FOMC Minutes Signal Fed Open to More Rate Cuts This Year, Bitcoin Bounces

Highlights

- Most participants agreed it will be appropriate to bring interest rates further this year.

- Some still raised concerns over inflation, with their 2% target currently stalling.

- Bitcoin rose on the back of the minutes release.

The FOMC minutes have signaled a dovish shift from the Fed officials, who look likely to make further rate cuts to end the year. The Bitcoin price bounced on the back of the Fed minutes release, as market participants anticipate another rate cut this October.

FOMC Minutes Show Fed Willing To Make More Rate Cuts This Year

The Federal Reserve released the minutes of the September FOMC meeting, in which most participants judged that it is likely appropriate to ease monetary policy over the remainder of the year. However, many Fed officials still raised concerns over inflation, with their 2% target stalling this year as inflation readings increased.

As CoinGape reported, the Fed made the first rate cut of the year at last month’s FOMC meeting. The FOMC minutes revealed that concerns over the weakening labor market were the primary driver of this move. The officials observed that the employment rate had edged up and job gains had slowed. Additionally, they judged that the downside risks to employment had risen.

Based on the median estimate, Fed officials expect to make two additional 25-basis-point (bps) rate cuts by year-end. This is likely to come at the October and December FOMC meetings. CME FedWatch data shows that there is currently a 92.5% chance that the Fed will make a 25-bps cut at the October 29 meeting.

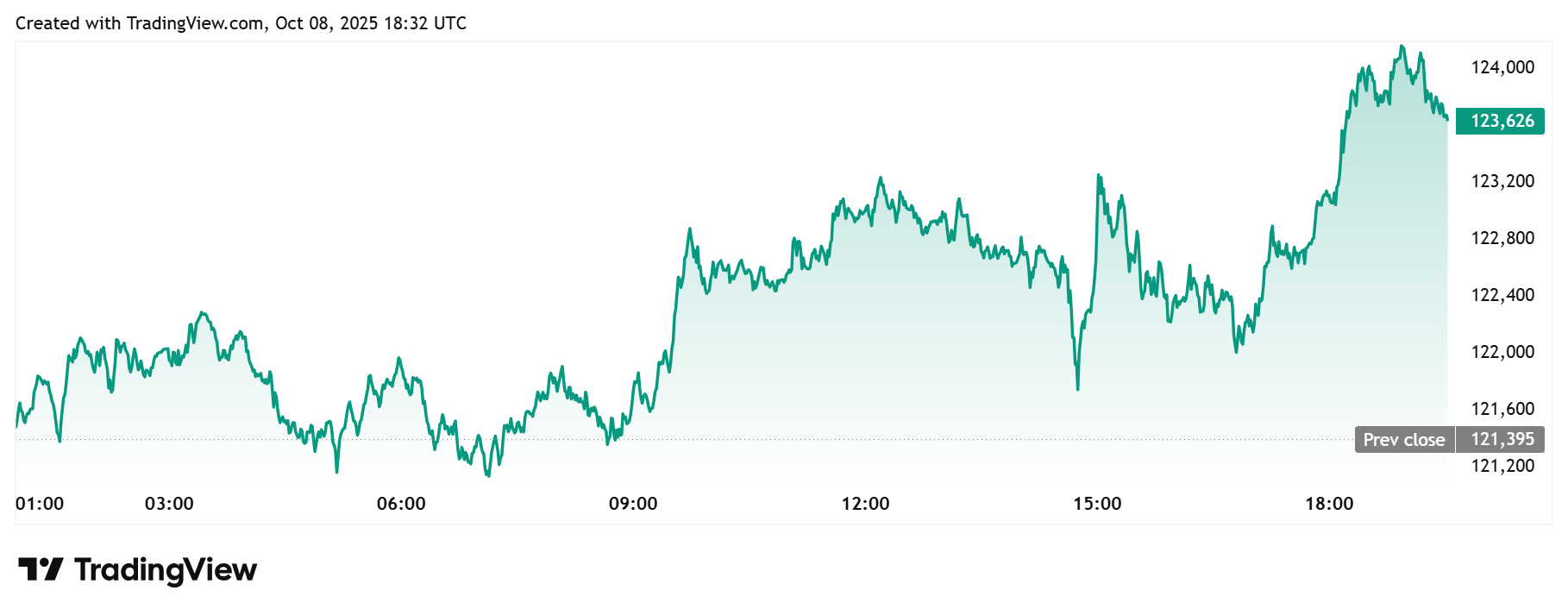

Meanwhile, the Bitcoin price briefly surged above $124,000 on the back of the FOMC minutes release but is now hovering around $123,500. TradingView data shows that the flagship crypto is up over 2% in the last 24 hours.

On The Dual Mandate Of Employment And Inflation

The FOMC minutes revealed that Fed officials remain divided over whether to prioritize addressing downside risks to employment or mitigating rising inflation. Most participants observed that it was appropriate to move the target range for the federal funds rate to a more neutral setting, as the downside risks to employment had increased.

They also observed that upside risks to inflation had either diminished or not increased. However, a few officials stated that there was merit in keeping interest rates unchanged at the September meeting or that they could have supported such a decision. This came as they expressed concerns that longer-term inflation expectations may rise if inflation does not return to its objective in a timely manner.

The FOMC minutes reflect recent statements by some Fed officials, including Kansas City Fed President Jeffrey Schmid, who has recently signaled opposition to further Fed rate cuts, citing inflation as “too high.” On the other hand, Fed Governor Stephen Miran, who was the only member to dissent in favor of a 50 bps cut at the September meeting, said that he is more “sanguine” about the inflation outlook.

Meanwhile, whether or not the current interest rate is restrictive has been heavily debated. The minutes revealed that FOMC members expressed a range of views on the degree to which the current monetary policy stance was restrictive. Some noted that based on several factors, the monetary policy may not be particularly restrictive, which they believe warrants a cautious approach when considering future policy changes.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs