Fisher Investments CEO says Crypto is no longer a “potential risk”

The billionaire and CEO of Fisher Investments, Kenneth Fisher recently predicted that the upcoming year will experience double digits for the stock market, while the crypto industry will also continue its hype. In an interview with CNBC-TV18, Fisher noted that he still believes that crypto poses substantial risk to the financial systems, however, it is unlikely to become a potential risk in 2022.

“I do think it’s a potential risk, but I don’t think it’s a potential risk that is likely to be a problem in the year 2022. Probably afterwards.”

Amid arguing in favour of the stock market, levying its volatility to the ‘pre-price’ phenomenon, the anti-crypto billionaire maintained his stance on virtual currencies, claiming “these kinds of things burst”. Referring to the “burst”, he asserted that the bear market will steep lower and lower until it hits rock bottom and then some. Furthermore, Fisher only gave crypto a free pass for 2022 and emphasised that it may become a problem very soon if not next year.

“Normally these kinds of things burst. After you have already started what is a normal kind of a bear market. The bear market begins first, bear markets usually begin gently, not violently and then they get more violent later and in that later violent period that you usually see these kinds of things blow up and become potential real problems.”, Fisher told CNBC-TV18.

Crypto adoption 2021

While the world stands divided on the decentralised industry, crypto has proven itself several times over in 2021. From countries opting Bitcoin as legal tender to institutional giants running multi-billion dollar VC rounds related to crypto, the industry has outperformed as this year nears its end.

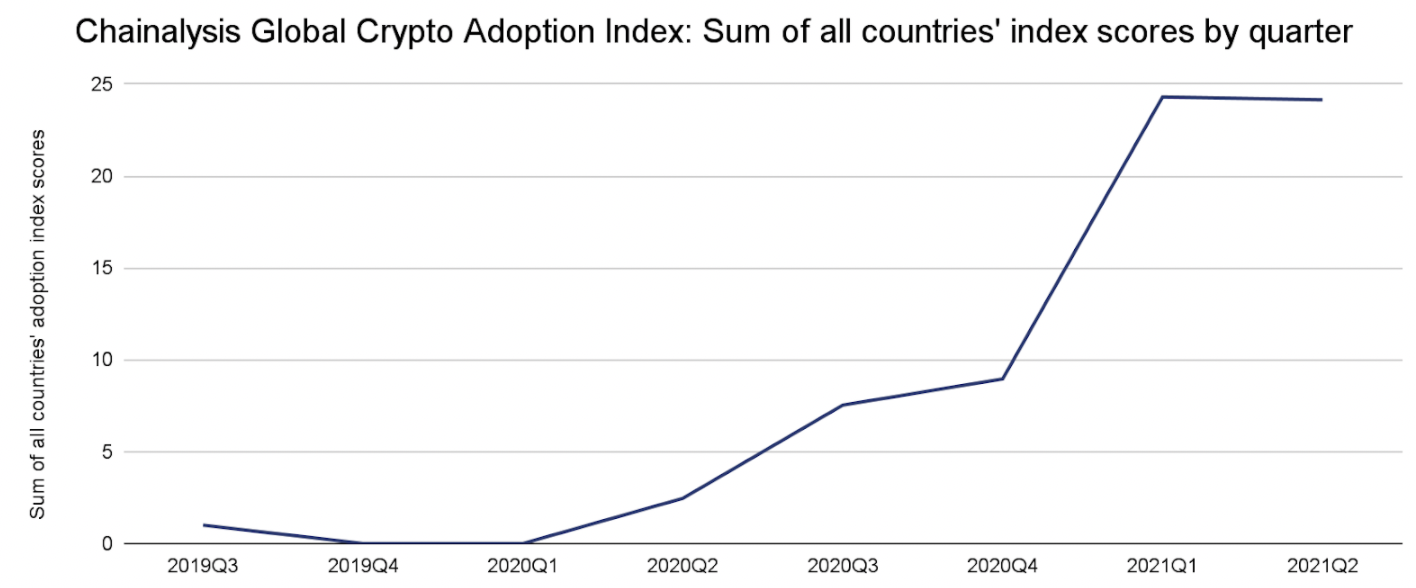

According to the 2021 Chainalysis Global Crypto Adoption Index, residents of more and more countries around the world adopted cryptocurrency use this year. Data collected from 154 countries’ index scores determined that as compared to the end of Q2 2020 when total global adoption stood at 2.5, saw unrealistic hike by the end of Q2 2021 with a total score standing at 24, suggesting that global adoption has grown by over 2300% since Q3 2019 and over 881% in the last year.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs