FOMC Meeting Tomorrow: Will Federal Reserve Lower Interest Rates?

Highlights

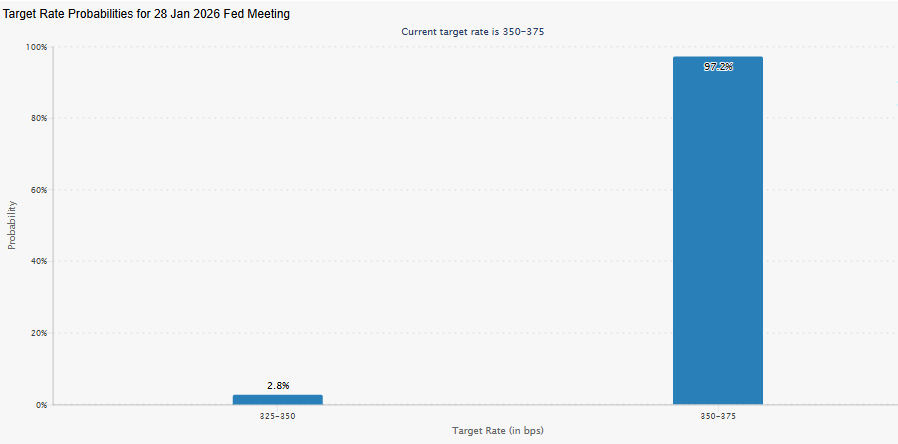

- Markets price a 97% chance of a Fed rate pause after three consecutive cuts following the FOMC meeting.

- Last month's FOMC minutes signal caution as officials balance inflation and labor risks.

- Crypto remains volatile, with Bitcoin and altcoins under pressure.

The crypto market is keenly awaiting the Federal Reserve’s potential decision on interest rates after the FOMC meeting tomorrow. With inflation still high and the job market starting to cool, investors are watching to see whether the Fed will change its approach or keep rates unchanged. After easing policy in recent meetings, the central bank appears to take a wait-and-see approach.

Fed to Hold Rates After This FOMC Meeting

The Federal Reserve is reportedly gearing up to conduct its FOMC meeting today and tomorrow. After the FOMC meeting, the Fed will decide whether to change the interest rates, currently at 3.5%-3.75%.

The central bank has reduced the rate by a quarter point at the last three FOMC meetings. In December, the bank lowered the rates by 25 basis points to the current level. These moves were intended to prevent a slowdown in the job market from turning into higher unemployment.

However, in the FOMC minutes last month, many Fed officials stated that it would be better to pause rate cuts after three consecutive reductions. This cast a shadow over the central bank’s potential move.

The odds on the CME FedWatch Tool also reinforce this speculation, as the chance for a Fed rate hold is currently at 97.2%. This marks a marginal surge from last week’s Fed rate hold odds at 95%, as reported by CoinGape.

While President Donald Trump repeatedly calls for interest rate cuts, Fed Chair Jerome Powell sees this as a challenging situation. He noted,

“A very large number of participants agree that risks are to the upside for unemployment and to the upside for inflation. So what do you do? You’ve got one tool. You can’t do two things at once. So at what pace do you move? It’s a very challenging situation.”

What This Means for the Crypto Market?

If the Federal Reserve decides to hold interest rates after the FOMC meeting tomorrow, it could have significant implications for the crypto market, especially considering its current volatility. The crypto market is currently up by a marginal 0.8%, reaching $2.99 trillion. But top coins like Bitcoin, Ethereum, and XRP are facing significant losses. As BitMine CEO Tom Lee noted, the current market dip is driven by surges in gold and silver.

Polymarket recently highlighted a massive 99% probability for the Fed to maintain its current rates. While these projections have sent Bitcoin and other cryptocurrencies suffering, the potential rate hold is poised to have at least short-term volatility in the market. However, the effect could be short-lived unless the bank decides to hike the rate.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: MSTR Stock Price Climbs As Michael Saylor’s Strategy Adds 17,994 BTC

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- BTC Markets Moves to Offer Tokenized Assets as RWA Market Hits $26.5B Peak

- Why BTC Price is Rising Today? (March 9, 2026)

- Wall Street Expert Warns 35% Crypto Stocks Market Crash Amid U.S- Iran War Tensions

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

Buy $GGs

Buy $GGs