FTX Bankruptcy Claims Drama Intensifies As Bitcoin and Crypto Prices Skyrocket

Highlights

- Attestor Ltd making 200% profit on FTX claims as crypto prices surge.

- Attestor profit hits roadblock as Lemma Technologies refuses to sell claims as per earlier agreement.

- Lemma Technologies and Haru Invest also intensifies the drama and confusion.

FTX bankruptcy crashed crypto market but some hedge funds and investment funds are making huge profits on FTX claims. A London firm that specializes in trading distressed assets is making a record 200% profit on FTX claims, but the largest deal has hit a roadblock sparking legal challenges.

FTX Claims and Controversies

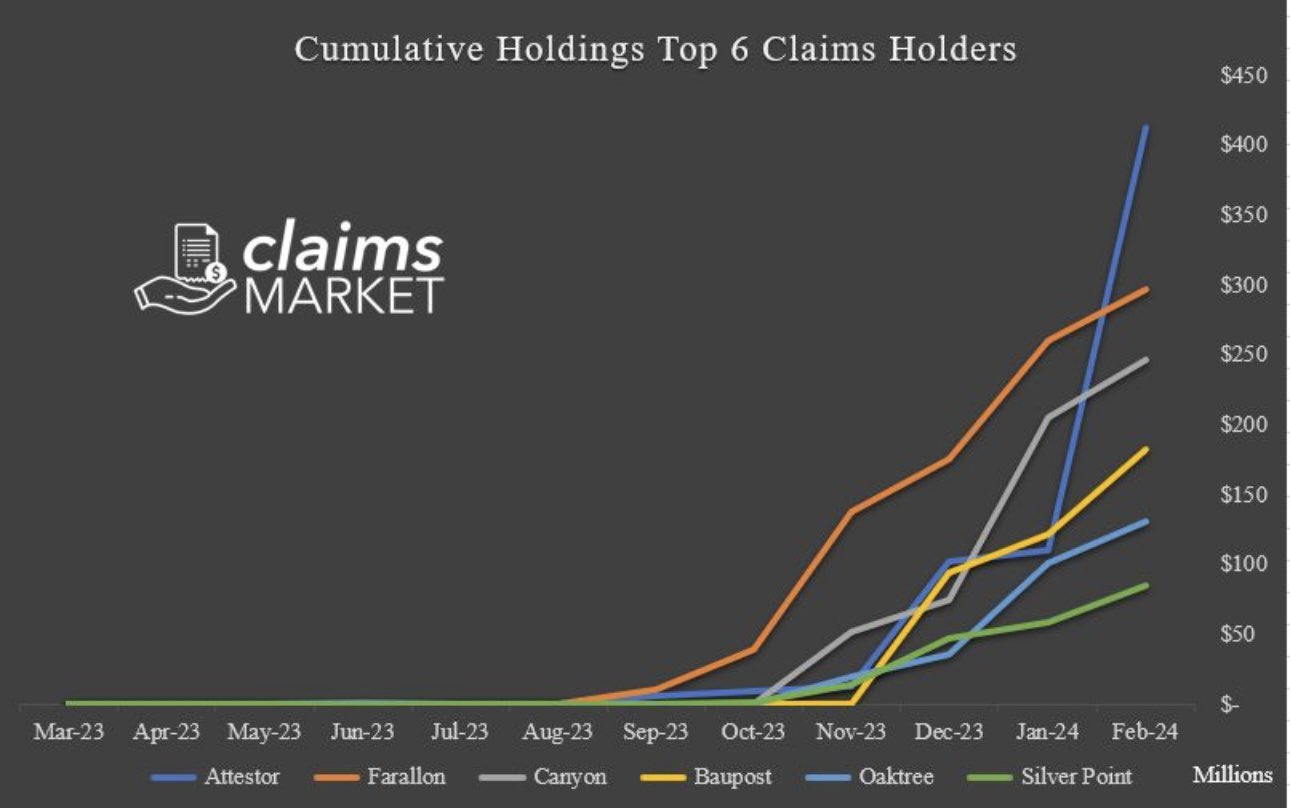

As FTX bankruptcy lawyers now estimate 100% return of money frozen during FTX collapse and crypto prices skyrocket, firms like London-based Attestor Ltd are purchasing whatever they can for better profits. Attestor is the largest FTX claim holder, as per Claims Market.

In 2023, Attestor signed deal to purchase claims from Lemma Technologies, one of the biggest FTX claim accounts, at the sale price of $58 million. The value of claims is expected to pay over $165 million, which is almost 200% of the sale price. However, these buying of claims are riskier trades than typical purchases of defaulted bonds or loans.

Lemma Technologies, controlled by a South Korean trader, has now opted to keep the claim for itself as the value rises amid skyrocketing crypto market. Attestor’s lawyers filed a lawsuit in New York court on allegations of “seller’s remorse,” reported Bloomberg on March 18.

Also Read: AI Coins Rally Another 20% Before Nvidia GTC Conference, What’s Ahead?

Attestor FTX Claims Impact by Haru Invest

Lemma Technologies hasn’t filed a defense against Attestor’s New York suit. Meanwhile, Lemma’s principal investor Junho Bang currently facing charges in South Korea has further escalated the drama and confusion.

Junho Bang was indicted by South Korean authorities for stealing digital assets from Haru Invest in February. South Korean authorities arrested three executives at yield platform Haru Invest for stealing 1.1 trillion won ($828 million) worth of crypto. Before halting withdrawals last June, beleaguered firm Haru Invest offered yields up to 50%.

Haru Invest called Junho Bang as the majority shareholder of B&S, a crypto trading firm that invested in tokens such as FTX’s FTT Token. Junho Bang transferred his FTX claim to Lemma in January 2023, according to the court documents seen by Bloomberg News.

Also Read: Bank of Japan Mulls First Rate Hike in 17 Years, What’s Ahead for Bitcoin and Crypto?

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise