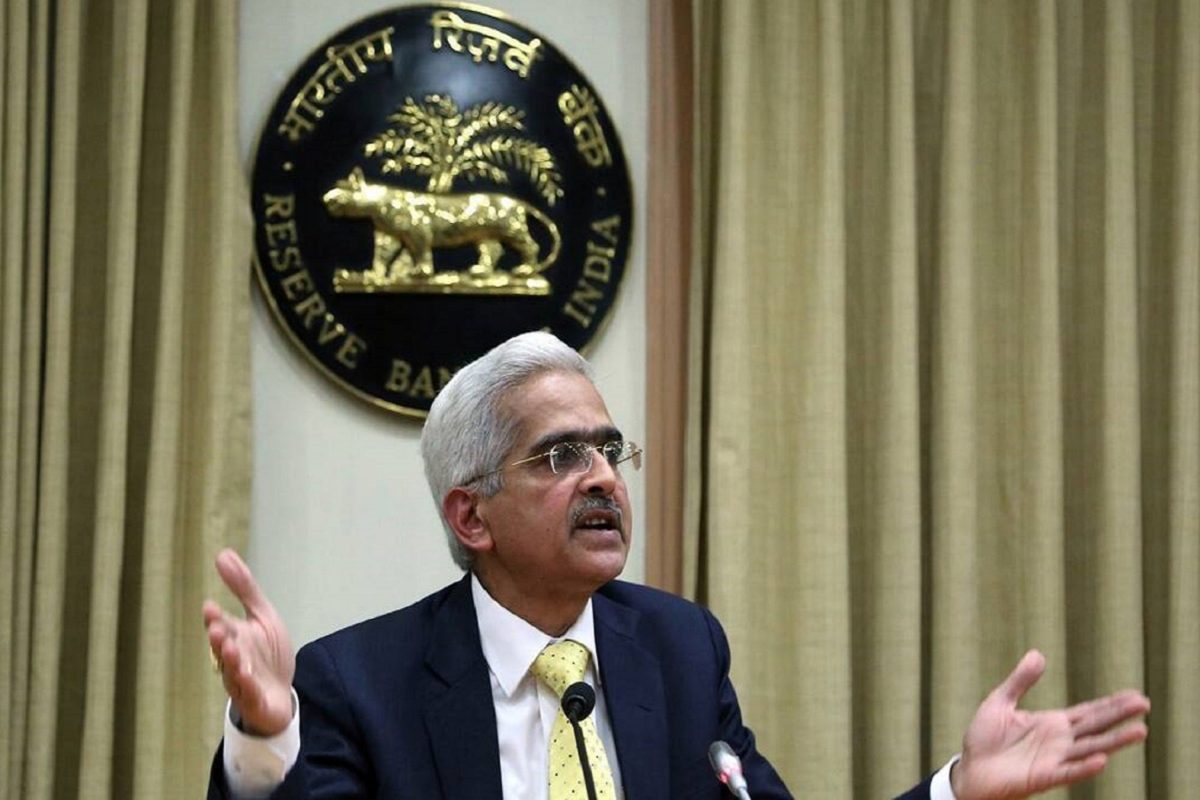

G20 Members Considering Complete Ban On Crypto, Says RBI Governor

Crypto Regulations: The Governor of Reserve Bank of India (RBI) Shaktikanta Das says some members of the G20 are calling for considering a complete ban on cryptocurrencies. Ahead of the G20 summit, Indian finance minister Nirmala Sitharaman said that India’s position on crypto assets has been recognised by G20 members.

G20 members talk about crypto regulations

The discussions on international architecture on crypto regulations are expected to be completed by September, when India is to preside over the G20 summit. In a press conference at the end of First G20 Finance Minister and Central Bank Governors (FMCBG) meeting, the Indian Finance minister said that there is almost a clear understanding that anything outside the Central bank is not a currency. India has been taking this stance on crypto for a very long time and this position is now getting acknowledgement from so many different members, Sitharaman added. In an attempt to ward off competetion from cryptocurrencies, India is launching its own CBDC.

Responding to a question on crypto regulations, Sitharaman said recognizing the risks attached to the private virtual assets, G20 nations moved a step closer to developing a coordinated and comprehensive policy approach to deal with the crypto assets by considering macroeconomic and regulatory perspectives.

Crypto assets risk financial stability: RBI Governor

Talking about crypto regulations, RBI Governor said that multiple options are under consideration. But it’s too early to speak on what will be the eventual architecture, he added.

Das revealed that there were views that it should be regulated with a view to control and check its proliferation, to control its risks. There were opinions expressed saying that the option of a ban or prohibition should also be considered. But this is a work in progress, the Governor added.

RBI governor said that there is a wide acceptance of the fact that cryptocurrencies involve several major risks to the financial stability, to cyber security issues, and to overall financial stability. The central bank’s governor had earlier said that the next major financial crisis will stem from cryptocurrencies.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs