Expert Warns More Crypto Bloodbath Ahead of CPI Data Tomorrow

Highlights

- Investors braces for Friday's US CPI inflation data release ahead of Fed rate decision.

- Wall street giants such as JPMorgan estimated annual CPI to come in at 3.1%.

- CPI print below the forecast will help fuel the Fed rate cut expectations, BTC price.

- Experts predicted Bitcoin and Ethereum capitulation amid rising uncertainty.

The U.S. Bureau of Labor Statistics (BLS) will release the Consumer Price Index (CPI) data on Friday, despite the U.S. government shutdown. Investors are bracing for the U.S. Federal Reserve’s preferred inflation gauge, seeking further cues on whether crypto market could crash again.

How US CPI Estimates by JPMorgan and Other Wall Street Giants

The crypto market now awaits the key Consumer Price Index data later today for further cues on direction as uncertainty and volatility rise amid the U.S. government shutdown. While Fed officials, including Chair Jerome Powell, hinted at a further rate cut this month, the US CPI data print will greatly influence the FOMC’s decision.

Economists expect the monthly CPI to come in at 0.4%, the same as August’s 0.4% print. This would make the annual CPI inflation rise to 3.1%, higher than the 2.9% print last month.

Meanwhile, the core CPI is projected to rise 0.3% month-on-month, the same as in the previous month. The market is projecting the annual core CPI to remain steady at 3.1%.

The Wall Street Journal’s Nick Timiraos said the median of 18 Wall Street giants’ expectations showed the core consumer price index rising 0.30%. Besides, the median estimate for headline CPI is 0.39%, corresponding to 3.1% YoY. Notably, Barclays, BNP Paribas, Citigroup, Deutsche Bank, Morgan Stanley, and Nomura estimated core CPI above 0.40%. JPMorgan estimated monthly headline and core rising 0.30% and 0.39%, respectively.

Bank of America, Barclays, BNP Paribas, Citigroup, Deutsche Bank, Employ America, First Trust, Goldman Sachs, JPMorgan, Moody’s, Morgan Stanley, Nomura, TD Securities, UBS, and Wells Fargo expect the annual CPI to come in at 3.1%.

Is Crypto Market Crash Imminent Ahead of Fed Rate Decision?

The CPI print below the forecast will help fuel the Fed rate cut expectations. As a result, BTC price could reclaim above $112K-$115K and even to $120K amid massive upside momentum. At present, the cooling CPI inflation sentiment has triggered Bitcoin buying sentiment among traders as price rebounds above $110K.

If inflation figures come in line with economists’ projections, BTC price will consolidate between $106K-$110K. The crypto market could witness a crash as selling pressure will continue to persists and focus turn towards Fed rate cut decision.

However, Bitcoin can dip to $102K-$104K level again if the CPI inflation data comes in hot. Broader crypto market crash may happen as expected by derivatives traders.

Experts’ Prediction on Bitcoin, Ethereum, and Possible Crypto Crash

According to the latest report by 10x Research, traders are bracing for short-term volatility in Bitcoin and Ethereum, with option markets signaling caution. Skews have flipped sharply bearish after October’s liquidation, with an increase in put demand and hedging activity.

BTC’s implied volatility still trades above the realized price, rewarding option sellers. Meanwhile, ETH has dropped below its realized price, making its options cheap to buy. 10x Research recommends structured trades shorting BTC and buying longer-period ETH options.

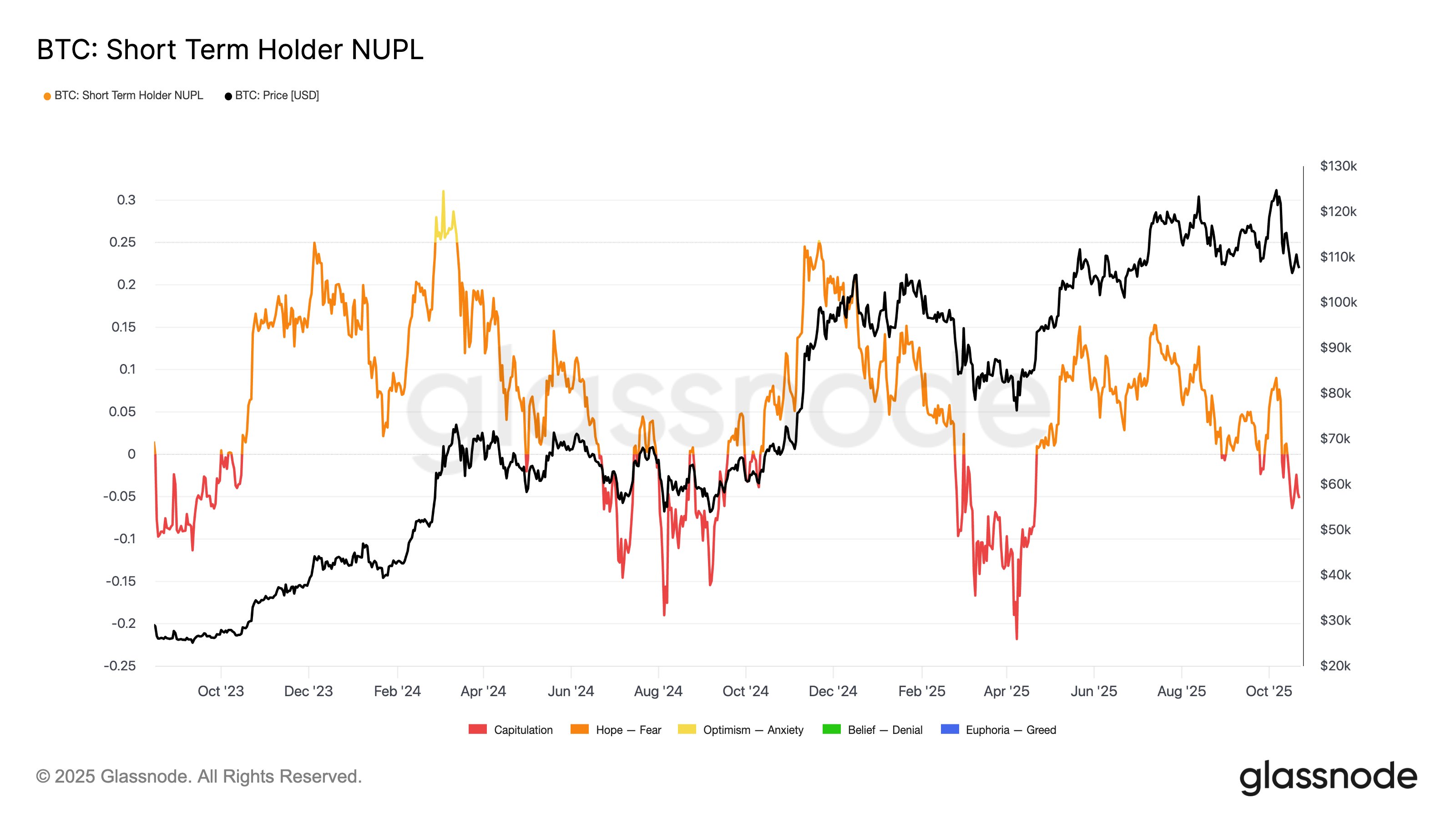

In a post on X, Glassnode highlighted Short-Term Holder NUPL data signaled capitulation, with growing stress among recent buyers. Historically, this type of short-term holder pain has aligned with healthier market recovery.

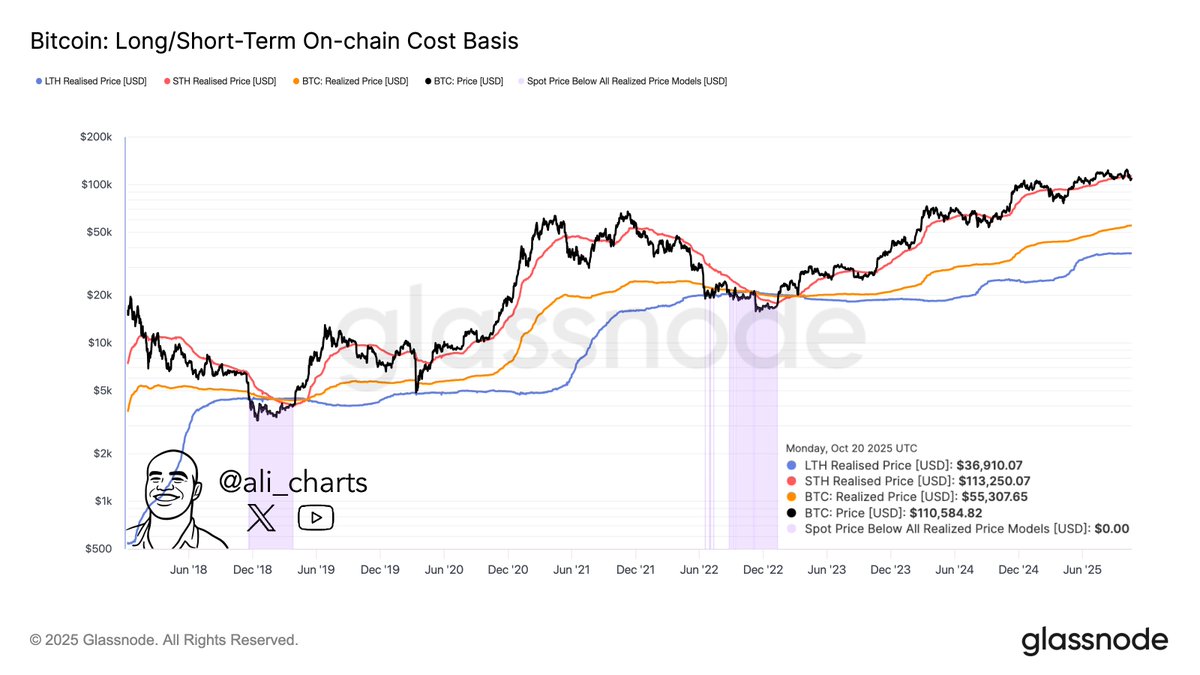

Analyst Ali Martinez pointed out that when Bitcoin broke below the STH realized price historically, it mostly fell under the LTH realized price. The LTH realized price is now sitting at $37,000.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs