FOMC Meeting Today: What To Expect as Markets Price In No Rate Cut

Highlights

- FOMC meeting expected to keep rates steady, amid mixed inflation and labor signals.

- Experts have noted that the focus will be on Powell's speech for guidance regarding monetary policy this year.

- Bitcoin historically reacts to FOMC decisions, showing pre- and post-meeting volatility.

Today, market focus is on the FOMC meeting as the latest rate decision will be announced. The Federal Reserve announces policy at 2:00 p.m. ET, followed by Chair Jerome Powell at 2:30 p.m. ET. Markets expect no rate change, with pricing showing near certainty, despite active debate among policymakers.

FOMC Meeting Outlook and Market Expectations

The FOMC meeting comes after weeks of firm economic data and mixed inflation signals. Futures markets show a 97% probability that rates remain unchanged today. As CoinGape reported, the odds of a rate cut are at 1%, according to Polymarket data, as crypto traders expect interest rates to remain unchanged.

Former Federal Reserve Vice Chairman Roger Ferguson, in a CNBC interview, noted that durable goods orders remain steady and that unemployment remains relatively low. However, inflation continues above the Fed’s 2% target, supporting patience for now.

According to Ferguson, these conditions allow policymakers to wait for clearer inflation trends. He highlighted Powell’s press conference as one to closely watch for tone and emphasis. He predicted that markets focus on language rather than immediate policy changes.

Powell, Dissents, and Policy Messaging

In an X post, macro expert Brent noted that no policy change appears likely. He stated that questions may focus on the Fed’s balance sheet runoff and Treasury bill purchases. Brent also flagged potential questions about yen volatility and President Trump’s prior remarks.

Historically, the Fed has avoided foreign-exchange commentary, limiting direct responses. Meanwhile, possible dissent votes may be highly scrutinized by the market during today’s FOMC meeting. Brent suggested dissenters could include Federal Reserve Board member Stephen Miran and possibly Christopher Waller. Brent noted that Fed Governor Michelle Bowman appears less likely, based on recent alignment with committee consensus.

Meanwhile, speculation surrounds Powell’s future after his term as Fed chair ends in May. The expert highlighted this as another development market participants should monitor today, as the Fed chair could address it during his press conference. Brent noted Janet Yellen signaled her exit months before leaving the chair role. However, no confirmation or guidance has emerged from the Fed.

Bitcoin’s Volatility In Focus

The FOMC meeting often brings notable Bitcoin moves. Crypto analyst Ali Martinez noted that the Bitcoin price declined following seven out of eight meetings last year. The May FOMC meeting was the only time that BTC saw an upward trend following the Fed decision.

Analyst Mister Crypto noted a recent pattern of pre-FOMC drops followed by rebounds. This time, Bitcoin declined ahead of the FOMC meeting, altering short-term expectations. Still, historical volatility keeps risk high in announcement periods.

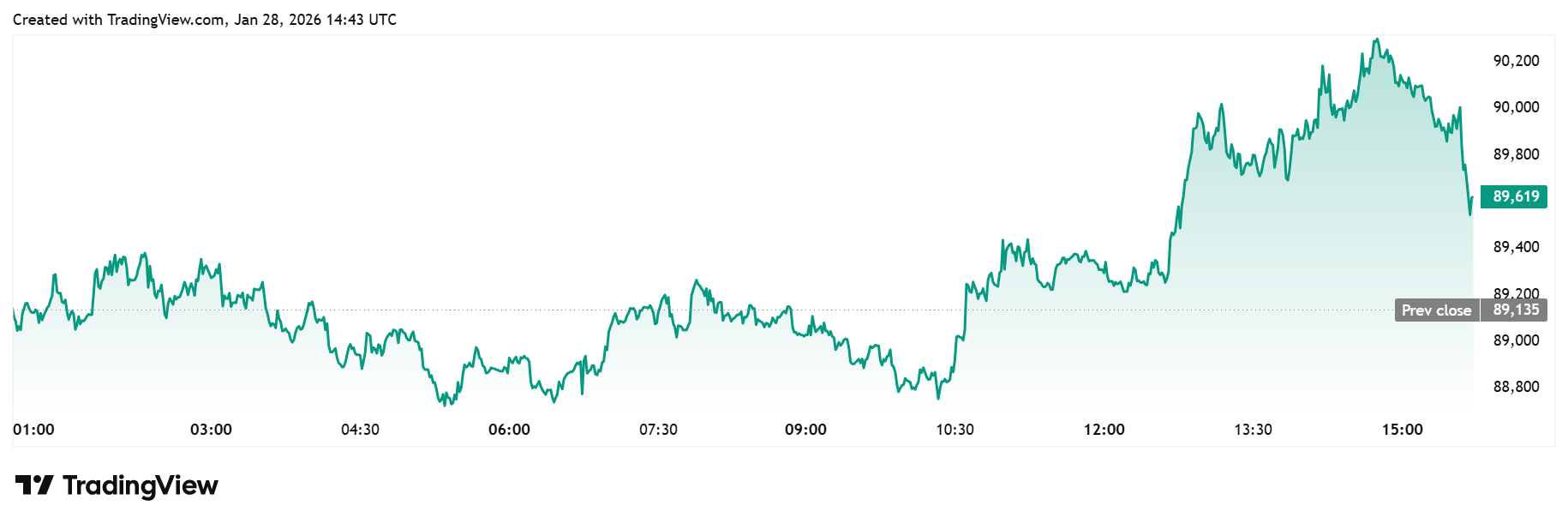

Notably, Bitcoin had climbed above $90,000 earlier in the day ahead of today’s FOMC meeting. The flagship crypto is trading just below this psychological level at press time. In addition to the Fed meeting, Tesla, Microsoft, and META report earnings today, which could impact BTC and the broader crypto market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Trump Says The U.S.-Iran War Could End Soon, Mulls Taking Over Strait Of Hormuz

- Bhutan Dumps More Bitcoin as BTC Price Climbs Amid Falling Oil Prices

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

Buy $GGs

Buy $GGs