How FTX’s SBF Went From Being “The New JP Morgan” To A “Con Artist”

Sam Bankman-Fried went from being a poster boy of crypto to being the most hated in a matter of few days. Weighing in on the situation, Jim Cramer, the American TV personality called SBF a “con artist” when asked about it in a recent interview with Andrew Sorkin on CNBC’s latest episode of SquawkBox.

Change of Views

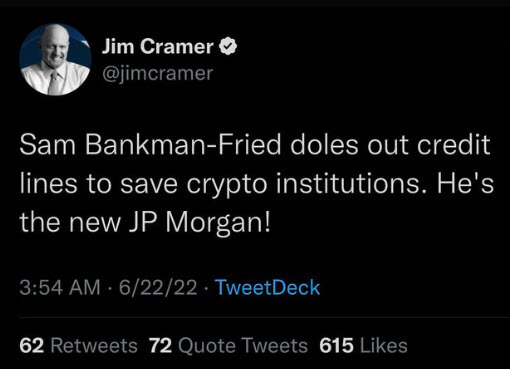

However, the same Jim Cramer once hailed SBF as the “new JP Morgan” when the FTX founder made headlines by buying out or providing credit lines to distressed crypto companies during the steep market fall of June 2022.

SBF The Crypto Crusader?

Sam Bankman-Fried was most famous for saving the now-bankrupt crypto lender BlockFi by providing a $250 million revolving credit facility.

SBF had even gained the trust of America’s largest asset management firm, BlackRock, whose CEO recently disclosed to having a $24 Million investment in the defunct FTX exchange.

Read More: Blackrock CEO Larry Fink Says FTX Failed Due To FTT Token

Not just BlackRock, but FTX got accolades and financial support from top conglomerates like Sequoia Capital, SoftBank, Ontario Teacher’s Pension Plan and many others.

The Ongoing FTX Saga

As reported earlier on CoinGape, FTX financed Alameda Research, billions of dollars worth of customer assets to finance risky trades and even personal loans to the management, thus paving the way for its sudden downfall. With only $1 Billion in liquid assets, FTX failed to bridge the gap and eventually had to file for bankruptcy.

Read More: FTX Exchange Finally Files For Bankruptcy

In what appeared to be a potential bailout of the troubled exchange, under a liquidity constraint, crypto giant Binance signed a letter of intent earlier this month to acquire its ailing rival, FTX. However, that plan failed a little more than 24 hours later following Binance’s due diligence on FTX.

Read More: SBF Resigns, John Ray III Joins As New FTX CEO

The renowned crypto exchange, once a leader in its domain, has crumbled into pieces in less than a few weeks. And SBF, who at one point had a net worth of over $16 billion, lost 98% of his wealth in a single day, following the demise of FTX.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs