Fed Rate Cut: Trump Signals Fed Chair Pick Kevin Warsh Will Lower Rates

Highlights

- Trump stated that Kevin Warsh will cut rates without pressure from the White House.

- The U.S. president claimed that he didn't ask Warsh to lower rates, describing it as "inappropriate."

- Crypto traders expect the Fed to make three rate cuts this year.

U.S. President Donald Trump has indicated that his Federal Reserve chair pick, Kevin Warsh, is open to making Fed rate cuts. Bitcoin climbed following the president’s statement as market participants weigh whether Warsh will make a dovish pivot.

Trump Signals Warsh Open To Fed Rate Cuts

Speaking during the signing of some executive orders, the U.S. president stated that Warsh will cut rates without pressure from the White House. When questioned on whether the Fed chair pick committee committed to lowering rates, Trump said that the former Fed governor didn’t commit to cutting rates and that it would be inappropriate to ask him to cut rates.

However, the U.S. president sounded confident that Warsh would make Fed rate cuts if the Senate confirms him as Jerome Powell’s successor. Trump’s comments came just hours after he officially announced his nomination of Warsh to become the next Fed chair.

Warsh has advocated for a smaller Fed balance sheet, which could pave the way for more cuts. However, the former Fed governor supports a strong dollar, which could be bearish for Bitcoin as a hedge against currency debasement. Furthermore, a smaller Fed balance sheet reduces the likelihood of quantitative easing (QE), which is typically bullish for crypto assets.

Despite Warsh being largely perceived as ‘hawkish,’ crypto traders are still pricing in the possibility of three Fed rate cuts this year. Polymarket data shows a 26% chance that the Fed will make three cuts this year. There is a 23% chance of only two cuts, and 15% and 12% chance of four and 1 cut, respectively.

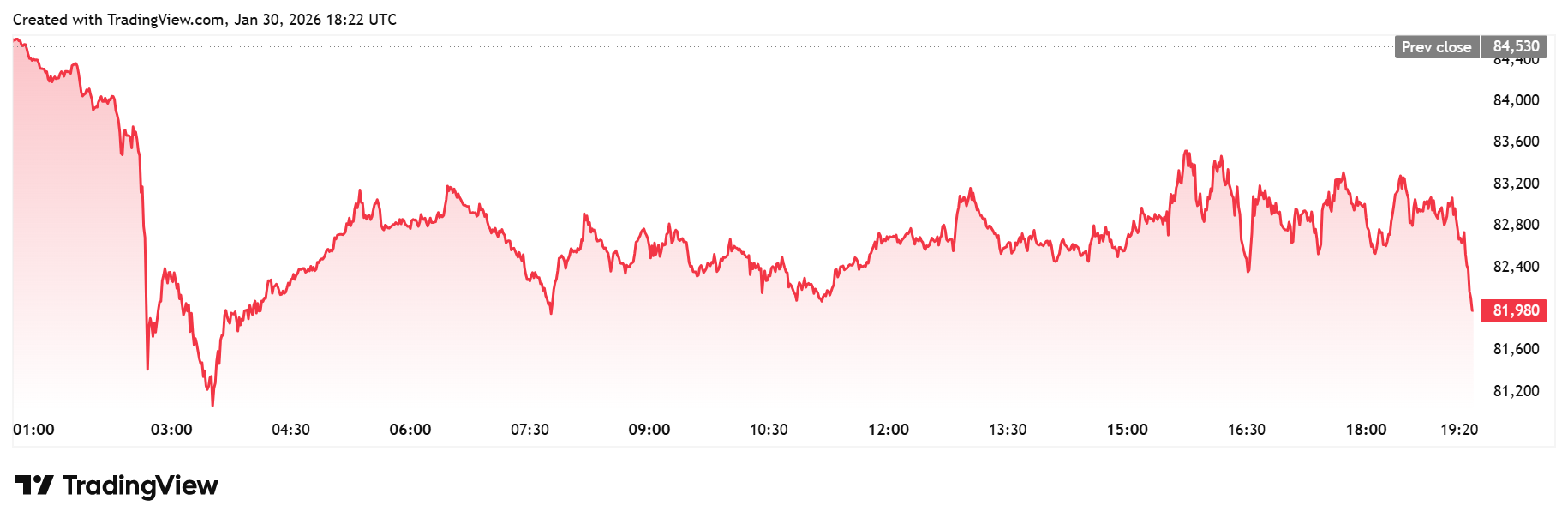

Bitcoin briefly rose to around $83,000 follwoing Trump’s comments about Warsh wanting to lower rates. However, TradingView data shows that the leading crypto is again testing yesterday’s lows, currently trading just above $82,000.

Warsh Will Be Persuasive

Fed Governor Stephen Miran backed Kevin Warsh’s nomination, stating that many at the Fed will find him persuasive despite his criticism of the U.S. central bank and its policies. How well Warsh is welcomed at the Fed could determine whether there are Fed rate cuts this year, as the chair is one of twelve votes on the FOMC, which determines monetary policy.

Warsh is likely to take Miran’s seat on the Fed board, with the latter’s term ending this month. Meanwhile, as CoinGape reported, current Fed chair Jerome Powell failed to comment on whether he will remain on the board once his term as chair ends in May.

This could be key to Fed rate cuts this year, as Trump doesn’t yet have a majority on the Fed board. At the moment, Miran and Waller are the only Fed Governors who have shown support for further cuts, and they were the only dissents at this week’s FOMC meeting, where the Fed held interest rates steady.

The ongoing case against Fed Governor Lisa Cook will also be pivotal, as Trump could get another open seat on the board if the Supreme Court determines that he can remove her from her position over the mortgage fraud allegations.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise