Experts Predict Big ETH Rally on Bullish Options, Whales Signal Post-False Break

Highlights

- ETH rally in play following recovery from fourth false break, predicts Matrixport.

- Whales and options traders turn bullish and eye move to $4,500.

- Popular analyst points to $4,250 as the next major level to watch.

ETH saw a sudden rebound to $4,200 from $3,800 level after the fourth false break, according to crypto research firm Matrixport. The recent rebound, fueled by renewed whale accumulation and options strategy, has set the stage for a big rally.

Matrixport Predicts ETH Rally on False Breaks

ETH has recovered to the multi-year upper triangle and is now attempting to rally again, Matrixport predicted on September 30. The market has witnessed the fourth false break this year, which has triggered a big rally in the weeks ahead.

Also, previous false breaks saw limited downside. The current ETH price action is showing similar signs, suggesting trades to watch for another quick rebound. On technical charts, the rebound looks constructive and indicates strength ahead of October seasonality.

Meanwhile, 10x Research revealed that options markets are also flashing bullish signals, completely different from a week ago during the Ethereum options expiry. 10x Research analyst Markus Thielen claims seasonality and positioning could decide the market direction next.

ETH options traders are mostly targeting $4,300 and $4,500 strike prices. Some are more bullish on an ETH rally to $5,000 by the end of October, with a put-call ratio of 0.70 and max pain at $4,200.

ETH Whales Are Accumulating Massively

Whales are withdrawing massive amounts of ETH from crypto exchanges in the last few days. Continued ETH buying by Ethereum treasury Bitmine Immersion (BMNR) and developments such as SWIFT partnering with Ethereum native Consensys have prompted bullish sentiment among crypto participants.

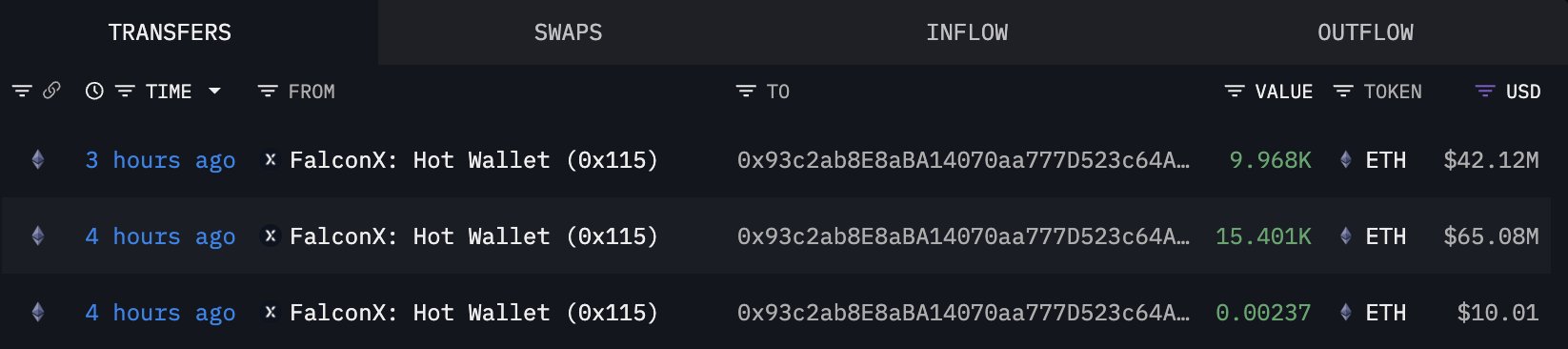

Lookonchain revealed that whales are on a buying spree, 0x93c2 and 0x6F9b purchased $106.74 million and $21 million in the last 4 hours.

Also, Onchain Lens reported a whale withdrew 3,629 ETH worth $15.22 million from Binance. The whale now holds more than 3,666 ETH, valued at almost $15.36 million.

1 hour ago, a whale 0x1fc withdrew another 2.36k $ETH ($9.92M) from #Binance

Withn 4 months, he accumulated totally 29.8k $ETH ($113M) at avg entry $3,794

Address:https://t.co/eGTBWRX43L pic.twitter.com/cQjf5zPEjd

— The Data Nerd (@OnchainDataNerd) September 30, 2025

Ethereum Price Reclaims the Key $4,200 Level

Ethereum price today jumped 1%, with the price currently trading at $4,185. The 24-hour low and high are $4,087 and $4,240, respectively. Furthermore, the trading volume has further increased by 40% in the last 24 hours, indicating a massive rise in interest among traders.

Analyst Ted Pillows predicts $4,250 as the next major level to watch, opening the door for more upside. Meanwhile, Ethereum ETF inflow of over $546 million builds up bullish sentiment, with Fidelity buying $202 million in Ether. However, if ETH fails to reclaim this level, a drop towards $4,000 could happen.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs