Expert Projects HYPE Token Upside as Bitwise Files for Hyperliquid ETF With SEC

Highlights

- Expert Ardi says HYPE’s current dip mirrors past pullbacks before major rallies.

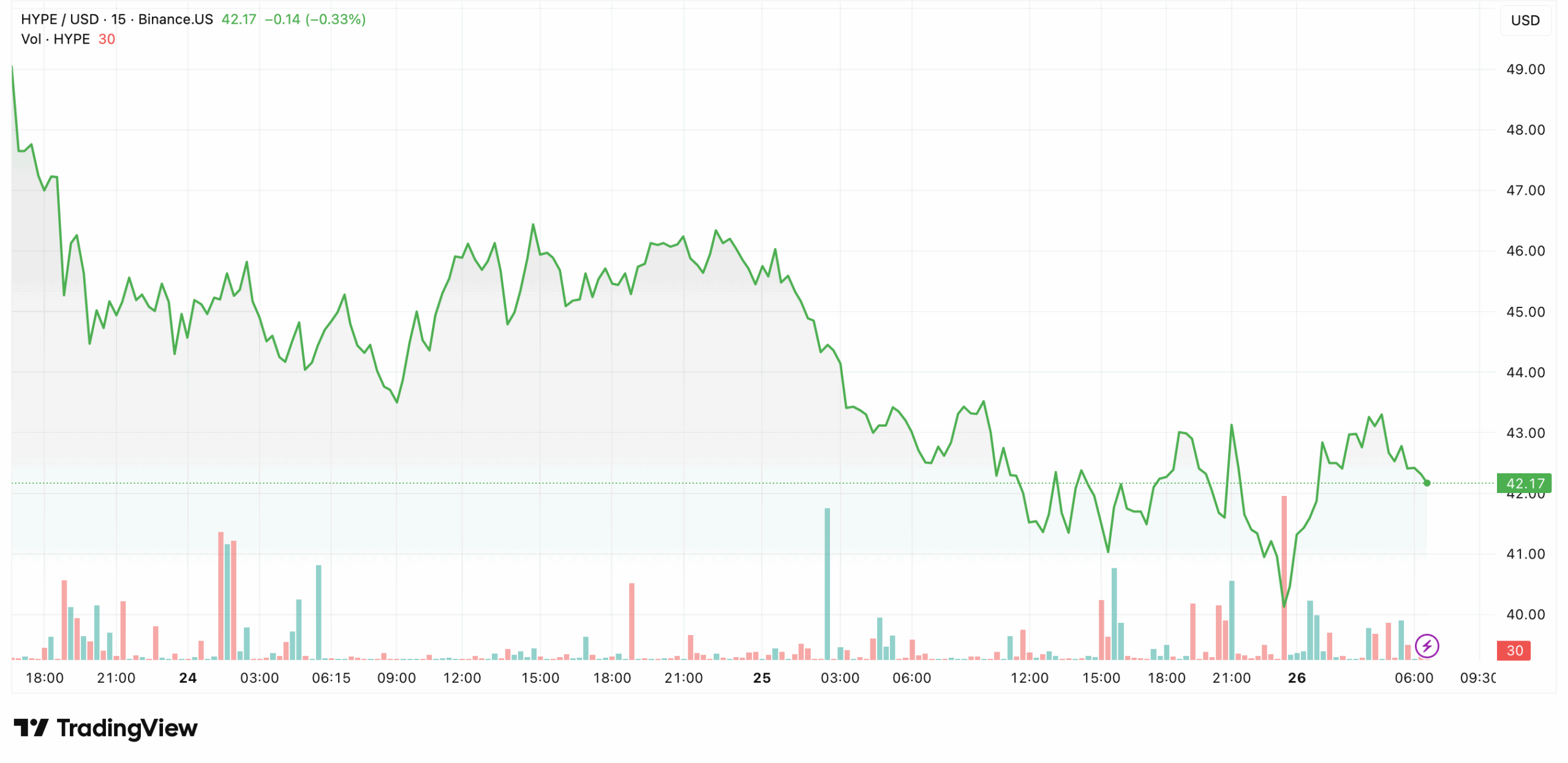

- HYPE trades at $42, down 24% in a week, but daily volume surged 18%, signaling strong activity.

- Bitwise files for a spot Hyperliquid ETF with the SEC, opening doors for Wall Street exposure.

An expert has projected a significant upside for the HYPE token, despite its recent dip in the market. This comes as Bitwise filed for a spot Hyperliquid ETF with the U.S. SEC. The move could open the door for Wall Street investors to gain direct exposure to the token.

Expert Maintains Bullish HYPE Outlook

Despite the recent downturn in the HYPE price, Crypto analyst Ardi highlighted that every time the token has reached a new all-time high, it has followed with a 20% pullback before rallying higher.

According to him, the token’s current consolidation is no different, suggesting another breakout may be imminent. He dismissed the “Aster is killing Hyperliquid” narrative as reactive commentary. Ardi then pointed to recurring bullish patterns in HYPE’s trading history instead.

This disclaimer from Ardi comes after BNB Chain-based Aster saw explosive growth, with its token surging 2,200% in just one week. During the same period, the token dropped 25%, raising concerns over whether the platform can maintain its dominance. Notably, prominent trader James Wynn predicted “slow death” for Hyperliquid.

The token is currently trading at $42, down 24% over the past week. However, its daily trading volume remains up by 18%, indicating high volatility.

Bitwise Pushes Hyperliquid ETF Filing

Against this backdrop, Bitwise submitted a Form S-1 with the SEC for the Bitwise Hyperliquid ETF. The fund is designed to hold the token directly. By doing this, conventional investors would be able to access opportunities without having to deal with wallets or on-chain transactions.

Uniquely, the ETF allows for in-kind creations and redemptions, meaning shares can be swapped for HYPE tokens instead of cash. This structure is designed to reduce costs and enhance efficiency.

The review process could last up to 240 days under the new SEC generic listing standards. The filing itself is seen as a milestone for the altcoin’s adoption in mainstream finance. Bitwise is not alone in pushing for the ETF product.

Reports suggest VanEck is preparing its own Hyperliquid ETF with a staking feature. They are also launching a parallel exchange-traded product in Europe. Executives at the firm believe such listings could set the stage for the coin to be added to major exchanges like Coinbase.

In other developments, Hyperliquid’s ecosystem is growing. Its stablecoin USDH went live on HyperCore, with more than $15 million minted within 24 hours. The stablecoin launch comes as Aster briefly overtook the platform in daily revenue. This shows the growing competition in the DEX sector.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- How Will Crypto Market Move amid Bitcoin, ETH, XRP Options Expiry and US PCE Inflation Data Today?

- CLARITY Act Not Expected to Pass Before April, Says Senate Leader John Thune

- TRUMP Coin Jumps as Team Announces Conference With President Trump as Keynote Speaker

- Breaking: Trump Calls For Emergency Fed Rate Cut Before Next Week’s FOMC Meeting

- Breaking: U.S. Senate Passes Bipartisan Housing Bill That Includes CBDC Ban

- What Happens to XRP Price If US Wins War Against Iran?

- COIN Stock Prediction as Crypto Crash Odds Jump as Expert Sees Inflation Hitting 3.4%

- Cardano Price Turns Bullish as ADA Futures OI Hits $416M Ahead Of Key Upgrades

- Dogecoin Price Outlook If Elon Musk’s X Money Integrates Crypto- Is $0.2 Possible This Week?

- Will XRP Price Rally After Ripple’s Strategic Acquisition in Australia?

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200