FTX Identifies Critical Failures By Sam Bankman-Fried And His Inner Circle

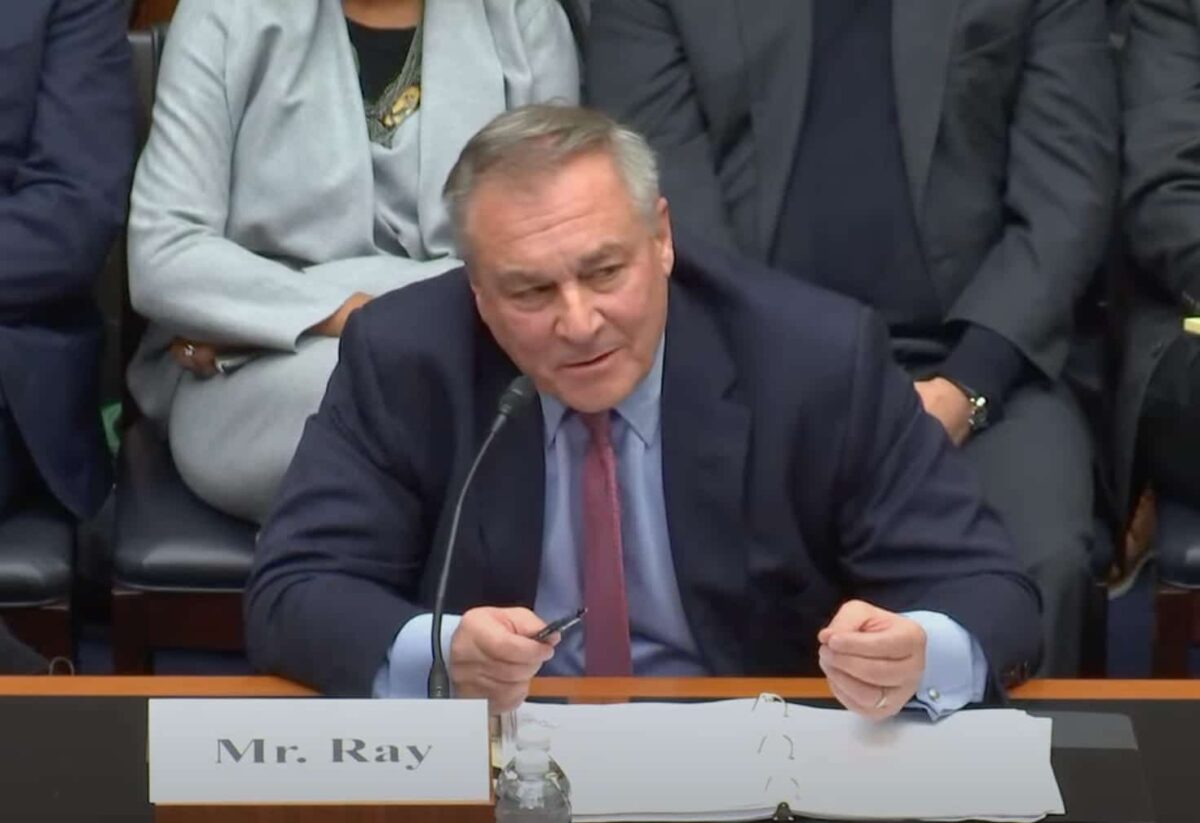

FTX under CEO John J. Ray III on Monday released its first report identifying mistakes and failures of FTX’s former management under Sam Bankman-Fried that led to the collapse of the crypto exchange and its subsidiaries.

According to a press release on April 10, FTX Debtors found and discussed control failures by the previous team under former CEO Sam Bankman-Fried and his inner circle. The report identifies blunders in critical areas including management and governance, finance and accounting, digital asset management, information security, and cybersecurity.

The report was prepared through careful review and examination by Debtors with the help of a team of legal, restructuring, forensic accounting, cybersecurity, computer engineering, cryptography, blockchain, and other experts.

John J. Ray III, the new CEO of FTX, said:

“We are releasing the first report in the spirit of transparency that we promised since the beginning of the Chapter 11 process. In this report, we provide details on our findings that FTX Group failed to implement appropriate controls in areas that were critical for safeguarding cash and crypto assets.”

FTX was controlled by a small group consisting of SBF and his inner circle including Caroline Ellison, Nishad Singh, Gary Wang, and others. These showed little interest in practicing oversight, implementing control frameworks, and managing customer crypto assets.

Former FTX US President Brett Harrison also gave the same reasons for his resignation from the crypto exchange in September. Harrison said he tried separating FTX and FTX US teams, as well as bank accounts and crypto wallets, and customer accounts from the company’s operating accounts. However, SBF and his inner circle interfered with FTX US operations.

In fact, Sam Bankman-Fried is reportedly using Alameda Research funds to pay for hefty legal fees charged by his lawyers for his high-profile criminal fraud lawsuit that costs investors billions of dollars.

The Debtors have recovered and secured over $1.4 billion in digital assets in cold wallets. The new team has also identified an additional $1.7 billion in digital assets that they are in the process of recovering. The Debtors will continue to provide updates on their ongoing recovery efforts and investigation.

Also Read: Binance Futures Users Affected; CZ Replies

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible