETFs, Jay Jacobs, had earlier stated that altcoins like XRP and Solana are not currently on their agenda. However, experts argue that the growing market demand and regulatory developments around XRP could soon change BlackRock’s stance.

Large asset managers including Fidelity play crucial roles when it comes to this particular market segment. The regulatory approval of XRP ETFs by the SEC will allow these financial institutions to launch XRP-related products. Such high-profile firms’ participation will speed up both the adoption and institutional utilization of XRP within portfolios.

XRP Price Predictions Amid ETF Optimism

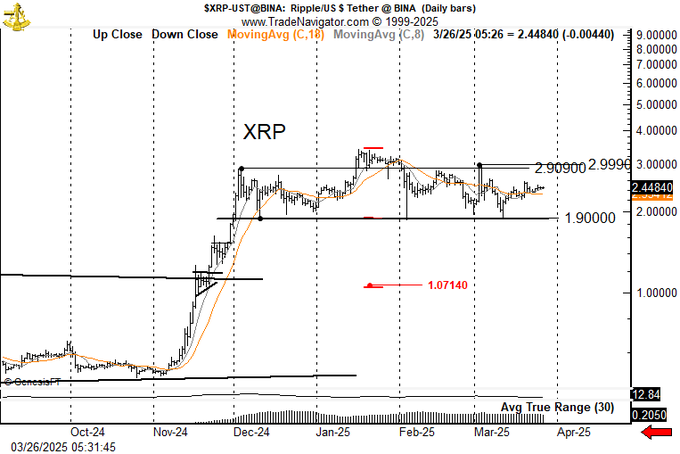

As the market anticipates the approval of an XRP ETF, different analysts have made bold price predictions for XRP. Renowned trader Peter Brandt has recently shared his technical analysis, highlighting a potential head and shoulders pattern in XRP’s price.

This pattern suggests that if XRP falls below a certain level, it could lead to significant losses, with a target price of around $1.07. However, Brandt also acknowledged that if the cryptocurrency stays above the $3 mark, shorting XRP could be risky.

On the other hand, cryptocurrency index fund manager Bitwise has offered a more optimistic price projection. Bitwise estimates that XRP could soar to as high as $29.32 by the end of the decade, assuming the cryptocurrency captures a meaningful share of the payments and tokenization sectors. In their “bull scenario,” Bitwise projects a price of $12.70 by 2030.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs