FTX On Bank Run? Data Shows 47% Drop In On-Chain Balance

The crisis surrounding FTX and its underlying token, FTT, is intensifying in the cryptocurrency community as one of the major exchanges in the world’s trading activity appears even more suspicious than it did a few days ago.

According to Binance CEO Changpeng Zhao, they obtained $2.1 billion in BUSD and FTT tokens from their early investment in FTX. As a result of SBF’s immoral practices, they intend to sell their digital holdings. In the following one to two months, they intend to disperse assets valued at $600 million on the open market.

CZ’s Gameplan or Fair Play?

Despite CZ’s claims, the decision made against the Bankman-Fried led FTX is considered as part of a “Bank Run,” which occurs when numerous clients remove their money from a financial institution, ultimately causing it to fail. The plan is working thus far.

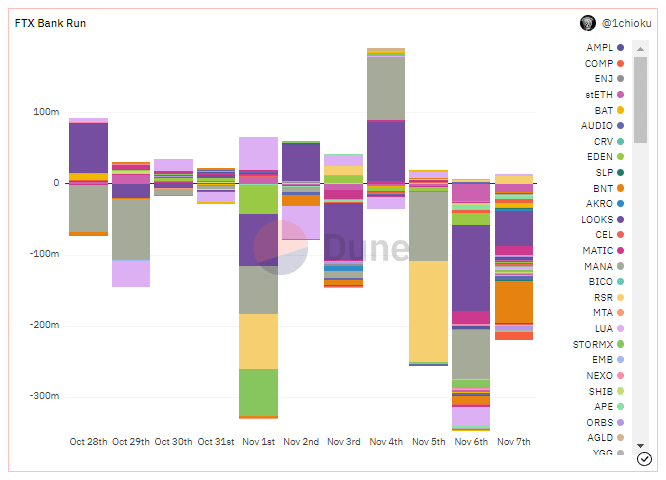

According to data from Dune Analytics, FTX’s 24-hour NetFlow is negative. In other words, more tokens are being withdrawn than being deposited. Netflow on the platform has been negative by $26 million.

The stablecoin USDC dominated the Netflow, as shown in the graph below. With the insolvency rumors, this metric began to slide downward. In more extended time frames, the Bank Run becomes worse, with FTX registering weekly net flows of -$86 million and 30-day net flows of -$230 million.

Sam Bankman-Fried Clears The Air

Sam Bankman-Fried responded to recent events on Twitter and claimed that a rival is attempting to discredit them with “false rumors.” The boss reassured his followers that FTX is “fine” and solvent in that regard. Bankman-Fried wrote:

FTX has enough to cover all client holdings. We don’t invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be. It’s heavily regulated, even when that slows us down. We have GAAP audits, with > $1b excess cash. We have a long history of safeguarding client assets, and that remains true today.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs