Fed Pumps $2.5B Overnight—Will Crypto Market React?

Highlights

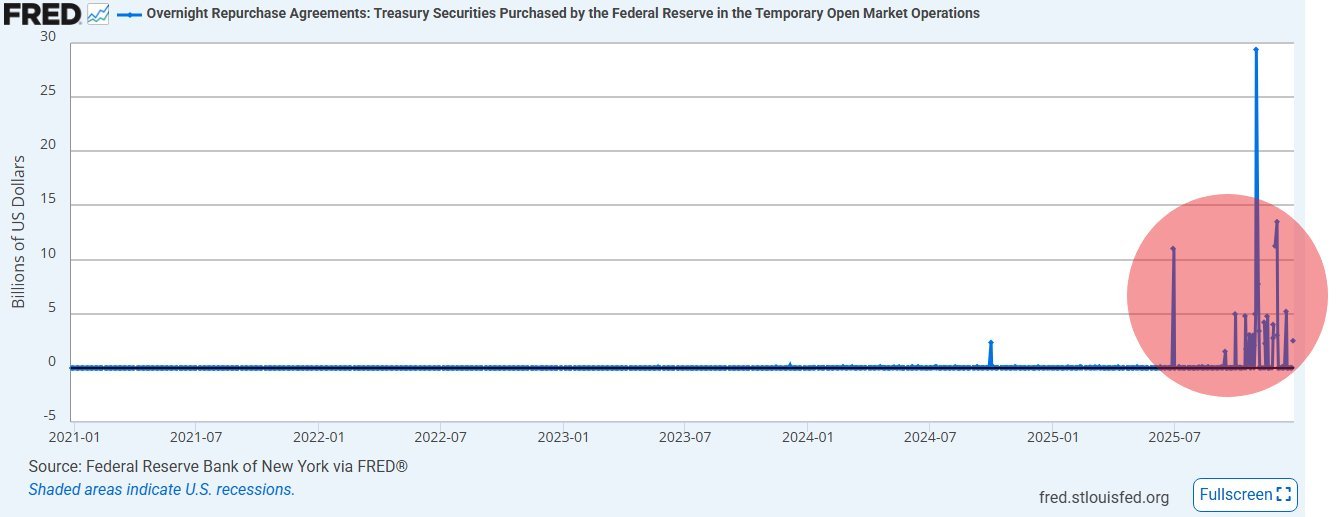

- The Federal Reserve injected $2.5 billion into the banking system through an overnight repo operation.

- U.S Fed also temporarily purchased Treasury securities for short-term cash.

- Despite the injection, crypto market reaction did not make any substantial move.

The U.S. Federal Reserve Bank has again injected billions into the financial system overnight. Analysts will be keen to see whether the added cash could impact the crypto market, with Bitcoin still under short-term pressure.

Fed Injects $2.5B Through Overnight Repo Operations

Disclosures by the New York Fed reveal that the Federal Reserve pumped $2.5 billion into the U.S. banking system via an overnight repurchase agreement. The operation falls at a time when the Bitcoin price has stagnated at around $87,500.

The transaction was carried out by the Federal Reserve Bank of New York’s Open Market Trading Desk under direction from the Federal Open Market Committee. The Fed temporarily bought Treasury securities from banks. It was said they would sell the securities back to them the next day.

This structure enhances short-term liquidity without increasing the central bank’s balance sheet on a permanent basis.

The overnight repo is a regular mechanism to deal with funding conditions, especially when the demand for short-term cash increases. The Fed attempts to avoid disruptions to money markets by anchoring overnight lending rates through such operations.

The latest $2.5 billion operation may seem small compared to past Fed liquidity pumps, but it is getting attention for its overall effect. Data showed that liquidity added by this year’s similar repo operations amounts to over $120 billion in total.

Federal Reserve officials have said that these operations are designed to change market mechanics, not directly raise asset prices. Growing frequency is a different matter, with repeated operations signaling that the short-term funding still remains a problem

How Did the Crypto Market Perform?

At this point, the initial reaction in the crypto market remains somewhat muted. Currently, Bitcoin is down by about 1% in the last 24 hours and is trading around $87,500, based on data from TradingView.

Total market cap is now down to about $1.74 trillion, and the daily trading volume is down by more than 11%.

Past market cycles carry many lessons that help to review projections of trends in liquidity and the potential impact on the crypto market. In 2020, when gold and silver prices touched multi-year highs, the central institutions were able to provide liquidity.

This also led to a significant boom in the price of Bitcoin that year. It rose from around $11,500 to $29,000 towards the end of that year. This trend further continued in 2021 as the overall market cap expanded from $390 billion to over $2 trillion.

Nevertheless, it is indicated that whereas overnight repos can help stabilize the market, this does not help much for the overall growth of the market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs