Federal Reserve Interest Rates Remain Unchanged Following FOMC Meeting

Highlights

- The Fed has decided to keep interest rates steady at the benchmark 4.25% to 4.5%.

- This is the fourth consecutive time Powell and the FOMC are opting against a rate cut.

- Based on assessments, there are projections of two rate cuts this year, totaling 50 basis points.

The Federal Reserve has again decided to keep interest rates unchanged following the June FOMC meeting. This comes in line with expectations that the US Central Bank is unlikely to begin quantitative easing (QE) until the latter part of this year.

Federal Reserve Keeps Interest Rates Unchanged Following FOMC Meeting

In a press release, the Fed announced that the committee has decided to maintain the target range for the federal funds rate between 425 and 450 basis points (bps). This marks the fourth consecutive FOMC meeting in which the Central Bank has decided against cutting rates.

The committee stated that uncertainty about the economic outlook has diminished but remains elevated. It also lowered the 2025 GDP estimate to 1.4% and lifted the inflation estimate to 3%. However, it is worth mentioning that in the latest statement, the Fed omitted lines about risks of higher unemployment and inflation, which is a positive for the market.

This Fed rate decision aligns with expectations, as traders had bet that there was little to no chance of an interest rate cut at this June meeting. Now, market participants would have their eyes on Fed Chair Jerome Powell’s speech to have an idea of what the FOMC’s next move could be.

As CoinGape reported, Jerome Powell’s Speech will take place at 2:30 pm ET. The Fed Chair is likely to comment on the rising tensions in the Middle East between Israel and Iran. The hostility between both countries has sent oil prices rising, which could lead to rising inflation.

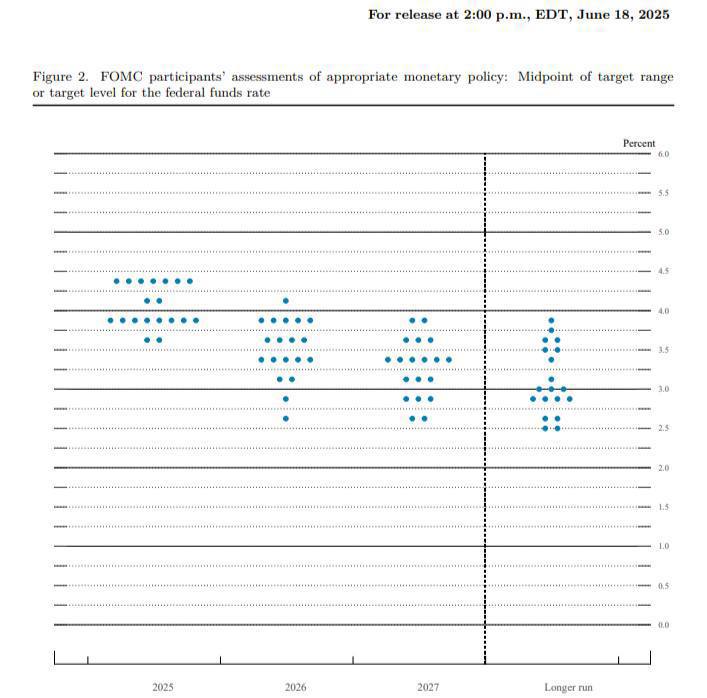

As such, Powell could allude to this and the Trump tariffs as to why they decided to keep rates steady at the FOMC meeting. Fed officials project that there will be two rate cuts this year, totaling 50 basis points.

Specifically, eight Fed officials expect two rate cuts this year, seven project zero rate cuts, two anticipate one cut, and the other two project three rate cuts. There are still four FOMC meetings this year, although traders expect the Central Bank to keep rates unchanged during the July meeting.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Fed Rate Cut at Risk: Janet Yellen Flags Inflation Concerns Amid US-Iran War

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs