Fed’s Chris Waller Advocates for December Rate Cut, Citing Labor-Market Weakness

Highlights

- Waller stated that inflation isn't a big problem with his focus on the labor market.

- He declared that he is advocating for a rate cut at the December FOMC meeting.

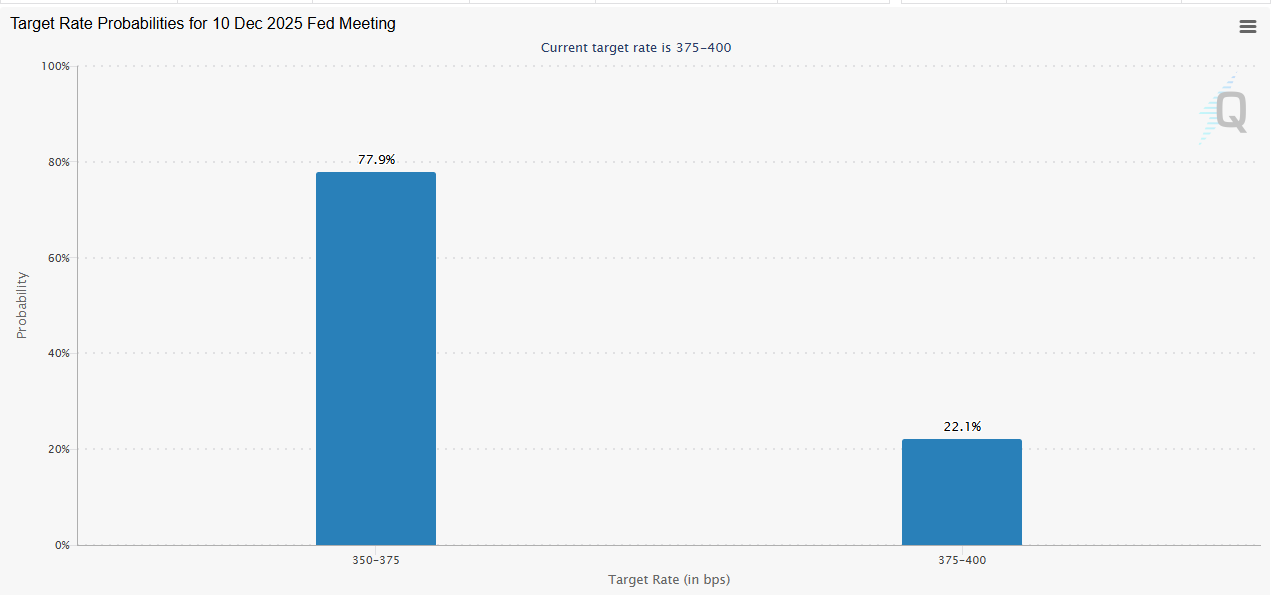

- There is a 78% chance that the Fed will cut rates next month.

Federal Reserve Governor Chris Waller has revealed that he will vote for a Fed rate cut at the December FOMC meeting. This comes just days after Fed President John Williams signaled his support for another cut, which is a positive for the crypto market as the odds of a third rate cut this year climb.

Waller Says He Will Advocate For Another Fed Rate Cut

In a FOX Business interview, the Fed governor stated that he will be advocating for another cut at next month’s FOMC meeting. This came as he noted that the private data they have gotten shows that the labor market continues to weaken.

He added that inflation didn’t turn out as bad as they expected when they got the CPI inflation report. As such, Waller remarked that he doesn’t view inflation as a big problem and that he expects it to start pulling back. Meanwhile, he doesn’t see any evidence that the labor market is rebounding despite the September jobs report, which is why he is advocating for another Fed rate cut.

Notably, Waller, who is currently one of the Fed chair candidates, has continued to advocate for a rate cut since earlier in the year and dissented in favor of a 25-basis-point cut at the July meeting. Meanwhile, he indicated that they could take a meeting-by-meeting approach from January next year once they have more macro data to work with.

Waller’s comments come just days after New York Fed President John Williams signaled that he could support another Fed rate cut at the December FOMC meeting. However, FOMC members currently hold differing views on whether to make another cut next month. Fed Presidents Lorie Logan and Susan Collins stated that holding rates steady may be appropriate for now, while citing inflation concerns.

Odds Of Another Continue To Climb

The odds of a December Fed rate cut continue to climb despite the division among the FOMC members. CME FedWatch data shows that there is currently a 78% chance that the Fed will lower rates by 25 bps at next month’s meeting.

This represents an increase from last week after the odds jumped to around 72% following Williams’ remarks. It is worth noting that the odds of a rate cut had also dropped to as low as 30% early last week, sparking fear in the market, with Bitcoin crashing to the $80,000 range.

However, the BTC price has since rebounded following the increase in the odds of a December Fed rate cut. Crypto market participants now have their eyes on the upcoming macro data, with the PPI and PCE inflation dropping this week. These economic data could also influence the Fed’s decision at next month’s meeting.

- Robinhood to Raise $1B IPO to Open Private Markets to Retail Investors

- Elemental Royalty Becomes First to Pay Dividends in Tether’s Tokenized Gold XAUT

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k