FOMC: BTC Price To Dip Below $60K, Analyst Predicts

Highlights

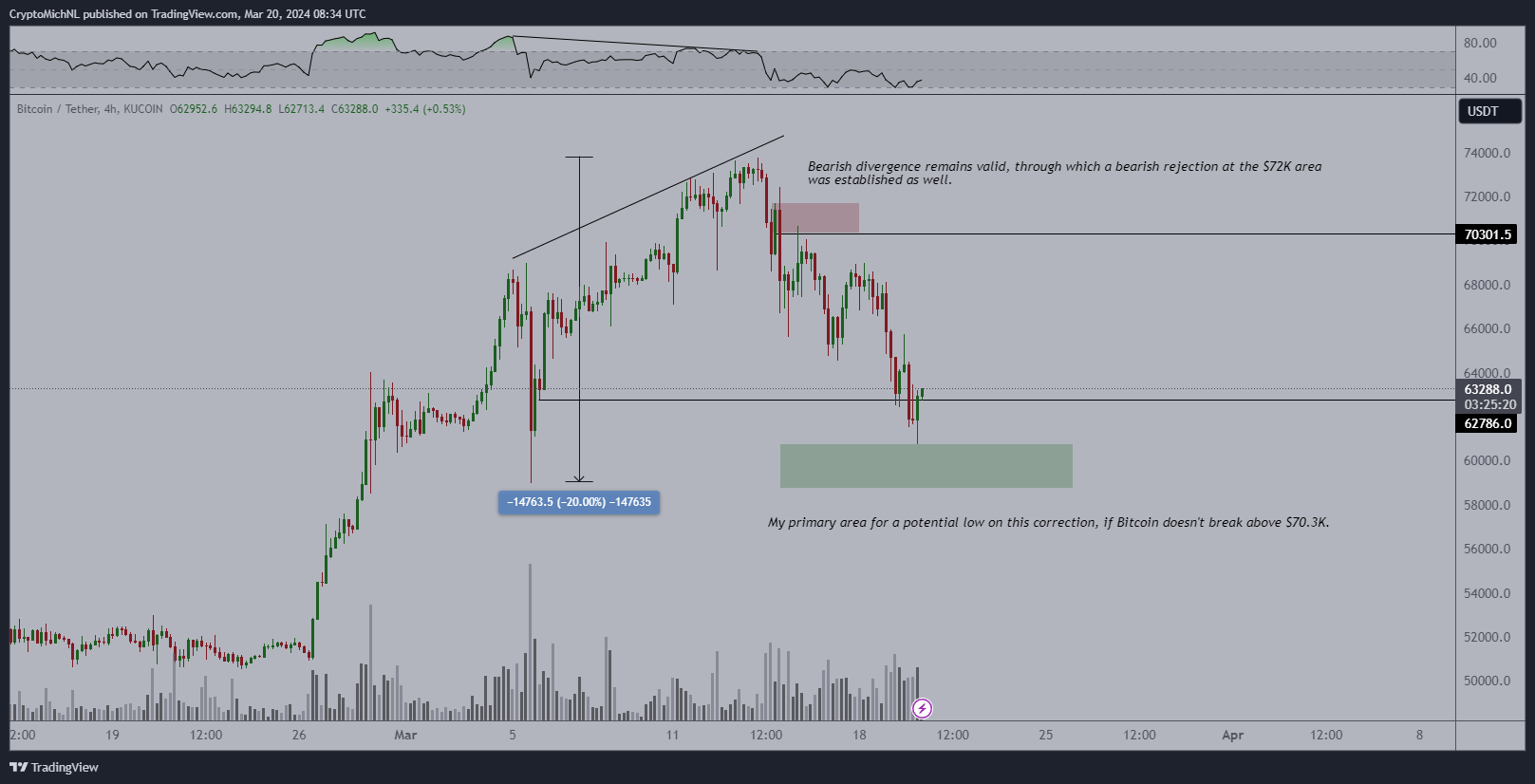

- A prominent analyst predicts Bitcoin price may dip below $60K amid market volatility.

- FOMC's decision to impact Bitcoin's trajectory, with analysts eyeing potential market flux.

- Market sentiment remains cautious as investors brace for potential pre-halving retracements.

As the Federal Open Market Committee (FOMC) convenes today, Bitcoin’s price trajectory is under scrutiny, with investors bracing for potential volatility. Amid inflation concerns and anticipation over the FOMC’s decision, analysts predict a possible dip in Bitcoin’s price, notably highlighting the $60K mark as a pivotal level.

So, let’s delve into the insights driving these forecasts and what investors can expect in the crypto market landscape.

Analyst Predicts Bitcoin Price To Dip Below $60K

Ahead of the Federal Reserve’s monetary policy decision, Bitcoin’s recent retreat has stirred speculation among investors and analysts alike. While expectations lean towards the Fed maintaining its policy rates, attention pivots towards cues embedded in the dot plot, particularly amid lingering inflationary pressures.

For context, the latest U.S. Consumer Price Index (CPI) and Producer Price Index data showed that inflation is still at a higher level than market expectation, let alone the Fed’s 2% target range. This hotter-than-inflation data has raised concerns among investors, potentially signaling a hawkish stance by the central bank.

However, according to the CME FedWatch Tool, the Fed is likely to keep the interest rates unchanged at the upcoming FOMC announcement, with a 99% possibility. But the investors would keep a close track of the Fed’s potential future plan during FOMC and Fed Chair Jerome Powell’s speech for cues on future stance.

Meanwhile, amid the volatile trading scenario, prominent crypto market Michael van de Poppe suggests a potential downturn for Bitcoin, eyeing a test around the $60K mark amidst FOMC deliberations. The analyst cited historical patterns and current market sentiments while predicting the downturn.

Notably, Van de Poppe’s forecast hints at a strategic inflection point, marking a possible low before a prospective rebound, contingent on the central bank’s tone and policy outlook. However, despite the bearish sentiment, the analyst said that Bitcoin might reach a new high before the Bitcoin Halving event.

Also Read: CoinShares Aims To Diversify US Offerings With New Bitcoin Products

FOMC Impact Market Sentiment Amid Halving Anticipation

Amid the FOMC anticipation, broader market sentiment remains cautious, with analysts highlighting the significance of pre-halving retracements in Bitcoin’s price trajectory. While past trends offer insights, market dynamics remain fluid, prompting investors to stay vigilant for potential shifts in sentiment and price action as the FOMC decision unfolds.

For instance, popular crypto expert Rekt Capital said that Bitcoin might face correction in the coming days. He cited that historical data suggests that the BTC tends to enter a pre-halving retracement phase ahead of the Bitcoin Halving event, before making a further rally to new highs.

Meanwhile, as of writing, the Bitcoin price was up 0.20% to $63,211.99, with its trading volume slipping 6% to $63.66 billion. Over the last 24 hours, the crypto has touched a high of $65,757.83 and a low of $60,807.79, suggesting the volatile trading scenario in the digital asset space ahead of the FOMC.

Also Read: Shiba Inu Team Hints At “Secret” Strategy To Eclipse Dogecoin

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card