Ripple Vs SEC Impact, Torres Decision & XRP Army’s Role in FIT21 Crypto Bill

Highlights

- Financial Innovation and Technology for the 21st Century Act (FIT21) gets majority boost in the US House.

- Section in the crypto bill aims to clarify treatment of digital assets sold pursuant to an investment contract.

- House Committee on Agriculture has criticized Gary Gensler and the SEC for the political nature of their position.

- XRP price jumps but remain volatile amid macroeconomic impact.

On May 22, the U.S. House of Representatives voted on the Financial Innovation and Technology for the 21st Century Act (FIT21), marking the first step towards a regulatory framework for digital assets. Key influences on this landmark bipartisan crypto bill include the Ripple vs. SEC lawsuit, Judge Torres’ summary judgment, and the support from the XRP community, including lawyers. Pro-XRP lawyer John Deaton’s CryptoLaw highlights these contributions in the preparation for FIT21.

FIT21 Crypto Bill Passes

US House the Financial Innovation and Technology for the 21st Century Act (FIT21), H.R. 4763, will provide regulatory clarity over the regulation of digital assets and protect consumers, becoming the most important crypto bill to date. The Republican-favored crypto bill has become a key discussion affair amid the upcoming election this year.

Some Democrats have also supported the crypto bill that will provide clarity regarding which regulator either the SEC or CFTC has jurisdiction over digital assets. Along with providing consumer and investors protection, it will help distinguish which digital assets are commodities and securities.

US House Ranking Member Maxine Waters says the bill is not fit for purpose and can create massive loopholes. Democrats spoke against the crypto bill. Meanwhile, the White House said it will not issue a veto threat against FIT for the 21st Century Act, if passed in House.

The #NotFIT4PurposeActis legislation would create a massive loophole that would allow fraud to proliferate, & result in devastating losses for:

❌crypto consumers

❌investors trying to save for retirement, college & other goalsOur consumers deserve better, NO on #FIT21.

— U.S. House Committee on Financial Services (@FSCDems) May 22, 2024

Also Read: Ethereum ETF Approval Date: Is Thursday D-Day for SEC’s Decision?

Mentions of Ripple Vs SEC in Part of FIT21

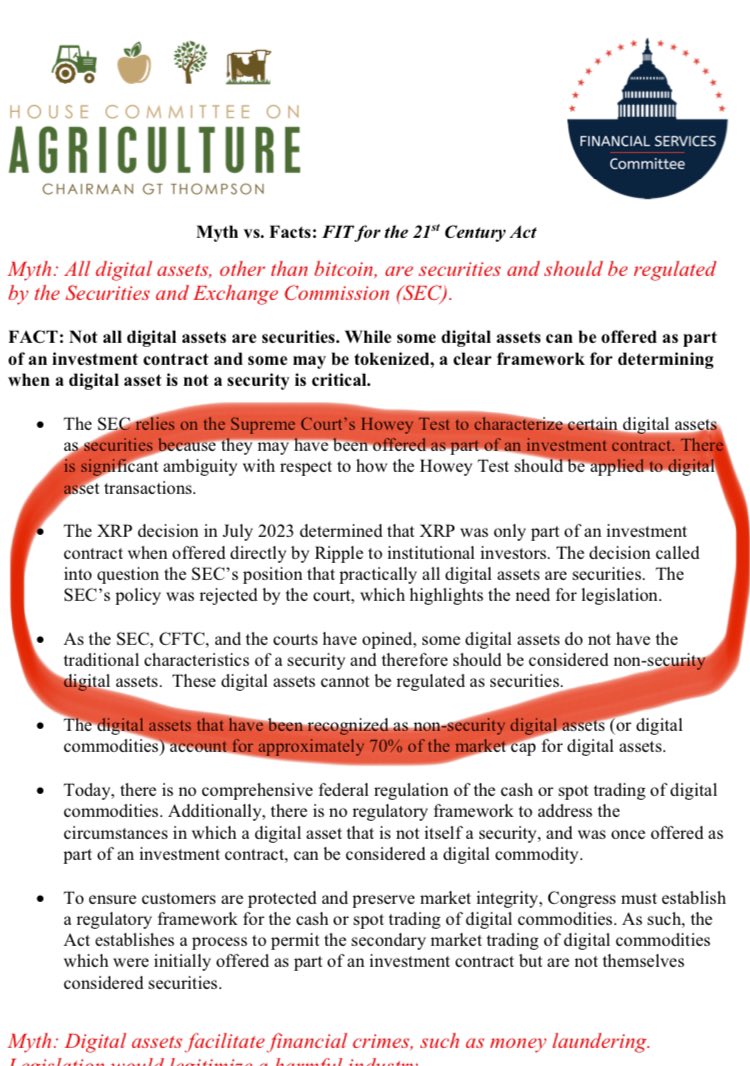

CryptoLaw, founded by Deaton Law Firm, said Ripple vs SEC lawsuit, Judge Torres’ decision in the case, and XRP Army’s relentless pressure to seek clarity have helped in addressing the creation of the bill.

A section in the crypto bill aims to clarify treatment of digital assets sold pursuant to an investment contract. “A digital asset sold or transferred or intended to be sold or transferred pursuant to an investment contract is not and does not become a security as a result of being sold or otherwise transferred pursuant to that investment contract,” it reads.

Judge Torres affirmed this in the Ripple Vs SEC lawsuit that the token itself is not a security such as programmatic sales by exchanges, but offers and sales of the token to institutions are securities. The XRP community called for amendments in the existing securities law for practicality to new technologies.

CryptoLaw stated that SEC Chair Gary Gensler opposes the FIT21 as he wants to continue arguing against Judge Torres’ summary judgment.

House Committee on Agriculture has criticized Gary Gensler and the SEC for the political nature of their position. It also highlighted that the XRP decision in July 2023 was key development in creating a regulatory framework.

XRP price currently trades at $0.5235, pared gains amid selloff due to higher S&P Global US Composite PMI data. The 24-hour low and high are $0.520 and $0.539, respectively. The trading volumes in the last 24 hours increased by 40%.

Also Read: US SEC Faces Probe Over Prometheum’s Plans to Custody ETH

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs