Experts Predict Bitcoin Price Crash If BTC Repeats This Pattern

Highlights

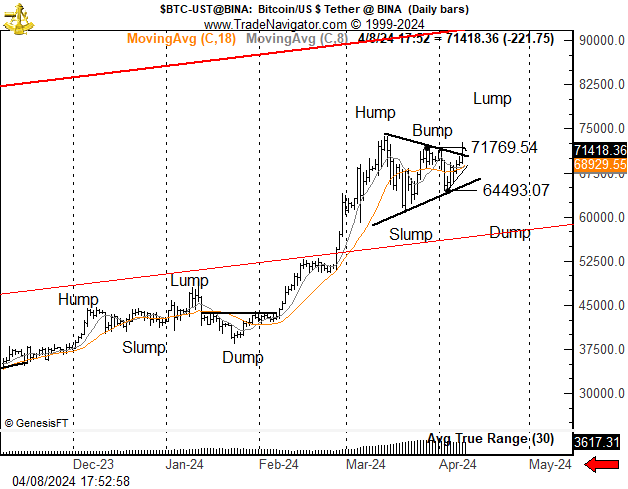

- Experts predict a downfall, possibly a crash, if BTC price chart pattern repeats a historical pattern.

- Benjamin Cowen, Peter Brandt, Arthur Hayes predict Bitcoin price drop ahead halving.

- BTC price momentum fades ahead Bitcoin halving and CPI.

Crypto market rally resumes as excitement for the upcoming Bitcoin halving increased BTC price to surpass $72,715, with some headwinds expected to resist BTC price rally towards $80K. Experts predict a downfall, possibly a crash, if BTC price chart pattern repeats a historical pattern.

A crash in Bitcoin price could trigger a market-wide drop as seen during previous Bitcoin halving events and recent spot Bitcoin ETF approval.

Bitcoin Price Correction Looms Amid Halving

Crypto investors keenly await Bitcoin halving for further upside momentum in the crypto market, but analysts warn a correction could happen if BTC price form a similar pattern as seen earlier.

Analyst Benjamin Cowen said if BTC repeats a similar pattern seen during spot Bitcoin ETF as it goes into Bitcoin halving, then a BTC price fall can be expected. He expects Bitcoin to make a new ATH after halving and then fall below the $60,000 level.

“Usually these patterns do not repeat exactly, but just showing it here in case something similar happens once again,: he added.

Veteran trader Peter Brandt reacted to the post and Bitcoin tends to follow similar historical patterns in past Bitcoin halving. He said the “same basic pattern has been common in past bull markets in Bitcoin.”

Also Read: JPMorgan CEO Jamie Dimon’s Dire Warning on 8% Interest Rate; BTC to $100K?

Bitcoin Price to Slide Below

BitMEX co-founder Arthur Hayes anticipates a decline in Bitcoin prices before and after the halving event next week. He suggests that during this period, US dollar liquidity will be constrained, contributing to heightened selling pressure on crypto assets.

Moreover, the total outflows from the spot Bitcoin ETFs were $223 million, with Grayscale Bitcoin ETF dragging the total flow towards negative due to outflows surging past $300 million.

Options trading expert Greekslive revealed Bitcoin has entered a pullback as traders mainly sold short-term bitcoin option. The market is still skeptical about the future trend with the main term IV fell slightly. However, a giant whale traded 350 calls for the $200,000 strike price expiring March 2025. Also, the whale has stockpiled nearly 30,000 calls above $100,000 at all terms.

BTC price jumped 4% in the past 24 hours but the price has pared some gains, with the price currently trading at $70,993. The 24-hour low and high are $69,654 and $72,715, respectively. Furthermore, the trading volume has increased by 90% in the last 24 hours.

BTC Futures Open Interest dropped 0.30% in the last 4 hours and BTC Options Open Interest rose slightly in the last 24 hours.

Also Read: US Treasury Seeks Stronger Crypto Controls for National Security

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs